My Two-for-Tuesday morning train WFH reads:

• Why Stocks Are Rallying in the Midst of a War and Soaring Inflation: Investors are confronting one of the most uncertain periods of their lifetimes. Stocks are rallying anyway. The S&P 500 has rebounded 7.6% from its 2022 low in March, cutting its losses for the year to about 6%. (Wall Street Journal) see also Always Buy High Uncertainty. Certainty In the Stock Market Is Very Expensive: The old adage that stocks hate uncertainty is true—but only partially. Stocks hate high and rising uncertainty. High but falling uncertainty, however, is the absolutely best stock market fuel anyone could ever ask for. And that is dead ahead now. (Real Clear Markets)

• Meet 2022’s Hedge Fund Rising Stars: The class of 2022 — the first since 2019, thanks to a two-year hiatus for the pandemic — includes several who run their own hedge fund firms, such as Andrew Cohen of Difesa Capital Management and Michael Englander of Greenland Capital Management. These two Rising Stars are the sons of Peter Cohen and Izzy Englander, respectively. (Institutional Investor)

• Inflation Is Here to Stay. Here’s How to Adjust Your Portfolio. Balance is the key here, and much depends on an investor’s age, risk tolerance, and existing portfolio. For example, a young investor can stick primarily with stocks, whereas a retiree already drawing down a portfolio might want more direct inflation protection, including inflation-linked and shorter-duration bonds, commodities, and real estate investment trusts. (Barron’s) see also I’ve Got Time to Recover From This Inflation, Right? Inflation hasn’t been this high since the early 1980s. Although this is not unprecedented – before then, it had been 65 years before it even reached those same levels – it is also not a regular occurrence. Hence why the Fed is adjusting the gears a bit higher, allowing the rest of the economy to coast downhill. (Wealth Found Me)

• The Can’t-Lose Betting Strategy That’s Taking the Gamble Out of Sports Gambling Caesars, DraftKings, FanDuel, and others have been handing out untold millions in sign-up bonuses. Coupon-clipping types are playing them against each other to make risk-free bets. (Bloomberg)

• Companies That Merged With SPACs Have Underperformed the S&P 500 by a Stunning Margin Since 2018 At no time during the recent SPAC boom — except for a few days in early 2021 — did these new listings beat the S&P. (Institutional Investor) see also Why Most SPACs Suck: The vast majority of “products” that can be stuck in a portfolio are mostly not worth the cost relative to the performance they provide. (The Big Picture)

• How to Stop Procrastinating A science-based system to conquer chronic procrastination (Curiosity Chronicle)

• How Liberia’s frontline health workers are protecting us all Remote regions of sub-Saharan Africa are among the world’s hotspots for new diseases. But Liberia is using an innovative approach to identify outbreaks before they become a problem. (BBC) see also Finding the next pandemic virus before it finds us The tricky work of seeking, sequencing, and sharing viruses around the world. (Vox)

• Why a U.S. Company Plans to Release 2.4 Billion Genetically Modified Mosquitoes The insects, created by biotech firm Oxitec, will be non-biting males engineered to only produce viable male offspring, per the company. (Smithsonian)

• The Black + White Truth about Oscar Peterson and Racism in Canada: Doc illustrates our discomfort with confronting racism in Canada (Point Of View Magazine) see also ‘Oscar Peterson: Black + White’ Review: A Giant of Jazz Piano He was an inspiration, and an influence, but you first had to figure out—amid his blizzard of notes and dazzling technique—what he was even doing. At the risk of belaboring the Tatum parallel, Peterson existed in his own jazz universe. Other than with his famous trios—with Ray Brown on bass and either Herb Ellis on guitar or Ed Thigpen on drums—Peterson worked alone, occupied his own space and wasn’t in competition with anyone. Which makes Mr. Avrich’s film that much more valuable(Wall Street Journal)

• The Future of the International Space Station Looks Dire For 30 years the U.S.-Russia partnership at the ISS was above it all. Now the U.S. finds itself in need of a friend, not a foe (Businessweek)

Be sure to check out our Masters in Business interview this weekend with Jonathan Lavine, co-managing partner of Bain Capital, and Bain Capital Credit’s Cheif Investment Officer. He is co-chair of the Board of Trustees of Columbia University.

