Market volatility is being blamed on various Fedspeak – most recently Lael Brainard, stating half-point increases are going to be needed to tamp down inflation.

Color me skeptical.

I assume most explanations of market action are a mix of narrative fallacy and hindsight bias, with a smidgen of accidental accuracy. The current explanations seem to fit into that

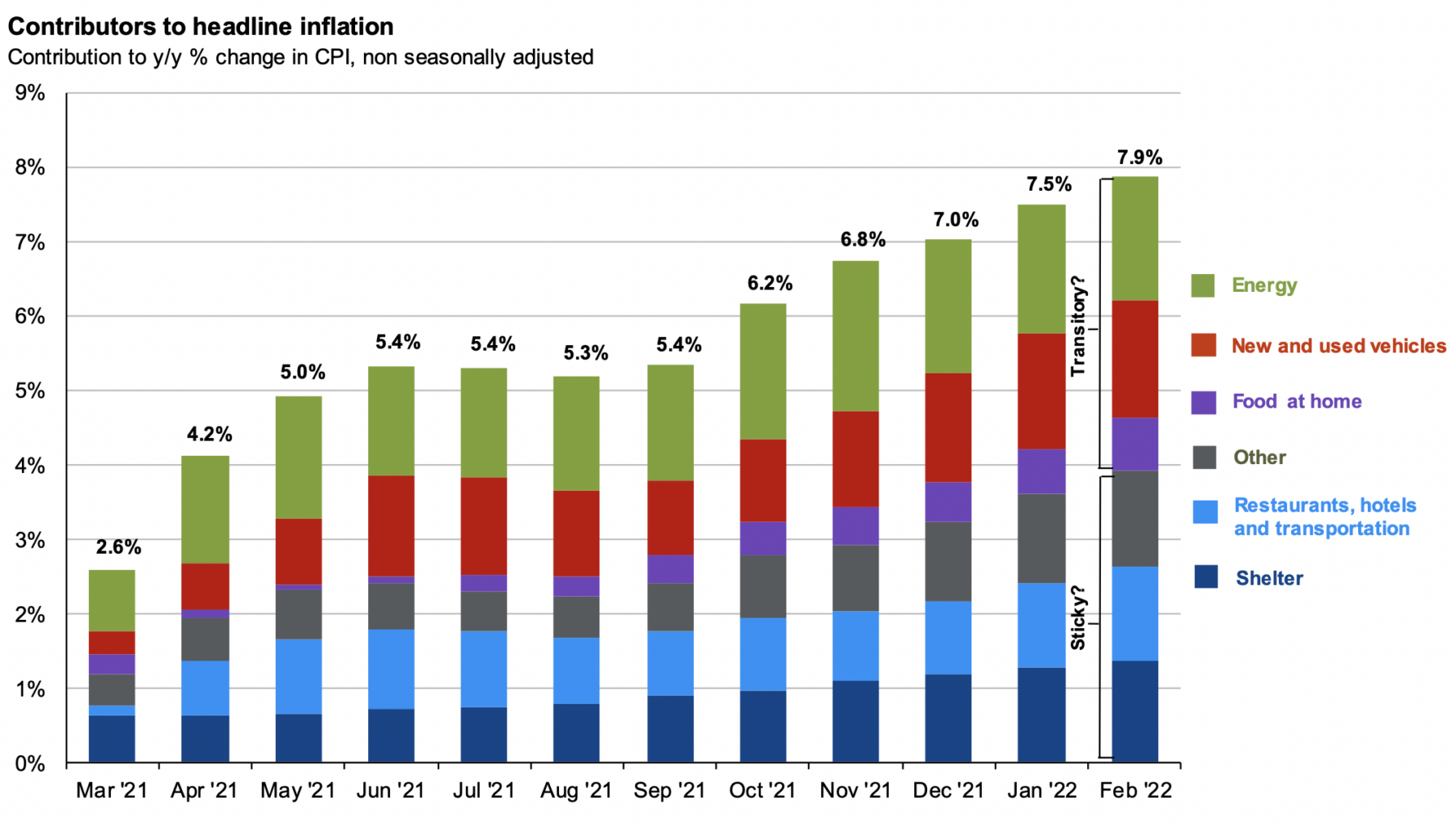

To assess the likelihood that these are anything more than Fed jawboning, and the rationality of the hindsight explanation for volatility, consider the various components that make up CPI inflation.

