My end-of-week morning train WFH reads:

• Americans Have Quit Quitting Their Jobs: The rate at which workers are voluntarily leaving employers is approaching prepandemic levels. (Wall Street Journal)

• The Case for Declining Core Inflation: We see four reasons to expect renewed declines in inflation this summer and beyond: 1) 9% pullback in used car auction prices we believe is only halfway done, 2) negative residual seasonality in the summer for CPI and PCE prices, 3) sharp deceleration in apartment rent list prices, and 4) significant progress on labor market rebalancing. (Goldman Sachs) see also Chartflation: Five Charts Showing Inflation Isn’t as ‘Sticky’ as Feared: Leading inflation indicators point toward price pressures easing further. While we don’t think this is a direct market driver, with inflation continuing to weigh on sentiment, the clearing fog likely reveals a better-than-expected reality. (Fisher Investments)

• The economy’s doomsday clock has been reset: Wall Street’s fearmongers were totally wrong about a recession. (Business Insider)

• The Simple Mistake That Almost Triggered a Recession: Leading economists said we’d need higher unemployment to tame inflation. Here’s why they were wrong. (The Atlantic)

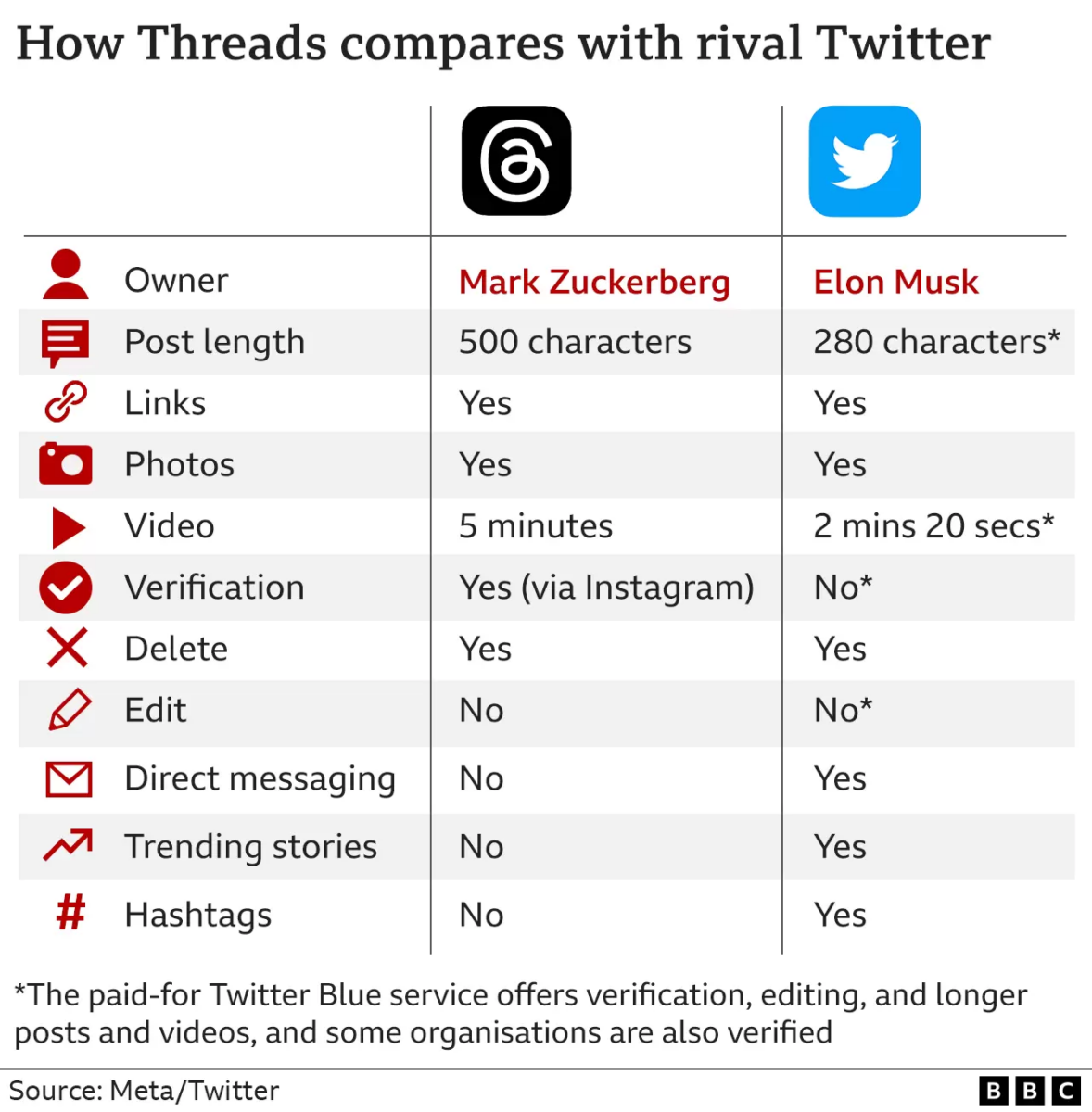

• Twitter is threatening to sue Meta over Threads. Twitter’s letter is an early sign that Threads is the most serious rival yet to Musk’s chaotic, but still-central, platform. (Semafor)

• The persistence of cognitive biases in financial decisions across economic groups: It is often implied but not tested that choice patterns among low-income individuals may be a factor impeding behavioral interventions aimed at improving upward economic mobility. Choices impeded by cognitive biases alone cannot explain why some individuals do not experience upward economic mobility. Policies must combine both behavioral and structural interventions to improve financial well-being across populations. (Nature)

• Yes, it’s hot. But this could be one of the coolest summers of the rest of your life. Heat waves like those in Texas and Europe are likely to get worse on the whole, not better. (Vox)

• Trump coup plotter John Eastman is finally facing real accountability: Pay attention to the disbarment proceedings that lawyer John Eastman is facing in California. He manufactured the bogus theory behind Trump’s effort to overturn his 2020 election loss + could lose his law license. (Washington Post)

• The trauma of Cary Grant: how he thrived after a terrible childhood – as told by his daughter Born into extreme poverty, Grant was told as a child his mother had died. She had actually been placed in a psychiatric institution. It was the start of a life of repression and extraordinary reinvention. (The Guardian)

• Money Isn’t Winning in MLB This Season. Is That Good or Bad for Baseball? The high-payroll Mets and Padres are flailing. The low-budget Rays, Diamondbacks, Orioles, and Reds are thriving. What’s behind MLB’s topsy-turvy standings? And what could it portend about the future of the sport? (The Ringer)

Be sure to check out our Masters in Business this weekend with Franklin Templeton CEO Jenny Johnson, which manages $1.5 trillion dollar in client assets. She has worked at FT since 1988, and held leadership roles in investment management, distribution, technology, operations, and high-net-worth clients. Franklin Templeton oversees more than 9000 employees and 1300 investment professionals. Johnson is on the list of most powerful women (Barron’s, Forbes, American Banker, and more). She has been CEO February 2020.

Threads could cause real problems for Twitter

Source: BBC

Sign up for our reads-only mailing list here.