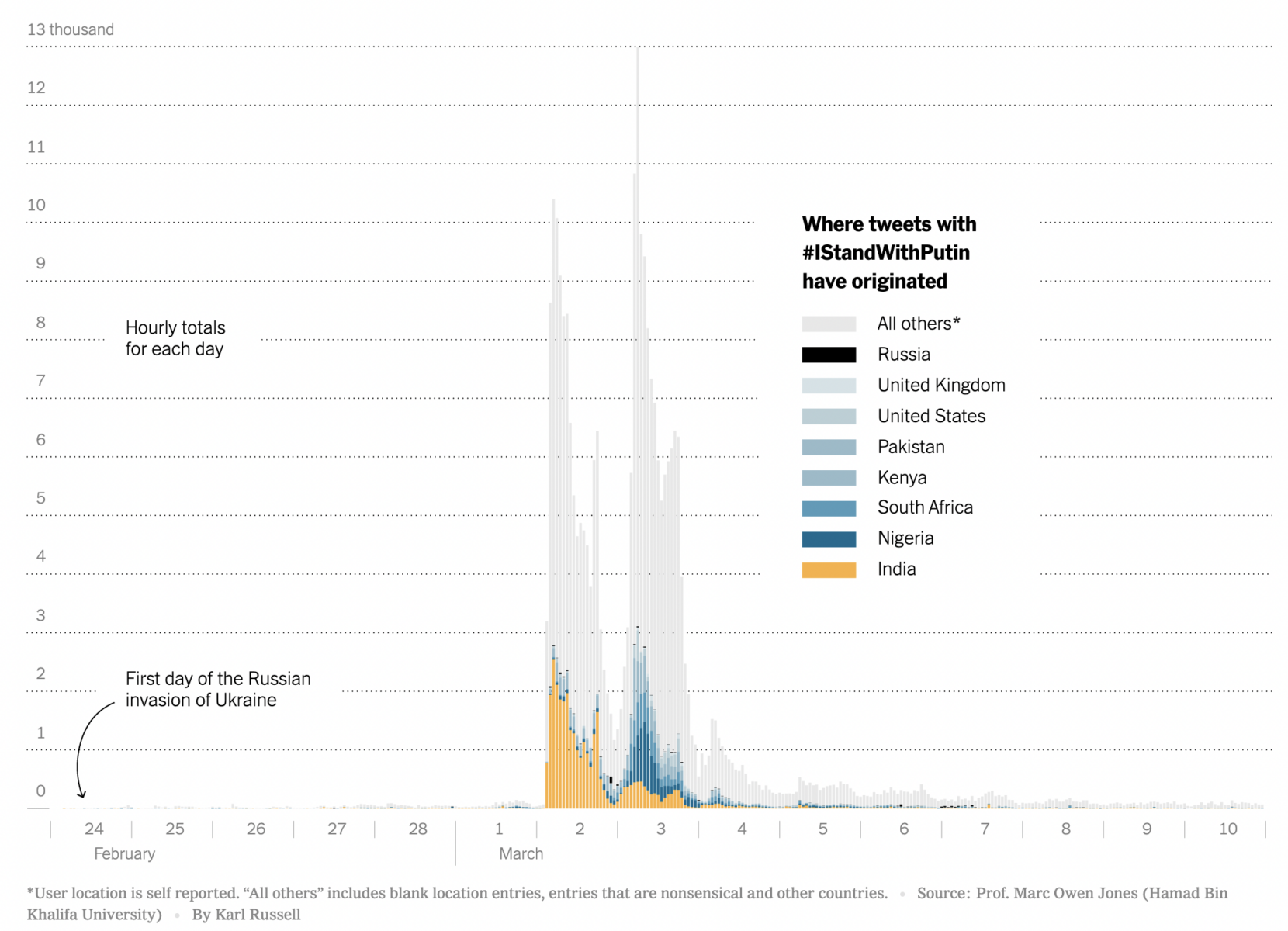

Pro-Russia Sentiment on Indian Twitter Draws Scrutiny

Source: New York Times