The news broke Sunday afternoon that depositors would be made whole and would have full access to their accounts and money today; equity investors in the bank would take their losses and senior management are fired. Whatever is left over (if anything) we’ll go to bondholders as new owners for both Silicon Valley Bank and Signature Bank are being assessed.

I watched a parade of cocksure analysts and commentators and speculators on several different cable news channels discussing the fallout from the weekend’s activities with great confidence, which I hasten to add is surely unwarranted.

Forget what comes next, we still have very little idea of the complex causes of what actually happened. Whether it’s crisis management, commission trades, syndicate or (literally) book sales, lots of people all talking their books tends to provide little illumination.

Over my three decades of surfing crises on Wall Street. The one unifying thread that connects all of the major events is just how little we know as they unfold, and how much we learn in the ensuing months and years. The first draft of history is typically emotional, rarely accurate and often conflicted.

Recall the Thai Baht Crisis, Russian Ruble collapse (& LTCM), dotcom implosion, analysts’ scandals, IPO spinning, accounting frauds, the Great Financial Crisis, the Flash Crash (2010), Covid Crash, and now the latest SVB/Signature Bank collapse, and all of these follow the same pattern.

I was less impressed by the breaking news at the time of each of these and more impressed by what we learned subsequently. Lest you doubt this, consider these deeply reported books on major market issues:

Maggie Mahar’s Bull: A History of the Boom and Bust, 1982-2004

Roger Lowenstein’s When Genius Failed: The Rise and Fall of Long-Term Capital Management

Bethany McClean’s The Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron

Michael Lewis’ The Big Short: Inside the Doomsday Machine

In addition to these being great reads, the big takeaway they reveal is how little we actually knew in real-time.

And now, Silicon Valley Bank and Signature Banks go bust and some very overconfident pundits Mansplain to us what just happened.

Hard pass.

Rather than tell you what happened, I would prefer to point to a few of the things we do not know. Note: these are not accusations, but simply are questions the answers to which would be informative:

10 Unknowns About SVB:

1. Why did the bank have so much capital wrapped up in long dated Treasuries? Who was advising them? Bond Investing 101 is shorten your duration during a rate hiking cycle – how was this unknown to them?

2. Why did Peter Theil’s Founder’s Fund (and others) advise companies pull deposits out of SVB? What was the concern? What non-public information did they have beyond the publicly announced capital raise? Were there any other conflicts of interests, legal or otherwise?

3. How much of this is related to the hangover from the Great Financial Crisis? One aspect of the GFC was junk paper was often not marked to market on a timely basis – the banks “marked to make believe” and created a misleading picture of their solvency. We changed the rules for that. But why are we marking to market Treasury Bonds if they are “money good” at maturity? Should we carve out exceptions to the asset book marks for paper the Fed will repurchase at Par?

4. What was the impact of the rollback of Dodd Frank in 2018 during the Trump Admin? CEO of SVB had requested – and won – some rule changes, what was their impact? Did that have a material effect on the investment book maintained by SVB? How and in what way?

5. When did the San Francisco Fed learn SVB/Signature were running into problems? What access did the FRBSF have to the SVB investment book? Did they pass this info on in a timely manner to the Federal Reserve?

6. Could the regional FRBSF or the Fed itself have helped facilitate a capital raise without disruption? We do not know what was known when.

7. What was the role of messaging here? Did miscommunication from the bank play a role in the subsequent panic?

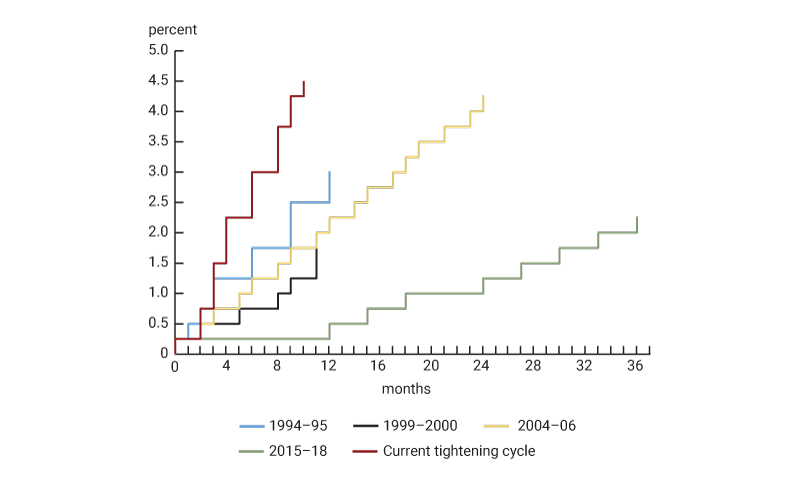

8. What was the impact of the most rapid set of rate increases in history have on this event? Was the FOMC a factor in setting off a bank instability? Was the Fed on both sides of the instability here?

9. What other banks might have similar issues with their “safe” investment portfolio? What don’t the regulators know about the regionals that they should?

10. Who ends up owning these banks? Do they become part of a major (Chase, Bof A, Wells Fargo, Citi) or do they stay a regional? What is the purchase price? Shareholders are wiped put, but do bondholder see any capital?

Of course, there is more, but I suspect we won’t know the answers to all of these questions for quite a while.

~~~

I am tempted to create a new post category titled “Today in Dunning Kruger but I fear it would become a full-time job…

Previously:

The Fed is Breaking Things (and it could get worse) (March 10, 2023)

A Dozen Questions for Jerome Powell, Fed Chair (March 6, 2023)

What the Fed Gets Wrong (December 16, 2022)

Why Is the Fed Always Late to the Party? (October 7, 2022)

Transitory Is Taking Longer than Expected (February 10, 2022)