First, the good news: Consumer Price Index (CPI) came in modest at 0.4%, with a year-over-year print of 4.9%. I love the 4 handle (!) and I expect CPI will continue to fall over the next few months. We are likely to see a 3 handle before Christmas, maybe even around Halloween.

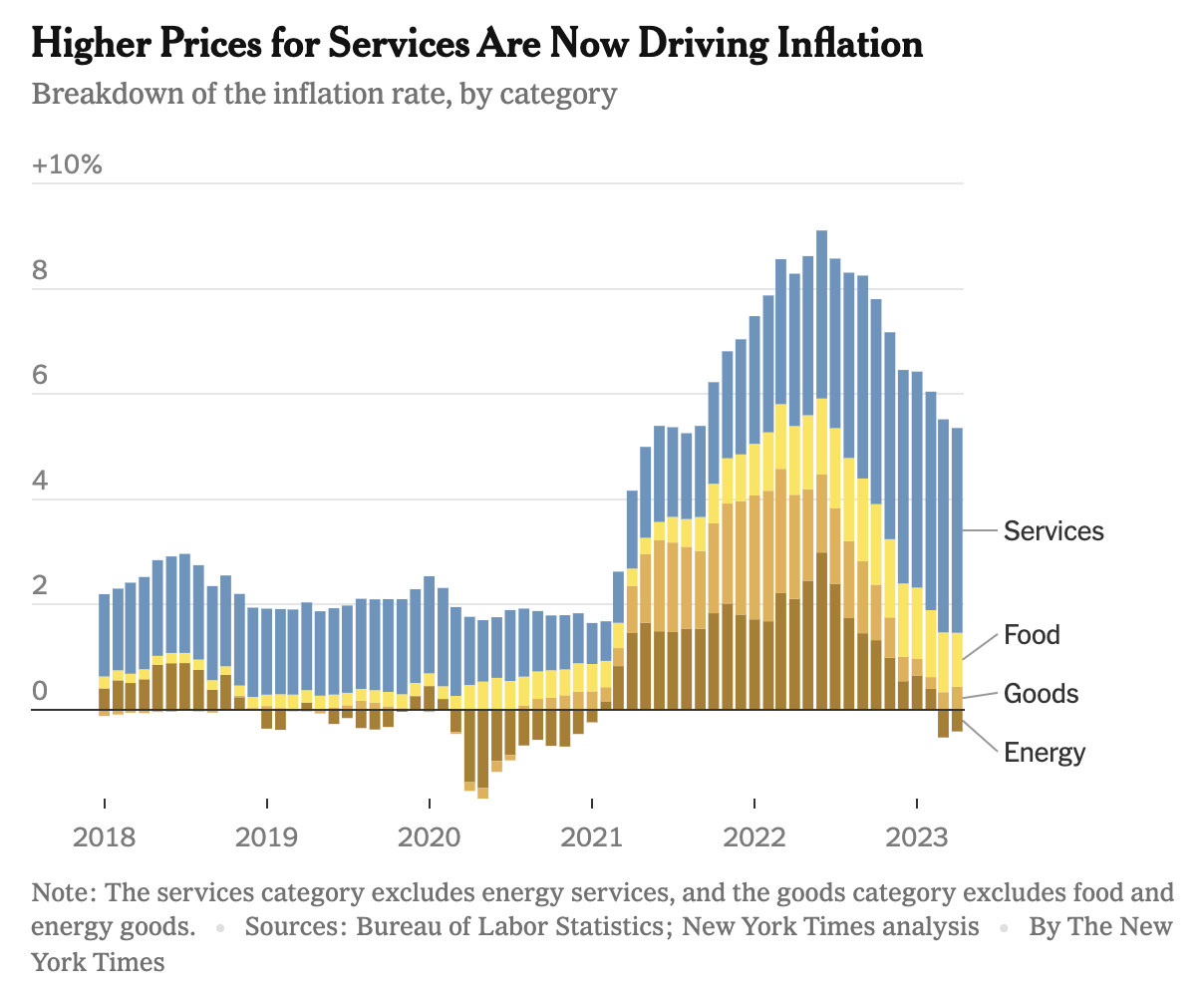

The inflation that appeared so pernicious in 2021 and into 2022 was driven by the combination of 3 things:

– Unique pandemic factors

– Massive monetary stimulus (CARES ACT I, II & III)

– Structural (long-term) shortages in labor and single-family homes

The unique environment of the COVID-19 lockdown for 18 months and the pent-up demands that followed its end have no comparables in history. No the current form of inflation is nothing like the 1970s, nor is it similar to what took place in the mid-2000s.

This has been a unique and (dare I say it) unprecedented set of factors that have sent prices higher despite the intentions of the Federal government and the FOMC.

