When I was younger, I often became infuriated at the assbackwardness of the world. It was frustrating to see all the waste, inefficiency and just downright idiocy wreak so much havoc on the people of planet earth.

Over time, one mellows, acquires wisdom, learns to shrug off the seriously stupid.1

My journey towards acceptance of this began on a trading desk, a place where mismanaged risk often turns into expensive errors. As a newbie, I took solace in the pithy wisdom of my head trader. His response to my questions about the (obviously) bad decision-making leading to an expensive loss:

“Someone has to be on the wrong side of the trade.”

This was strangely comforting.

Lots of financial foolishness still motivates me – I harbor a red hot ember of fury deep inside that burns brightly whenever any frustration blows oxygen on it. Over time, I have learned to keep it from spiraling, allowing me to channel my rage in a much healthier way.

Rather than getting furious over every perceived transgression, it created an opportunity to engage with the world in a more productive way. For example, I could:

– Use my interests to better educate myself;

– Share what knowledge I learned;

– Build a reputation based on these insights;

– Motivate others towards autodidactism;

– Deploy capital in ways that took advantage of what I learned.

Anger can be a useful motivator when properly channeled. Still, it is a never-ending battle versus ignorance and the damage it causes to people’s financial lives.

One can witness this manifest daily, especially on social media.

Each morning, I assemble my reading list, consuming only the most interesting and insightful items from authors I respect and trust. I have been doing this for decades, and ever since a friend asked me to share my daily list with him, in public.

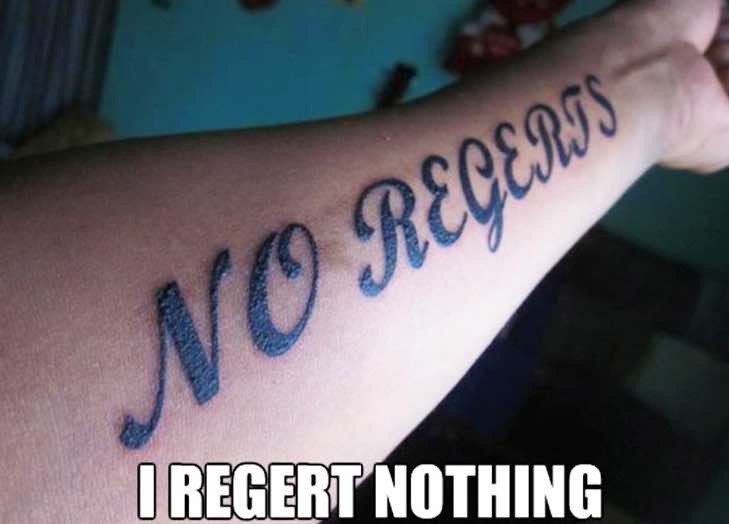

The greatest strength of the many-to-many publication platform of social media is as a discovery tool. Use it to find smart, insightful people who freely share their hard-won wisdom. But the great weakness of the same platform is that any idiot can go out and reveal themselves as such. Despite my best efforts to avoid being drawn into the losing side of the trade, some nonsense still manages to sneak into view.

Just today, I saw examples of idiocy here, here, here, here, here, here, and most especially here.

In markets, these are the losing side of the trade. The feedback loop punishes these folks financially – quickly, in measurable dollar amounts that show up in a P&L or portfolio. The ignorant, the misinformed, and the incompetent either get up to speed fast or go broke. This system is brutal but fair.

In society, these same people experience a very different kind of feedback loop: The personal consequences of idiocy are distant, they impact third parties, and are spread out over time and space. Spreading misinformation about vaccines, the big lie about politics and elections, generally disrupting life as we know it negatively has little personal costs. Maybe a few friends and relatives unfriend you on Facebook and write you off as a dolt. But that’s pretty much it. In an attention economy, it can even create gains.

Which side of the trade are you on?

Previously:

Judgment Under Uncertainty (March 25, 2022)

Wisdom I Wish I Knew 30 Years Ago (August 30, 2021)

What Expertise Do You Want? What Are You Willing To Do For It? (May 21, 2021)

Oblivious (February 3, 2021)

Investing is a Problem-Solving Exercise (January 31, 2022)

____________

1. There is some risk in this, as stupid is vast in numbers. In a Democracy, this risk is nascent, as stupidity is mostly random, disorganized, unaware of its own interests and needs. But just as an angry mob is a threat to life and limb, so too can stupid become motivated and organized. This is when stupid is quite dangerous.