A quick note on the state of the economy in light of some recent data.

Q1 2024 Gross Domestic Product expanded at a disappointing 1.6% — note this is seasonally and inflation-adjusted annual rate. That lagged economists’ consensus of 2.4%.

However, it’s not quite all it appears. Some of this is that “long and variable lag” of higher rates starting to bite — but it’s not just that.

As Sam Ro explains:

-Personal consumption grew at a 2.5% rate.

-Business investment grew at a 2.9% rate.

-Residential investment grew at a 13.9% rate.

The weakness was, in Sam’s words, a sign of “U.S. economic strength.” Because our imports rose 7.2%, versus our exports growing only 0.9%, the net is negative. That consumer strength is — in BEA model-terms — a drag on GDP.

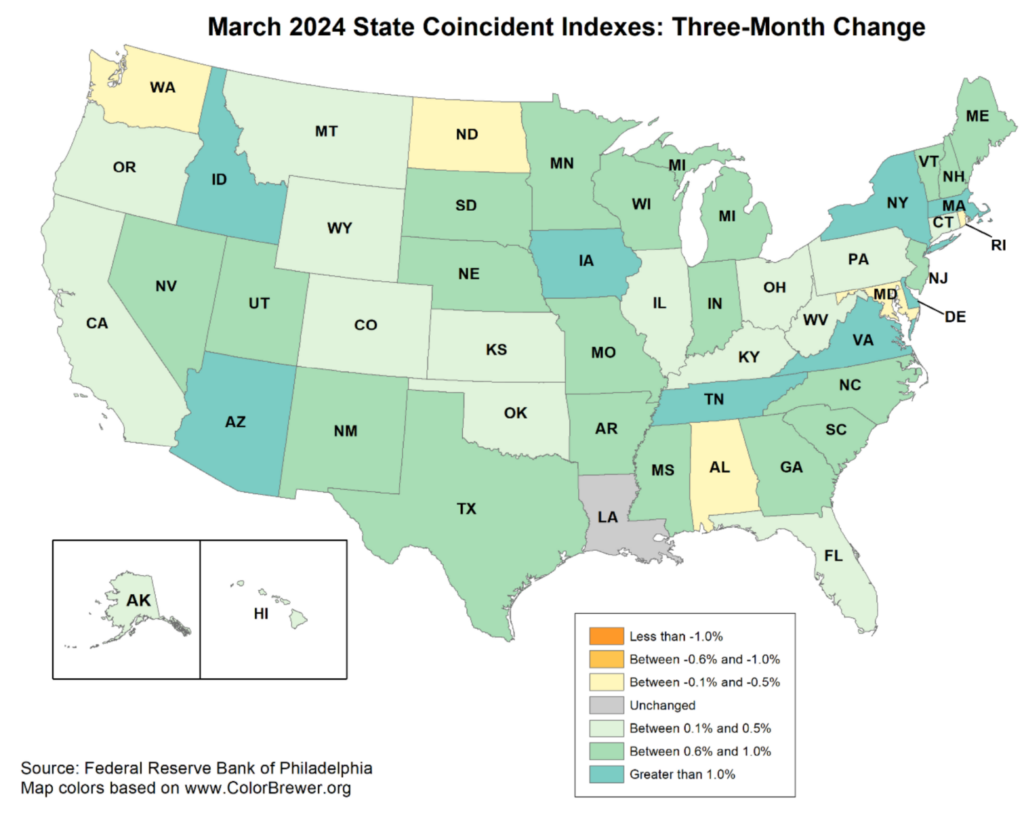

This brings us to State coincident indexes for the 50 states for March 2024: “Over the past three months, the indexes increased in 44 states, decreased in five states, and remained stable in one, for a three-month diffusion index of 78.” This is down from January’s three-month diffusion index of 96,” but the same as February’s measure.

No dangerous warning signs, and I continue to read the inflation measures as laggy and poorly modeled.

As Bill McBride pointed out in yesterday’s At the Money, lease renewals for rental apartments or homes do not reflect the current state of inflation — they were signed either 1 or 2 years ago; Monetary policy doesn’t impact that that all. Swap out OER for the more timely Zillow Rent Index / Apartment List Index, you get a CPI with a 2 handle. Or, just back out lease renewals, and you get the same results.

The economy remains robust, inflation is more of a housing issue with some services concerns thrown in.

I believe if we had better and more timely CPI/PCE models, the Fed would already be cutting…

Sources:

State Coincident Indexes: Release

The Federal Reserve Bank of Philadelphia, March 2024

At The Money: Bill McBride on What Data Matters and What Doesn’t (April 24, 2024)

Previously:

What Recession? State Coincident Indicators (April 9, 2024)

State Coincident Indicators Slipping (January 2, 2024)

State Coincident Indicators: November 2022 (January 4, 2023)

Signs of Softening (July 29, 2022)

Why Recessions Matter to Investors (July 11, 2022)