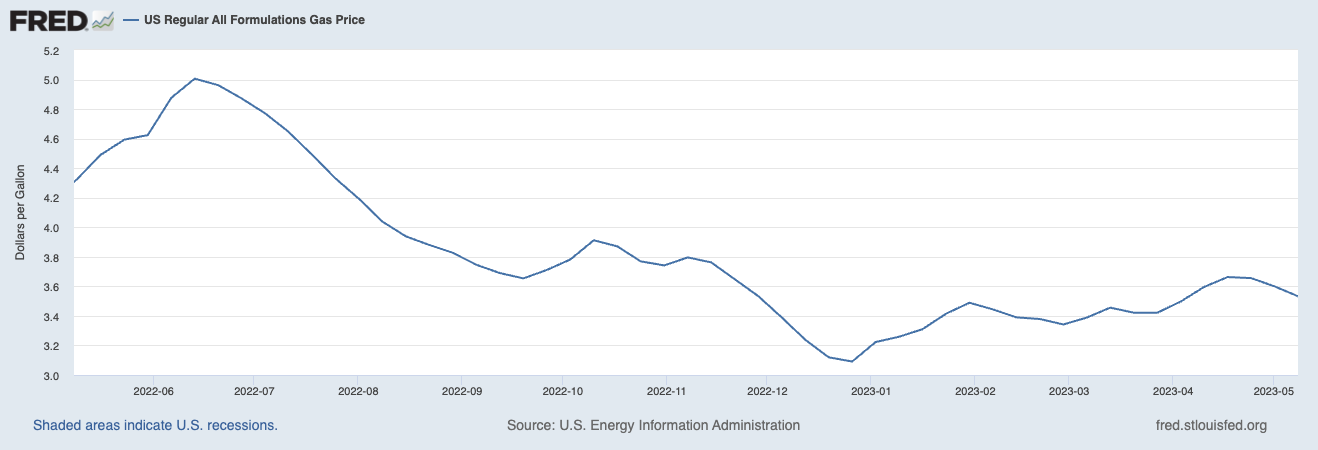

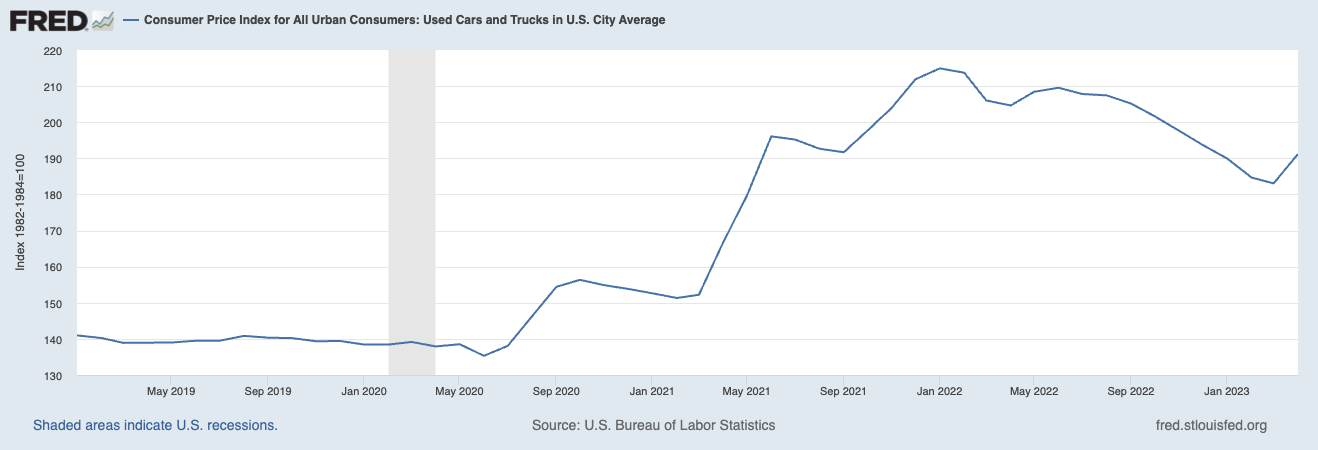

But CPI data is always lagging and backward-looking: Consider the big risers in April were shelter, used cars and trucks, and gasoline.

Gasoline prices in April are far behind the curve, as oil prices fell below $70 this week. You can see the overall trend in gasoline is lower, with some volatility as the summer driving season approaches.

The same is true for Used Cars and Trucks, they are still elevated due to the shortage of new cars which traces itself to the slowly easing supply shortages of semiconductors. But higher rates are sending them in the right direction.

Last, Shelter: It’s being driven higher by the Fed itself, as they have sent mortgage rates much higher thereby making rental rates higher.

The FOMC’s 2% inflation target was a post-GFC, ZIRP/QE driven creature during a period of slow growth, no wage gains, and zero fiscal stimulus. Post-lockdown, pent-up demand met massive fiscal stimulus — $4 trillion in three CARES acts, an infrastructure and an inflation bill — to create a massive surge of consumer spending. The post-pandemic economy differs significantly from the 2010s.

The old regime of a 2% inflation target is dead.

I would move the goalposts towards a more rational 3% over the next 12 months. To get back to 2% inflation target, the economy would need some combination of ZIRP, or higher unemployment, or more than a mild recession.

The Fed’s new motto should be: 3% or Bust…

Previously:

For Lower Inflation, Stop Raising Rates (January 18, 2023)

Press Pause (May 3, 2023)

Transitory Is Taking Longer than Expected (February 10, 2022)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

How the Fed Causes (Model) Inflation (October 25, 2022)