A quick note to answer this question:

What happens after markets make a new all-time high (after a year w/o one)?

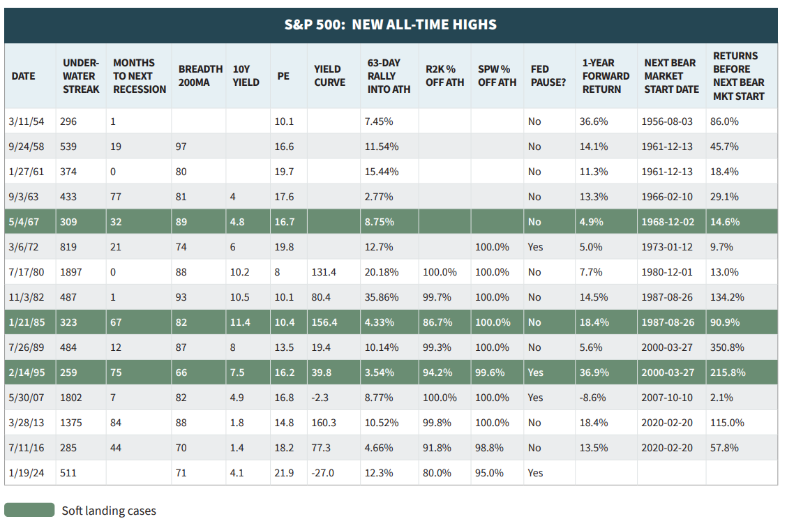

Check out the table above, via Warren Pies. He spoke with Batnick and Josh earlier this month.

Going back to 1954, markets are always higher one year later – the only exception was 2007. That was after housing had peaked, subprime mortgages were defaulting, and the great financial crisis was about to start.

This is the 15th time markets have made ATH highs after 12 months. Excluding 07, returns have ranged from 4.9% to 36.9% a year later, averaging about 14%; the bull market that followed ranges from 9.7% to 350%, with an average of 85%. Drawdowns following ATH tend to be shallower than other periods as well.

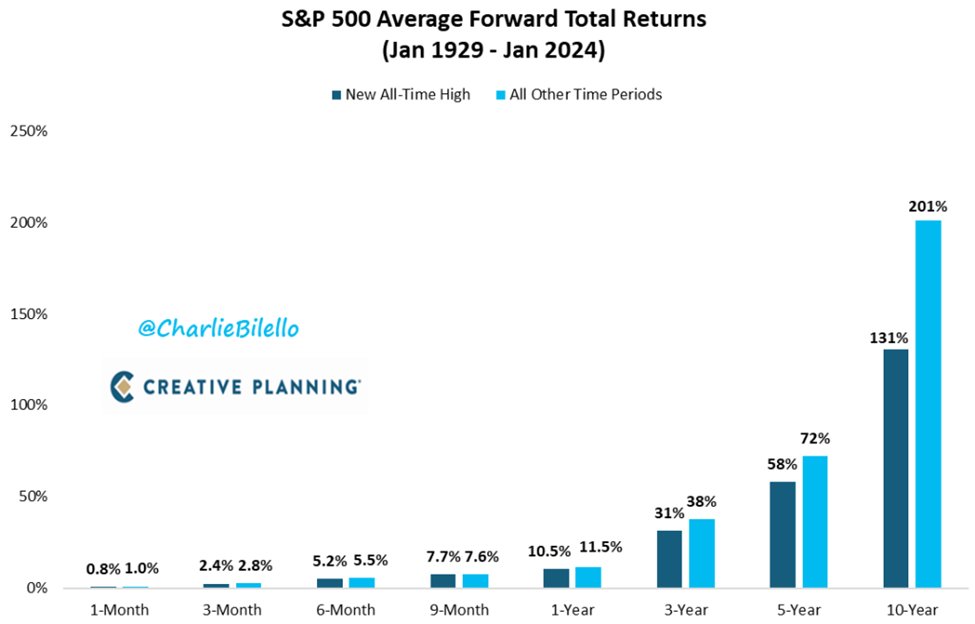

Peter Mallouk points out that investments made on days of all-time highs outperform investments made on all other days,

Technicians will tell you All-Time Highs are bullish because there is no selling resistance; behavioral economics suggests it’s bullish due to FOMO and plain old greed.

Ask yourself this: Is 2024 more akin to 2007, or most other markets where new all-time highs were made?

See also:

Nothing is More Bullish than All-Time Highs (Michael Batnick, February 3, 2024)

All-Time Highs in the Stock Market are Usually Followed by More All-Time Highs (Ben Carlson, February 8, 2024)

Previously:

How Bullish Were You in 2011? (November 29, 2023)

The Most Hated Rally in Wall Street History (October 8, 2009)