Ignore the emojis in the headline long enough to ask yourself this question: What might the rest of 2022 look like?

I did that exercise last week in response to a client inquiry about the second half of the year. The context was excess cash looking for a good long-term home (not a trade). The question was not so much where to put the capital, but rather when to deploy it. They understood the advantages of lump sum investing, and the psychological benefits of legging in over time; for this chunk of capital, they were looking for an aggressive, well-timed entry point.

Some caveats: RWM certainly does NOT manage client dollars this way; you do NOT want to invest “real” money based on my or anybody else’s gut as to when to jump into the deep end of the pool. It only works for someone whose financial plan is fully funded, the rest of their house is in order, and they are playing with a modest amount of discretionary cash.

Regardless, it is an interesting question.

To answer it requires some imagination as to possible paths the market can take from here. It also requires some self-awareness (and some chutzpah) about what it is you think you know that most of the market has yet to figure out. Throw in some of Howard Marks‘ second-level thinking and you can cobble together an answer with an outside chance of success.

Let’s start with how we got here:

A massive global pandemic led to a shutdown of the world’s economy. Enormous government response — most notably $5 trillion in fiscal stimulus from the U.S. — avoided a catastrophic depression but supercharged the economy. This was made worse by A) Shift from services to goods; B) Supply chain disruptions; C) Vaccine hesitancy. D) Federal Reserve staying at Zero for too long.

Exacerbating matters was this failure to normalize rates in a reasonable time period after the pandemic recovery began. With the benefit of 20-20 hindsight, this likely would have tamped down some of the worst of the inflation prints.

