My Friday Reads included a chart showing “where Americans get their news and who they trust for information.” What made it interesting was the obvious partisans — Breitbart, Fox News, and MSNBC — were trusted the least; but what was also interesting was how much people trusted media sources believed to be more objective, like the PBS, the BBC, and at the top of the list, the Weather Channel.

I was surprised about some of the pushback to TWC and weather forecasters in general. It’s a probabilistic exercise but has objectively improved over the past few decades, especially when involving extreme risk events. Regardless, this gives us an opportunity to discuss a particular form of bias: the tendency to overstate low-probability, negative outcomes.

I suspect people intuitively grasp the downside of things more easily than the upside. Risk aversion is well understood – imagine the survivability of those who usually ignore existential threats to themselves versus those who do not. We imagine the risk-embracing subgroup has their genes exit the pool due to – whoops! – self-inflicted mortality versus those who do not ignore risks.1

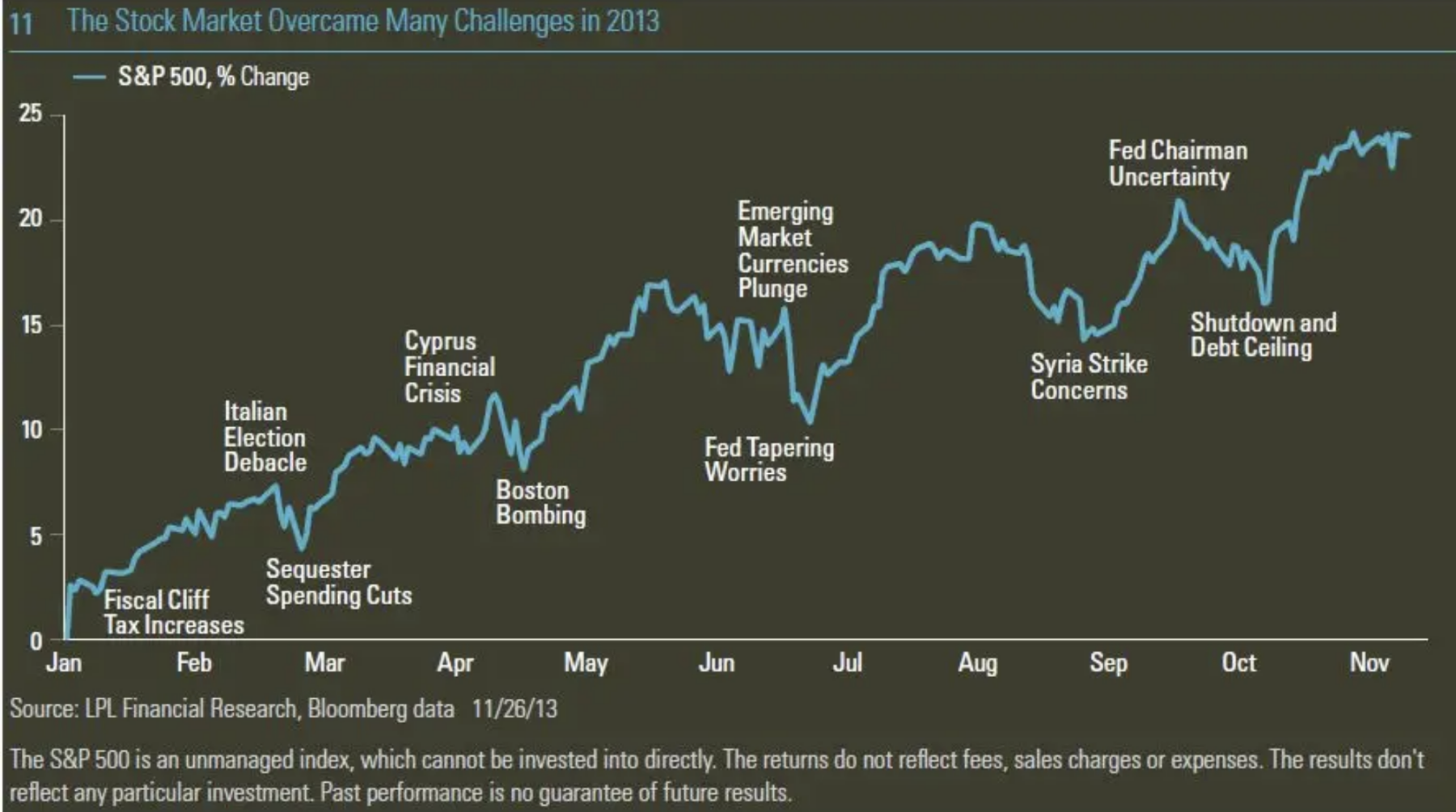

This discussion sent me hunting for a chart (above) I recalled from (then LPL’s) Jeff Kleintop. It shows some of the more popular “threats” to the market that were going to derail the bull market. I hasten to add that the S&P500 was 67% lower – about 1500 back then versus ~4500 today.

Kleintop pointed to a study by Texas A&M that found when the Weather Channel forecasted a 20% chance of precipitation for the same day, precipitation occurred only 5.5% of the time.

The lesson for us: “The well-known bias of weather forecasters to exaggerate fears of negative, low-probability outcomes, such as the likelihood and amount of snowfall, also often appears in the forecasts of non-weather-related issues.”

It is not a stretch to apply this to general investor fears: Recession, war, rate hikes, currency issues, societal collapse, even nuclear Armageddon.

It is not a stretch to apply this to general investor fears: Recession, war, rate hikes, currency issues, societal collapse, even nuclear Armageddon.

