My back-to-work morning train WFH reads:

• What a Stock Market Bottom Looks Like: Life would be easier if this was the case. But if everything was obvious in the stock market it wouldn’t offer such wonderful long-term returns. (Wealth of Common Sense)

• America Is Unleashing Its Economic Arsenal: Targeted measures are becoming a bigger part of US foreign policy. (Businessweek) see also US Chip Sanctions ‘Kneecap’ China’s Tech Industry: The toughest export restrictions yet cut off AI hardware and chip-making tools crucial to China’s commercial and military ambitions. (Wired)

• US banks gain from Fed rate hikes while keeping deposit interest low Wall St is charging more for loans but setting aside money for a possible downturn. (Financial Times)

• Bad News is Good News: 52-week lows tend to cluster, and right now that’s the environment we find ourselves in. The S&P 500 has experienced thirteen 52-week lows this year…which is more than we saw the entire last decade. (Irrelevant Investor)

• Twitter Faces Only Bad Outcomes If the $44 Billion Musk Deal Closes: The company has been damaged by the drama over the deal, and things look bumpy if it goes through. (Businessweek)

• San Francisco’s Empty Train Cars Spell Trouble for Public Transit: The Bay Area experienced the nation’s sharpest decline in ridership during the pandemic, and a fiscal cliff looms. (Bloomberg)

• The AI is Coming: It is now possible to generate a stunning lifelike image from scratch in thirty seconds by typing a prompt. Truly incredible. (Alex MacCaw)

• Five Decades Into The War On Drugs, Decriminalizing Marijuana Has High Bipartisan Support: Americans agree that the country’s legislation on marijuana does need an update. Polling conducted before the Oct. 6 pardon found 6 in 10 American voters said weed should be legal in the U.S.; 7 in 10 among voters under 45 (72%), Democrats (71%) and Black voters (72%), Republicans (47%) and voters 65 or over (45%). (FiveThirtyEight)

• ‘Almost Famous’ Heads to Broadway, Purple Aura Intact: Cameron Crowe adapted his Oscar-winning screenplay, about writing for Rolling Stone in the ’70s, preserving parts of the movie’s soundtrack and zingers (Don’t take drugs!) for the stage. (New York Times)

• The Bigfoot of Baltimore: Justin Tucker is the surest thing in football. But he gets nervous thinking about those kicks, too. (Wall Street Journal)

Be sure to check out our Masters in Business this week with Tom Rampulla, managing director of Vanguard’s Financial Advisor Services division since 2002. He runs the business that provides investments, services, education, and research to more than 1,000 financial advisory firms representing more than $3 trillion in assets.

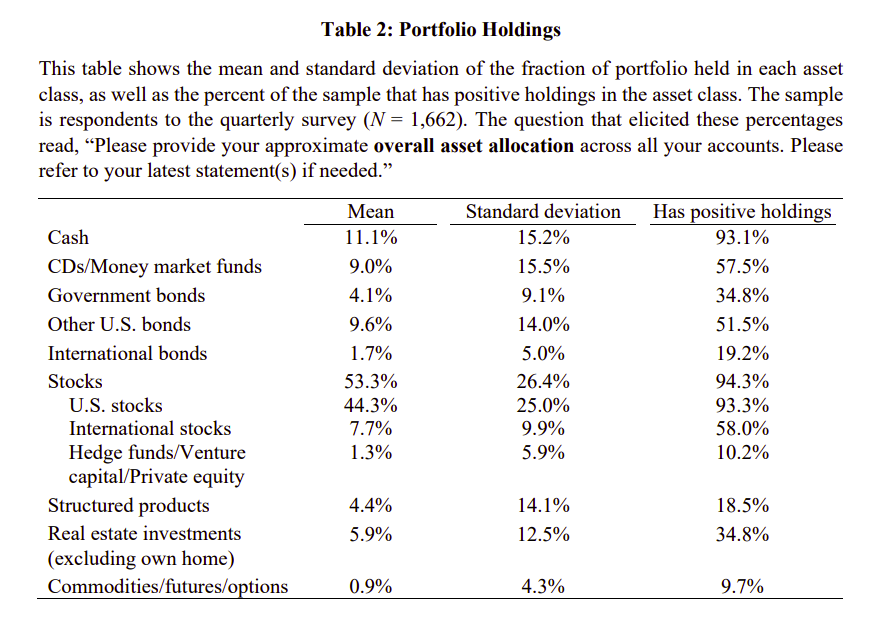

What do millionaires invest in?

Source: Alpha Architect

Sign up for our reads-only mailing list here.