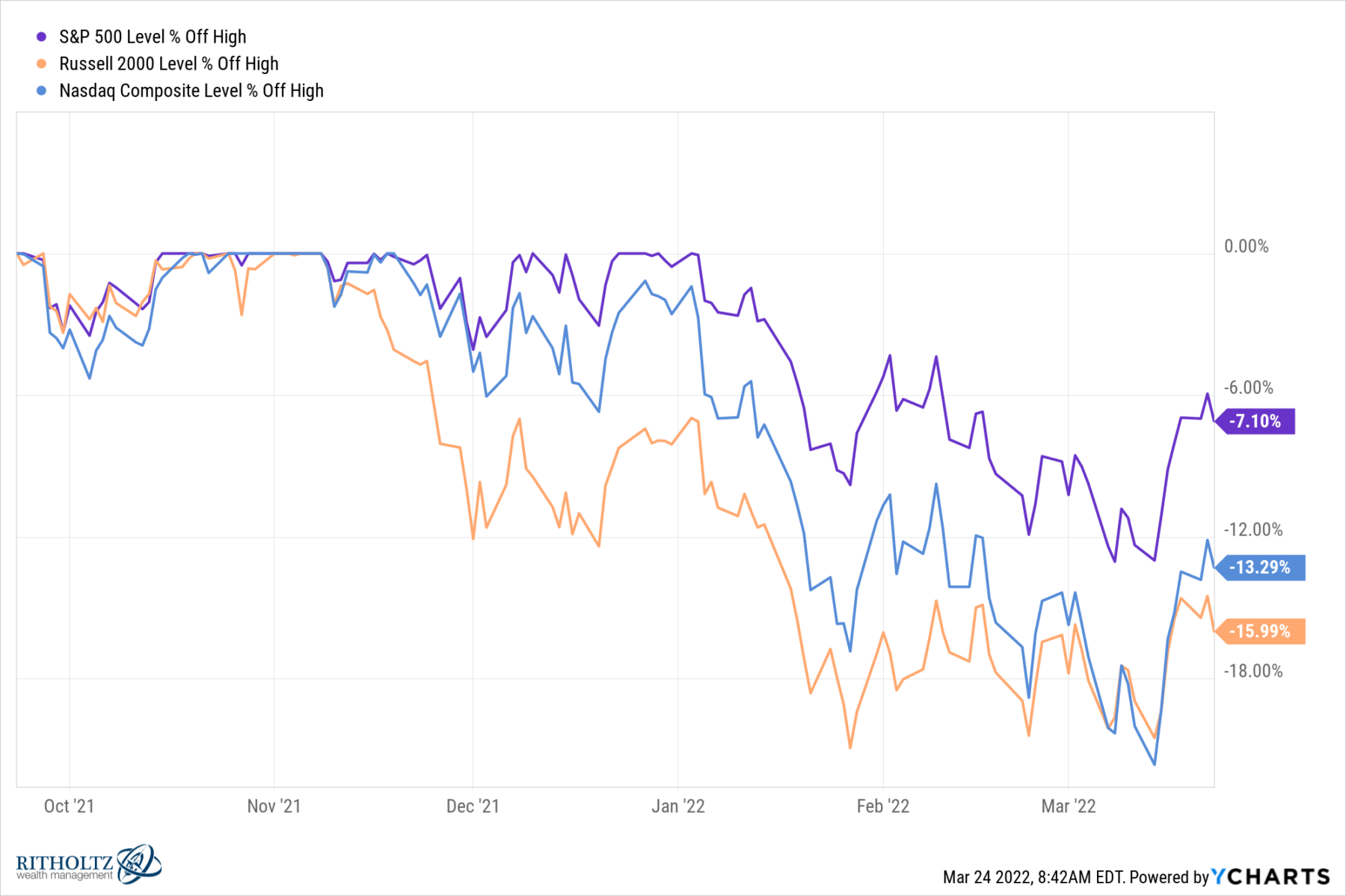

The easiest button to press in the world is the one marked “Sell.” It’s a salve for your emotional distress, especially when facing volatile, disruptive stock markets. Panic selling might ease your upset stomach or help you sleep better, but it wreaks havoc on your portfolio.

The challenge of liquidating equities: How do you get back in? When? What determines your repurchase decision? What metrics do you base this Buy upon? 1

We discussed why Human nature makes this so difficult on Bloomberg TV yesterday. My experience about this was influenced by the investor behavior I observed during the 2008-09 financial crisis, the 2000 dot-com implosion, and to a lesser degree, the 2020 Pandemic sell-off.

There was some pushback, but the most interesting challenge came from an advisor who was Sympatico with my view: “I share similar experiences to yours with investor panic, and while I don’t disagree with your position, I wish I had data to back it up.”

Which leads us to a very interesting study 2 that looked at the issue of freaked out investors: “When Do Investors Freak Out? Machine Learning Predictions of Panic Selling.” Note this study was based on “the financial activity of 653,455 anonymous accounts corresponding to 298,556 households from one of the largest brokerage firms in the United States.”

A key finding: “Investors who are male, or above the age of 45, or married, or have more dependents, or who self-identify as having excellent investment experience or knowledge tend to freak out with greater frequency.”

But that buries the lead. From an advisor’s perspective, the more important issue is about what those investors who panic-dumped their equity portfolios did subsequently. Here is what I found to be the most important takeaway from this research:

“We find that 30.9% of the investors who panic sell never return to reinvest in risky assets.”

Think about the impact of that astonishing data point: Nearly a third of investors who panic sell never buy equities again. My experience is that many panic-sellers repurchase equities at higher prices than they sold for, and often later in the recovery when the news flow has improved (and confirmed by the study). Markets tend to bottom when the headlines are horrific, leading to capitulation.

This is very consistent with our experience following the great financial crisis. I cannot count how many times I heard something like this: “I followed you out of the market in 2008, but when you flipped bullish in March 2009 I thought you were crazy.” We were getting emails like that in 2010 and they continued in 2011, ’12 ’13, ’14, and (shockingly) even in 2015.

Selling is easy, getting back in is hard, not getting back in is ruinously expensive.

Previously:

If You Sell Now, When Do You Get Back In? (March 23, 2022)

Don’t Panic! (with apologies to Douglas Adams) (March 9, 2020)

The Plural of Anecdote IS Data (February 4, 2019)

Have a plan, and stick to it. (July 2, 2016)

Source:

When Do Investors Freak Out? Machine Learning Predictions of Panic Selling

By Daniel Elkind, Kathryn Kaminski, Andrew W. Lo, Kien Wei Siah and Chi Heem Wong

The Journal of Financial Data Science Winter 2022, 4 (1) 11-39; DOI:

https://jfds.pm-research.com/content/4/1/11

________

1. There is a longer conversation to be had about the tax consequences in nonqualified accounts. The simple math is that you have to overcome the big hurdle of long-term capital gains at 23.8% (20% plus 3.8% Affordable Care Act’s Net Investment Income Tax) just to break even…

2. Hat tip Larry Swedroe and The Evidence-Based Investor.