My 3-day weekend reads:

• How Friday Became the New Saturday: A summer perk became a year-round staple. More white-collar employees are clearing the decks at the end of the week after pandemic upended in-office work. ‘Friday is just a dead day.’ (Financial Times)

• All That Empty Office Space Belongs to Someone: If the nearly 100 million square feet of office real estate stays empty, who loses? (New York Times) see also How to Play the Property Meltdown in Five Charts: Savvy buyers made a fortune after the 2008 crash, picking up real estate at distressed prices. Investors hoping to spot bargains in the latest slump can watch these trends. (Wall Street Journal)

• Denmark pays students to go to college. But free education does have a price. Borrowers in the US and the UK rack up the highest debt in the world. In Denmark, tuition is free and students are given grants to pay for things like food and housing. Hardly anyone takes out loans, but free education comes with a price. (The World)

• A Closer Look at Risk & Reward in Bonds Right Now: T-bills still look pretty darn attractive, as those yields are still above 5%. If the Fed raises rates again, those yields will continue to go up. But you do face reinvestment risk in T-bills since the duration is so short. (A Wealth of Common Sense)

• Recession Signal From Yield Curve May Not Work, ECB Says: Deep inversion has previously been a red flag of recession Years of bond buying has compressed term premium, says ECB. (Bloomberg)

• 4 Days, 690 Miles, Countless Stalls: Behold the ‘World’s Longest Yard Sale’ Everyone loves a bargain. But can anyone survive the entirety of the 127 Yard Sale, an annual four-day event that stretches from Michigan to Alabama? (New York Times)

• The Early History of Counting: How ancient peoples learned to keep a tally. (Lapham’s Quarterly)

• The myths we tell ourselves about American farming: “Agricultural exceptionalism,” explained. (Vox) see also A Quest Inspired by the Pandemic Seed Shortage and a ‘Primal Fear’ When one gardener realized there was no seed available to order, she panicked and then began asking questions. Her new book offers some answers. (New York Times)

• America’s Surprising Partisan Divide on Life Expectancy: Centuries-old settlement patterns — and the attitudes they spawned about government — are to blame for differences in longevity between red southern states and bluer parts of the country. (Politico)

• The Song That Never Ends: Why Earth, Wind & Fire’s ‘September’ Sustains: “The, kind of, go-to phrase that Maurice used in every song he wrote was ‘ba-dee-ya,’ ” she says. “So right from the beginning he was singing, ‘Ba-dee-ya, say, do you remember / Ba-dee-ya, dancing in September.’ And I said, ‘We are going to change ‘ba-dee-ya’ to real words, right?’ ” Wrong. Willis says that at the final vocal session she got desperate and begged White to rewrite the part. “And finally, when it was so obvious that he was not going to do it, I just said, ‘What the f*** does ‘ba-dee-ya’ mean?’ And he essentially said, ‘Who the f*** cares?'” she says. “I learned my greatest lesson ever in songwriting from him, which was never let the lyric get in the way of the groove.” (NPR)

Be sure to check out our Masters in Business this week with Jonathan Miller, CEO of Miller Samuel, a real estate appraisal and consulting firm he co-founded in 1986. He is a state-certified real estate appraiser in New York and Connecticut who performs court testimony as an expert witness, and holds the Counselor of Real Estate (CRE) and Certified Relocation Professional (CRP) designations. His weekly email Housing Notes is widely read in both the appariasal and real estate brokerage industries. Miller Samuel’s research and data analytics drive much of the national real estate brokerage publications and strategic plans.

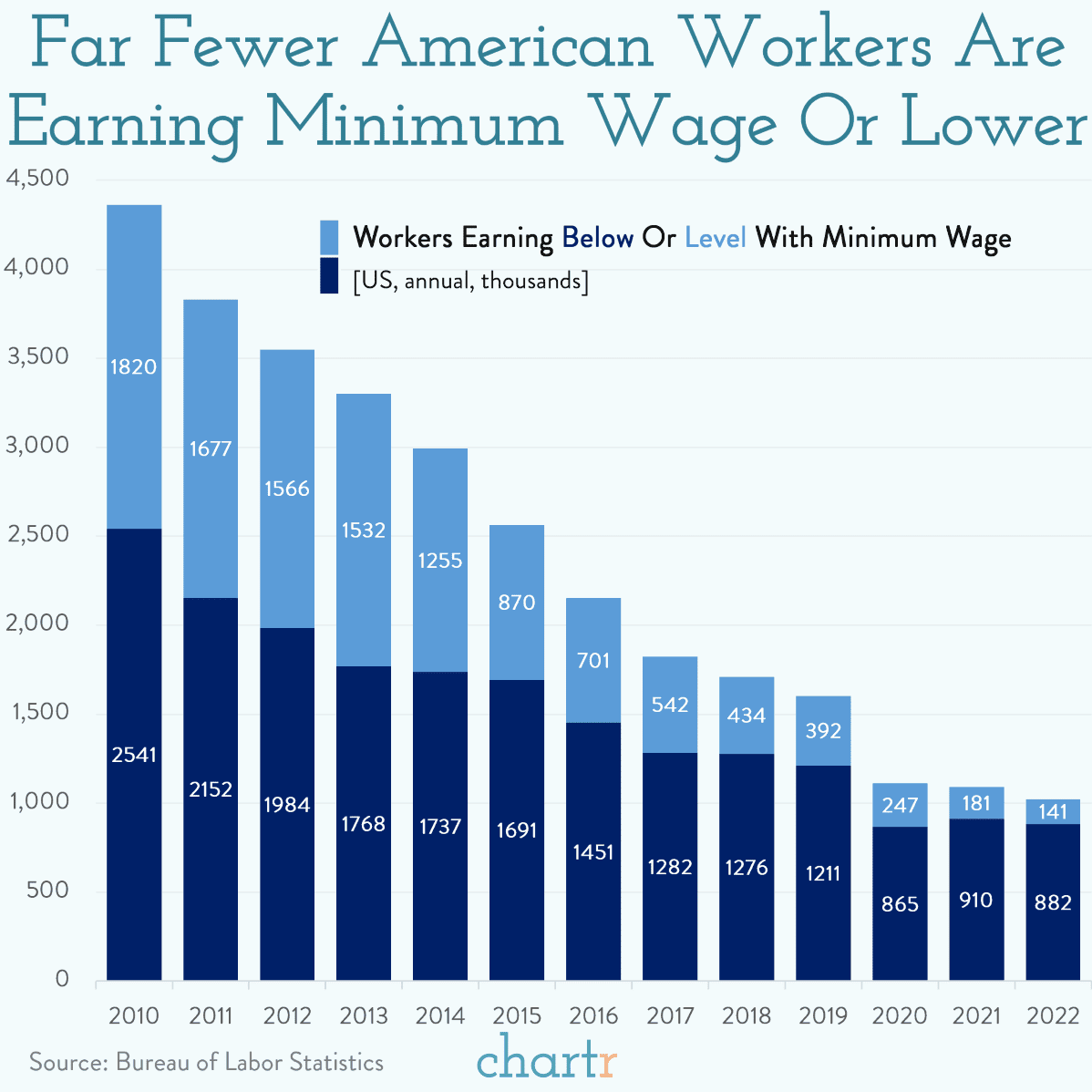

Is America’s minimum wage becoming irrelevant?

Source: Chartr

Sign up for our reads-only mailing list here.