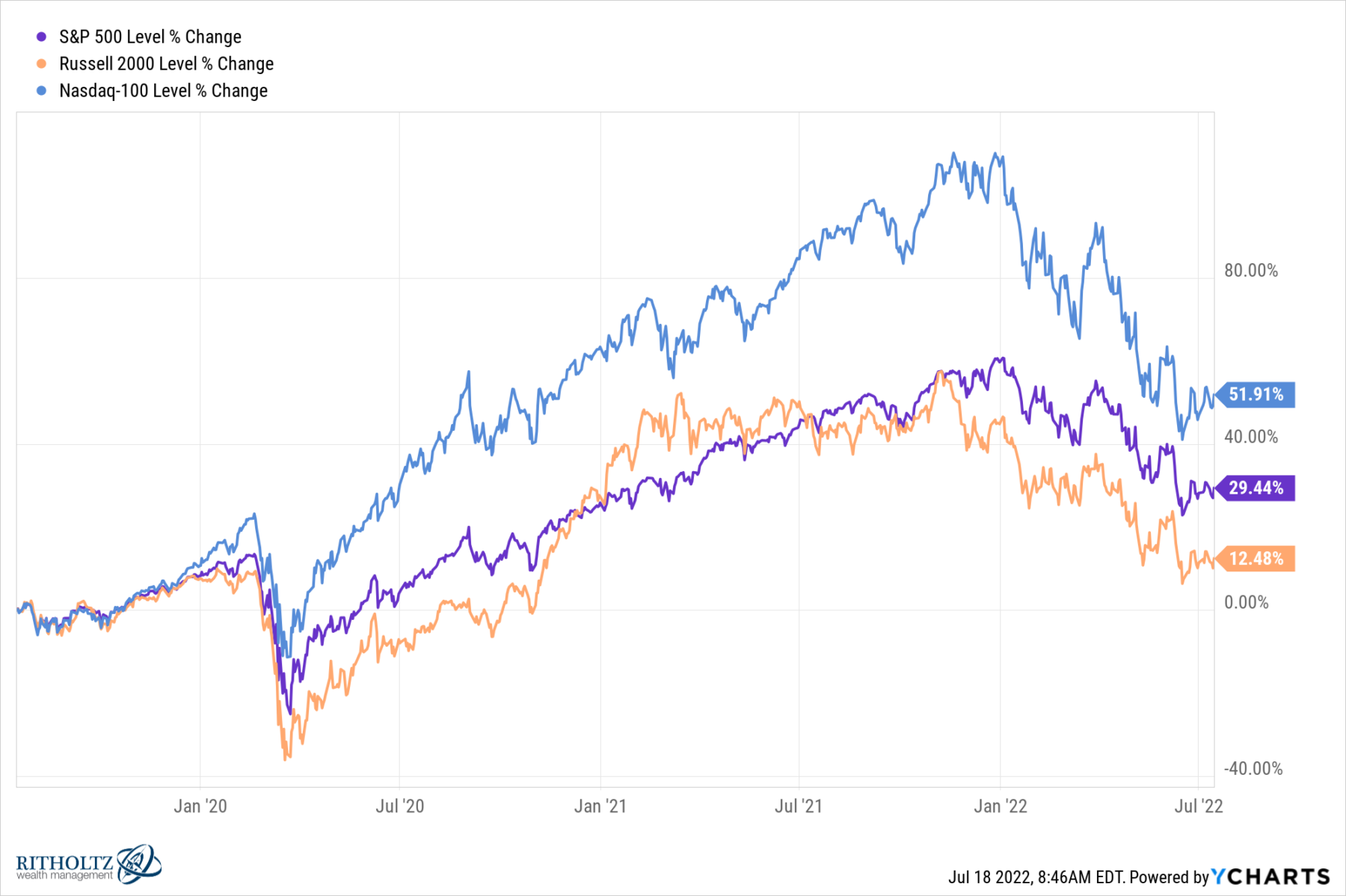

But all that stimulus had its economic and market impact: 2020 saw markets gain more than 20% as they recovered from a 34% sell-off; 2021 was even better, with markets up 28% and never falling more than 5% from all-time highs the entire year.

Then came 2022, the annus horribilis of this young decade. Some of this was surely mean reversion, but it was a lot of other things also: Inflation reached 40-year highs; the Fed began aggressively raising rates, and consumer sentiment hit new lows as recession fears increased.

The market sold off nearly 20% in the first quarter before recovering to about down 5%; 2nd quarter saw a 17% drop. There was no place to hide as bonds fell double digits in the first quarter (they recovered only slightly in Q2). It was the worst start to a year for Treasuries in the modern era. Crypto got demolished by 67%; Work-from-home stocks were punished; even FAANMG stocks fell dramatically. For traders, Energy (Crude, Nat Gas, Gasoline) was one of the few bright spots along with a basket of commodities in the first half of the year.

The decrease in equity markets is fascinating because the recent quarters of reported earnings were at record highs.1 This makes the drop over the first half of the year driven not by a decrease in earnings but by PE multiple compression. So far, it appears that companies have been able to pass along inflation-driven input costs to consumers. To repeat: So far.

That is where we are today: Markets seemed to have priced in a mild recession, with peak inflation behind us. I am unsure if the markets have priced in the Fed overtightening, and I am especially concerned about earnings softening a little this quarter (Q2 reporting started last week); I am not at all sanguine about what Q3 earnings will look like.

The positives are households have cash, Corporate America’s balance sheets are great, commodity prices have fallen hard, and consumers keep spending. The negatives are sticky services inflation, especially Rent, increased credit usage, low but rising delinquencies.

The big wildcards: Will a behind-the-curve Fed overreact to inflation that is already falling? How much will the new rate regime impact Q3 earnings? Will the consensus soft landing — a silky, sexy, mild recession — morph into something much worse? Last, are weak Q3 earnings already reflected in stock prices?

I suspect FOMC going 75 bps on July 27-28 pretty much seals the deal for a recession. And that could have a very negative impact on Q3 earnings.

Your best entry point will be determined by sentiment and how markets are trading at that moment. If you missed last week as your moment, then you are hoping this is just a bear market rally. I’d be looking for a big miss either during this quarters’ reporting season or even more likely, in Q3 when we find out if the Fed’s overreaction did too much damage.

Risk as much as you are willing to lose, and if you don’t want to leg into the position over time in 4 pieces, at least break the Buy in half to improve your odds of getting it right.

YMMV

See also:

What’s Priced In? (July 19, 2022)

Previously:

Too Late to Sell, Too Early to Buy… (June 16, 2022)

Capitulation Playbook (May 19, 2022)

Panic Selling Quantified (March 24, 2022)

If You Sell Now, When Do You Get Back In? (March 23, 2022)

Don’t Panic! (with apologies to Douglas Adams) (March 9, 2020)

_________

1. BAML noted this morning: “Weakest start since 1Q20, fewer beats than average Following Week 1, 35 S&P 500 companies (including early reporters) comprising 10% of index earnings have reported. 2Q EPS ticked down by 30bp since July to $55.18 (vs. our $55.35). Just 43% of companies beat on sales and EPS, weaker than the historical postweek 1 average of 47% and the weakest since 1Q20. We expect 2Q EPS to ‘meet’ at best with a flurry of downward revisions”