This is not to suggest that we should ignore the “unknown unknowns;” rather, we should recognize that Black Swan events are exceedingly rare. Even negative cyclical events — far less rare but still infrequent — tend to get exaggerated.

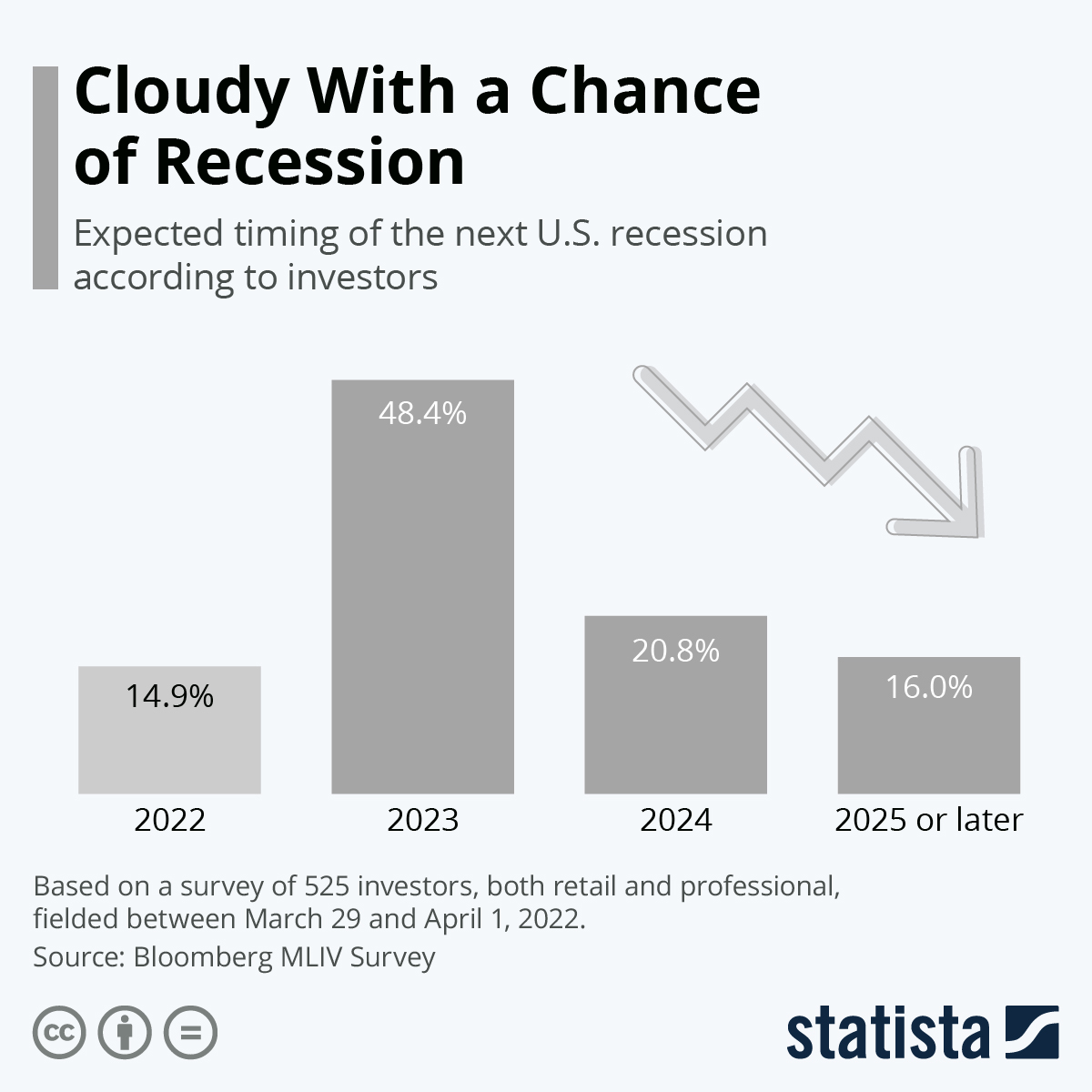

This is relevant as headlines today are presently dominated by recession chatter, structural inflation, and even fears of stagflation. These are negative, low probability, high impact events; the study Kleintoop cited suggests we tend to overestimate their likelihood of occurrence. Hence, they get disproportionate media coverage and tend to take up residence in investors’ heads.

The pernicious impact on investor psychology of these exaggerated forecasts is yet another reminder that forecasts are worse than a waste of investor time.

Previously:

War Impacts Stocks Less than You Think (March 2, 2022)

How We Experience Time, Inflation Edition (November 10, 2021)

Misunderstanding Narratives: The Hero’s Journey (September 22, 2021)

What If EVERYTHING Is Narrative? (June 21, 2021)

See also:

There Are Always Reasons to Sell (Batnick, June 10, 2020)

Source:

Negative, Low-Probability Outcomes Are Consistently Exaggerated

by Jeff Kleintop,

LPL Financial Nov 30, 2013

https://bit.ly/35UEUPJ

UPDATE: April 11, 2022 5:38pm

The original piece is no longer posted at LPL but a mirror of Jeff Kleintop’s commentary is at Business Insider: Negative, Low-Probability Outcomes Are Consistently Exaggerated.

___________

1. We could easily create an opposite scenario: A risk-averse group of cavemen who don’t want to attack a mammoth might starve that winter, whereas the next cave over that tries and succeeds has both meat and fur to get them through the winter. Sure, the risk-embracing group lose a few members in the attack, but the community overall does better.

The Narrative Fallacy is easy to overlook when crafting these stories hypothesizing some prior event. We should always be aware of this when we create stories explaining evolutionary psychology…