Energy: Breakdown the increase in energy prices into 2 phases: 1) The impact of return to office and reopening post pandemic, with much more driving and air travel period and 2) the recent spike caused by Russia’s invasion of Ukraine.

New and used vehicles: Bringing the full global capacity of manufacturing semiconductors back online continues to be an achingly slow process. It is a key factor in rising automobile prices. (U.S. laws do not allow automobiles to be sold minus chips which control safety systems — ABS, airbags, etc.) The supply shortage of new cars (at same demand) has led to price increases in new vehicles. Used car prices are tied to new vehicle prices, but perhaps less obvious is that all new cars become part of the future used car supply. Hence, even after new car supply ramps up the shortage of used (cheaper) vehicles is likely to persist. Note: Ukraine supplies about half of the world’s neon, a key component in semiconductor manufacturing. (UPDATE “Biggest Monthly Drop in Used Car Prices Since April 2020,” Bloomberg, 4.7.22)

Food (Home): Russia and Ukraine supply approximately 28% of wheat products to the world. An outbreak of Avian flu has led to a terribly timed mass slaughter and shortage of chickens; a shortage of beef is blamed on everything from higher feedstock prices, industry-driven regulation, and increased demand. Even weedkiller has risen in price.

Other: A catchall category that includes such diverse goods and services as tobacco, haircuts and funeral expenses. Can we blame a Covid-created global shortage of coffins for driving this section higher?

Restaurants: Increased food prices to be sure, but also increased wages (and health care costs) are key drivers of restaurant price increases. And that is before we get to a point where landlords believe they have the ability to raise rents on new or renewed leases.

Shelter: The data here is easy to misconstrue due to 1) Owner’s Equivalent Rent, which tends to understate inflation; and 2) The year-over-year collapse and then recovery, which tends to overstate rent increase. Case Shiller at 20% suggests that prices have risen robustly.

Ask yourself this simple question: Which of the above price increases are highly responsive to Federal Reserve Interest Rate hikes?

None.

Ever since we began seeing 7% and 8% CPI prints, the Fed has had multiple opportunities to hike rates aggressively – at any of the four meetings since (November, December, January, and March) or any time between meetings.

That they chose not to and hiked only 25 bps in March, suggests they understand this completely.

They want to normalize rates without causing a recession.

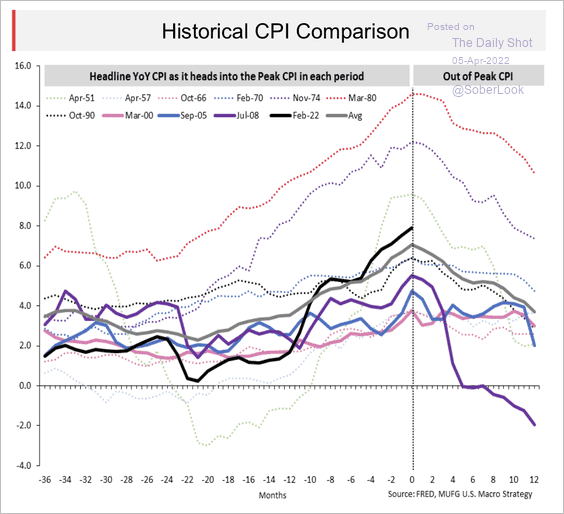

I suspect Jerome Powell believes (hopes?) we have already hit peak CPI, and that an organic fall-off is likely in the near future. It explains much of what we have seen and heard.

Changes in interest rates operate on an immense lag of 6 to 12 months. A soft landing depends upon gauging what the impact of the changes you made months ago will have months in the future while ignoring the screaming headlines today in the face of intense political pressure.

The Fed Chair must relate to Hippocrates, who describes the physician’s job as to “First, do no harm.”

If only pundits had similar obligations…

~~~

Fed minutes are released today at 2:00 pm.

Previously:

Normalization vs Inflation (March 14, 2022)

Comparing Stimulus: Monetary vs Fiscal (GFC vs C19) (March 11, 2022)

Transitory Is Taking Longer than Expected (February 10, 2022)

Structural or Transitory? (November 23, 2021)

Deflation, Punctuated by Spasms of Inflation (June 11, 2021)