Hey, it’s September! Kick off the new month with our end-of-week 3-day weekend reads:

• Rates Are Up. We’re Just Starting to Feel the Heat. Homeowners. Car buyers. Landlords. Big businesses. Here’s who stands to lose—and in some surprising cases, win—as interest rates stay high in the years ahead. (Wall Street Journal)

• Little evidence that a spot bitcoin ETF would expand the market: BlackRock’s application and Grayscale’s court victory stirred the crypto world, but such investment vehicles look very vanilla. (FT Alphaville) see also Allan Roth: Lessons From 2 Jim Cramer ETFs: Did Tuttle Capital Management close the wrong fund? (ETF.com)

• The Harrowing Story of a Top Manager’s Biggest Investing Mistake: Oakmark’s David Herro waited years for Credit Suisse to deliver. It never did. (Morningstar)

• Seventies Analogy Disorder: What Can We Learn From the 1970s? • A S.A.D. Story: Beginning in 2021, we really did have an inflationary surge, and it wasn’t entirely silly to worry that getting inflation back down to an acceptable level would require high unemployment, just as it did after the ’70s. (New York Times)

• Wall Street Gets Tough on Return-to-Office Laggards: Bosses ‘will be more rigid’ with latest in-person push: Wylde Many firms expect workers in office at least three days a week. (Bloomberg)

• Is the AI boom already over? Generative AI tools are generating less interest than just a few months ago. (Vox)

• America Is the World Leader in Locking People Up. One City Found a Fix: New York’s supervised release program, a national model, is juggling thousands of defendants facing violent felony charges—and the politics of letting them walk free.(Businessweek)

• The Moonshot Heard Round the World: What are the lessons of India’s frugal moon landing for any business on this Earth? (Wall Street Journal)

• The Evolution of A.O.C. The congresswoman from New York says she’s different from when she first took office. But she’s not ready to call herself an insider. (New York Times)

• Is Carlos Alcaraz the Next Billion-Dollar Tennis Player? At the US Open, the young Wimbledon champion will make his case to succeed Federer, Nadal and Djokovic—and Serena—as the sport’s next big star. (Businessweek)

Be sure to check out our Masters in Business this week with Jonathan Miller, CEO of Miller Samuel, a real estate appraisal and consulting firm he co-founded in 1986. He is a state-certified real estate appraiser in New York and Connecticut who performs court testimony as an expert witness, and holds the Counselor of Real Estate (CRE) and Certified Relocation Professional (CRP) designations. His weekly email Housing Notes is widely read in both the appariasal and real estate brokerage industries. Miller Samuel’s research and data analytics drive much of the national real estate brokerage publications and strategic plans.

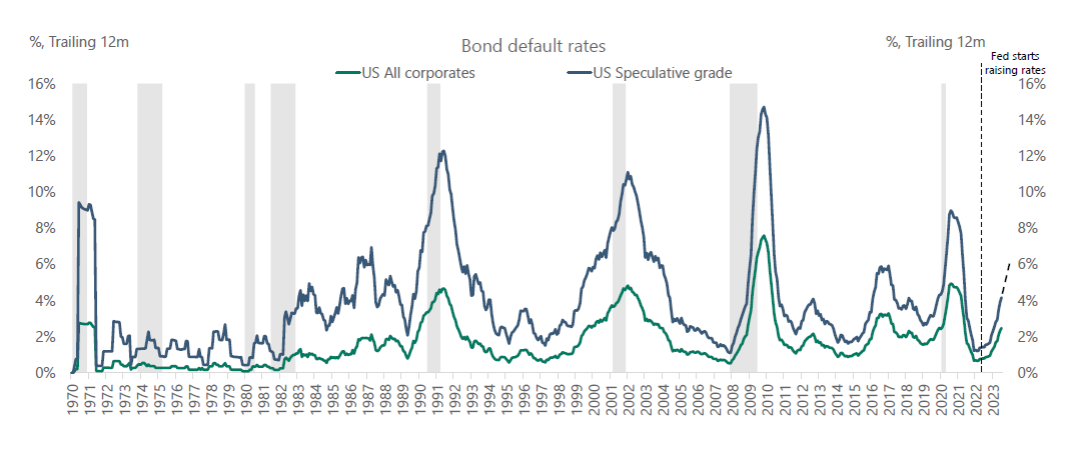

A default cycle has started, and markets are not paying attention.

Source: Torsten Slok, Apollo Global

Sign up for our reads-only mailing list here.