My end-of-week morning train WFH reads:

• How Wall Street Escaped the Crypto Meltdown: As cryptocurrency prices plunged and funds failed, strict rules on risky assets helped Wall Street companies sidestep the worst. Retail investors weren’t as lucky. (New York Times)

• Crazy Prices and Yearslong Wait Times Could Doom the Electric-Car Experiment: Supply-chain snarls, raw material shortages, and record-setting inflation are turning the simple act of buying a car into a war of all against all, and there’s no relief in sight. Could the electric-car market collapse under its own weight? (Vanity Fair) see also The Electric Car Market is About to Get Crazy (and Confusing) Bloomberg Green’s Electric Car Ratings will help you make sense of the chaotic market and find the most climate-friendly EV. (Bloomberg)

• Bond ETFs Attract New Investors With Narrower Offerings The specialization allows investors to find lucrative sectors despite rising rates. But there are risks. (Wall Street Journal)

• Chaos is a Ladder Everyone hates rules and regulations until it’s too late. The fantastyland idea of software protocols and algorithms and communities policing themselves flies in the face of 500 years of financial market history. Digital money is still money and people are insane. That doesn’t change, no matter what kind of investment we’re talking about. Financial markets were born in a time where you could not safely drink water so everyone drank alcohol all day long, out of cups made of lead. This is Europe in the 1500’s. We were crazy then and we are crazy now. (Reformed Broker)

• Time-Consuming, Complex, and Misconstrued: Why Pension Funds Can’t Put a Number on Private Equity Fees The SEC and others are pushing for more transparency in private markets — but pension staffers worry about the consequences. (Institutional Investor)

• Home Sellers Are Slashing Prices in Sudden Halt to Pandemic Boom The rapid rise in mortgage rates is cooling demand, jolting markets from coast to coast. https://www.bloomberg.com/news/articles/2022-07-01/will-home-prices-fall-sudden-housing-turn-has-sellers-paring-expectations

• Why You Should Quit Your Job After 10 Years Labor experts say a radical career shift every decade or two can be good for both workers and employers. (Businessweek)

• You’re Not Allowed to Have the Best Sunscreens in the World: Newer, better UV-blocking agents have been in use in other countries for years. Why can’t we have them here? (The Atlantic)

• Public lands are Americans’ birthright. It’s our duty to defend them against new landgrabs How one couple helped save vast areas of wilderness in the 1940s – and provided a map for protecting them today. (The Guardian)

• And Then the Sea Glowed a Magnificent Milky Green: A chance encounter with a rare phenomenon called a milky sea connects a sailor and a scientist to explain the ocean’s ghostly glow. (Hakai Magazine)

Be sure to check out our Masters in Business interview this weekend with Spencer Jakab, editor of Heard on the Street column at the Wall Street Journal, and author of the Ahead of the Tape column. He began his career as an analyst at Credit Suisse, where he eventually became Director of Emerging Markets Equity Research. He is the author of “The Revolution That Wasn’t: GameStop, Reddit and the Fleecing of Small Investors.”

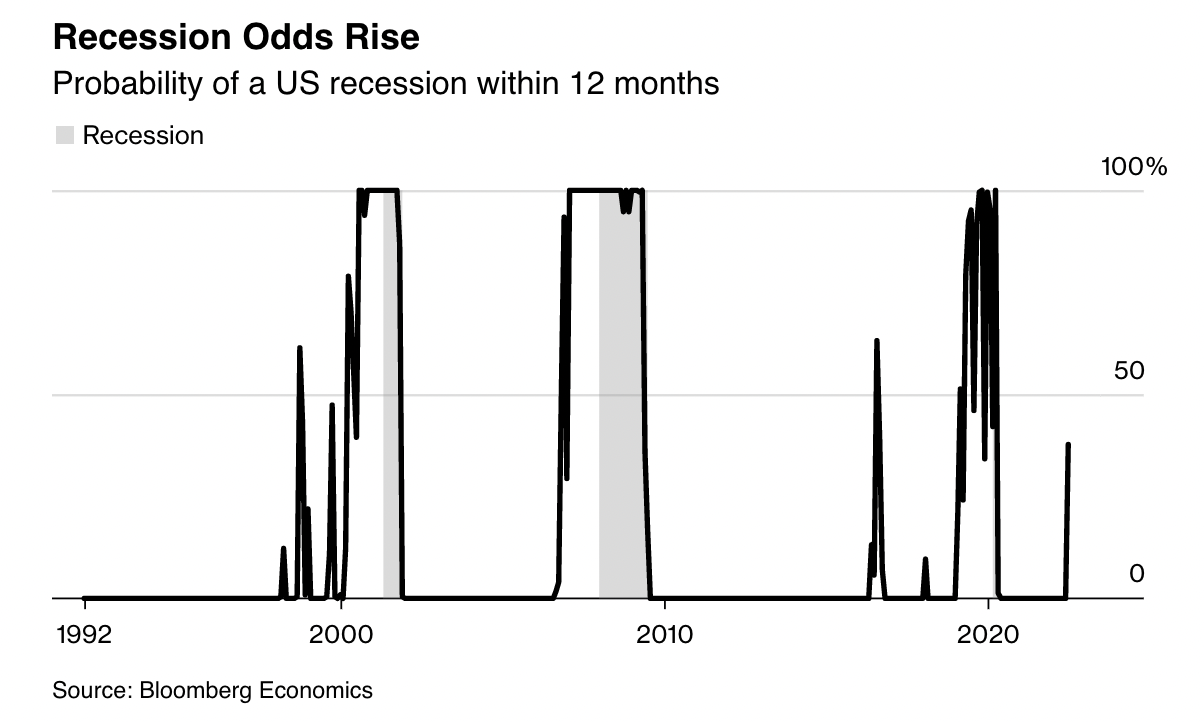

US Recession Chances Surge to 38%, Bloomberg Economics Model Says

Source: Bloomberg

Sign up for our reads-only mailing list here.