I’m deep in my book writing work discussing federal debt when I see a tweet that simply epitomizes the entire genre.

Full disclosure: My priors on federal debt are that I don’t know where the line of too much should be drawn, but I do know that none of the terrible things we were warned about over the past 50 years due to excess debt have come to pass.

NOT. ONE. THING.

We were warned that deficit spending would crowd out Private Capital, choke off innovation and new company formation; it will send the costs of US borrowing skyrocketing higher, making the debt impossible to manage; force the US Dollar to be radically devalued against all other currencies, thereby devastating the US Economy; cause rampant inflation, spiking prices to levels not seen before; last, act as a drag on the overall economy.

That none of these things occurred makes me wonder why we still pay attention to these deficit hawks.

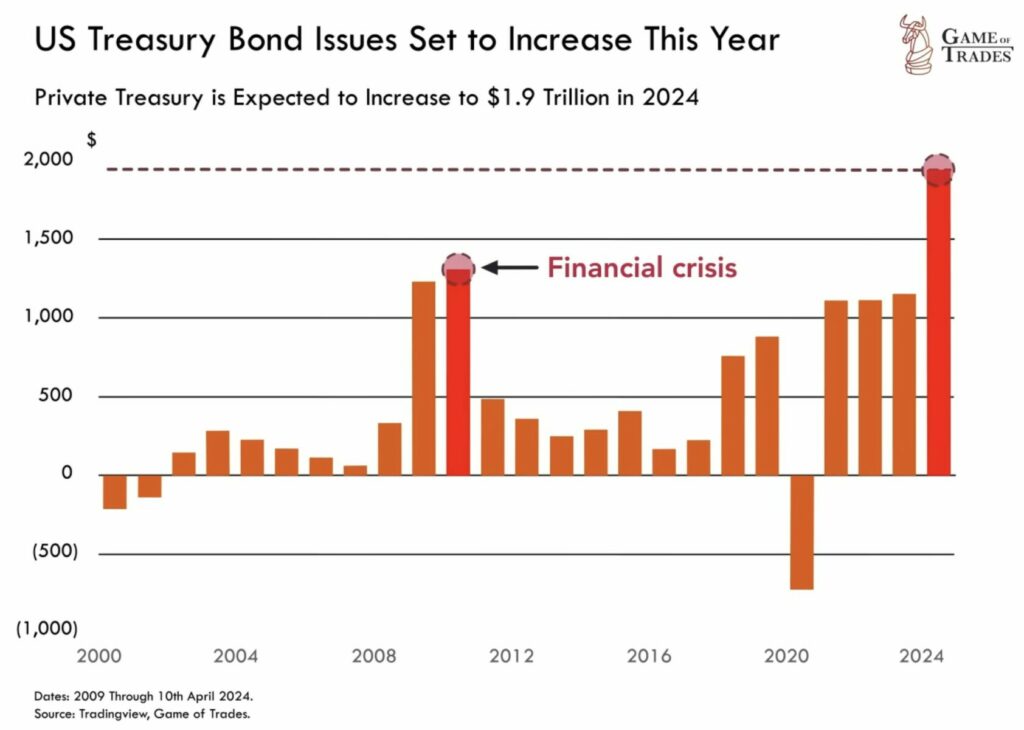

So when I see a chart like this two things come to mind the first is that looking at crisis peaks — GFC and Covid-19 — is inherently problematic; you are taking outliers that come along once every 15-20 years as opposed to the ordinary treasury issuances.

And second, should we ignore changes that have taken place over that 15-year period? Do we simply ignore the growth in the size of the economy and the U.S. population? The US population today is 341,814,420; in 2009 it was 308,512,035. Do we just ignore that? The U.S. Economy in 2022 was $25,439.70B; in 2009, it was $14,478.06B; ignore that also?

Do we pretend that there has been no inflation? By the way, inflation-adjust that $1.3T from 2009, and by June 2024 you get (wait for it) $193.44T.

Are we hellbent on the conclusion that this new debt is unexpectedly excessive, that we must therefore ignore all other contextualizing data?

~~~

Talking about the future requires a lot more humility than most of us on Wall Street seem to possess; we don’t know what the future will bring, we have no idea of the random events that occur to derail our overconfident forecasts. Too many of us adopt a self-assured, know-it-all persona because we know the investing public prefers that to the truth: Nobody knows anything, and the future is inherently unknown and unknowable.

Sorry, but “fake it till you make it,” and making wild unsupported ideological guesses seems like a poor plan for thinking about the future…

Previously:

Time to Stop Believing Deficit Bullshit (September 3, 2021)

Stimulus, More Stimulus and Taxes (January 25, 2021)

Cost of Financing US Deficits Falls (December 18, 2020)

Can We Please Have an Honest Debate About Tax Policy? (October 2, 2017)

Deficit Chicken Hawks vs Ronald Reagan (July 13, 2010)