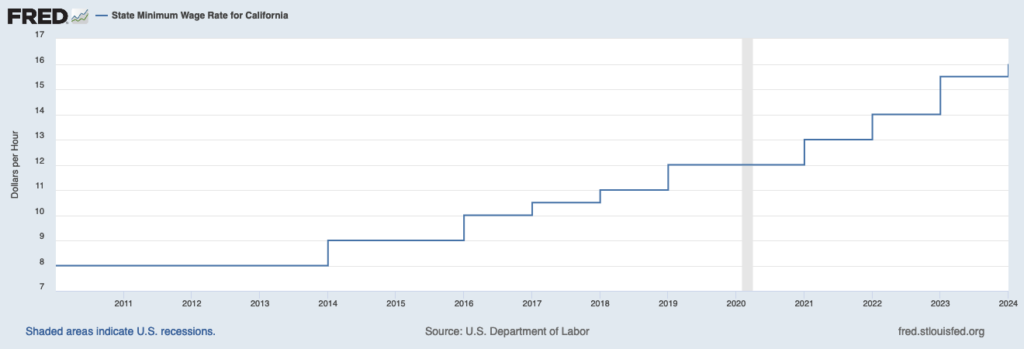

Our story so far: California has been raising its minimum wage for the past decade, starting at $8/hour through 2013. Many fast food workers (specifically) got bumped to $20/hour, from $16, in April (the law is very specific about who is eligible for the increase). Over that decade, with its minimum wage rising, California’s fast food industry has bested the rest of the US by leaps and bounds. Surprised?

The most recent raise was followed by intense hand wringing and predictions of catastrophe by the self-interested owners of fast food restaurants. They donated money to the usual suspects to make the case that this would soon lead to devastation in employment and wages.

To prove their point, a number of friendly commentators, academics, and hired guns all wrote endless white papers, Op-Eds and commentaries. Hey, everybody’s entitled to their opinion about new legislation and there was no shyness about sharing theirs.

But they made one super-sized mistake: they cheated with the numbers. They ignored seasonality; they mixed the match data from completely different data sets; they cherry, picked starting and stop dates for their analysis that bore no relationship to the underlying economic trends.

We called out their fire hose of bullshit for what it was; that was followed by mainstream coverage, ultimately leading to five separate papers being withdrawn by Hoover, as well as some great journalism in LA Times articles by Michael Hiltzik.

~~~

The echo chamber wound up with copious amounts of egg on its face for advancing a bogus narrative about how California’s recently enacted minimum wage law for fast food (QSR) workers impacted employment for that cohort.

Our story began in March with a Wall St. Journal (restaurant) reporter who inappropriately used non-seasonally adjusted numbers to make the following claim:

“California had 726,600 people working in fast-food and other limited-service eateries in January [2024], down 1.3% from last September [2023], when the state backed a deal for the increased wages.”

A bit of quick math: 726,600/0.987 = 736,170 (starting point). 726,600 – 736,170 = -9,570. And so a whopper of a lie that California had “lost almost 10k QSR jobs” was born. That error-laden, misleading story was written up by UCLA and Hoover Institution economist Lee Ohanian. From there, a full page ad was run by CA trade group CABIA, and from there it went absolutely viral.

Except none of it was true.

In the end, Hoover took the extraordinary step of retracting its story, along with 4 others (5 total we are aware of) that relied on similarly flawed analysis. The Journal, to its great discredit, refused to budge, telling me “the figures that the Journal published are accurate…“. Well, yes, they were. They were just wholly inappropriate in that circumstance.

So, that bubble having been burst, what was the right to do?

Well, along comes the Employment Policies Institute (EPI) with a fresh analysis of different BLS data set, the Quarterly Census of Employment and Wages (QCEW). QCEW is highly regarded for being as thorough and accurate a data set as BLS produces; as such, it is produced with a fairly hefty lag (some six months or so).

NOTE: EPI’s analysis – and mine – is focused on NAICS 722513, Limited Service Restaurants.

The crux of EPI’s new claim is this:

Since the passage of AB 1228 in September 2023, California’s privately-owned fast food restaurants5 have lost -6,166 jobs (-1.1%) through June 2024 (the latest available data). [Ed. Note: To be clear, while the law passed in Sept 2023, it did not take effect until April 2024.]

To my eye so far, the EPI numbers appear to check out, so I won’t quibble with them unless/until I find a mathematical or analytical error. I will, however, make a couple of substantive points by way of rebuttal:

Correlation is not causation. We should always resist the low hanging fruit claim of x happened, then y happened, ergo x caused y. Economies are extremely dynamic, ever-changing on a day-to-day basis. It’s easy, and often very convenient, to assert a cause/effect relationship where one may or may not exist. So it has always been with minimum wage. We saw this play out a decade ago in Seattle, which did fine, thank you, after what was a then-groundbreaking increase in its minimum wage. This feels a lot like that.

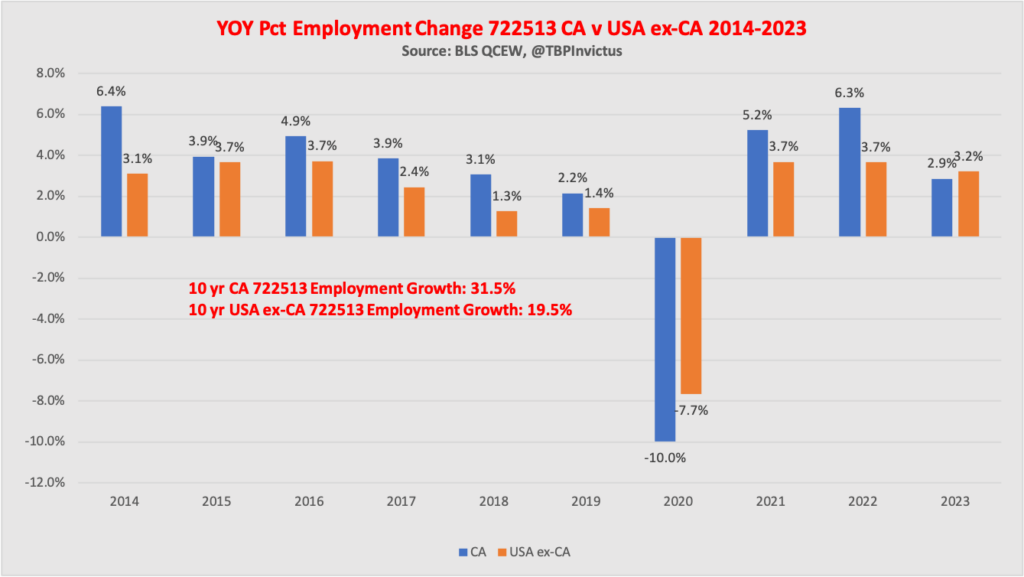

Most importantly, however, I would say this: In the context of QSR establishment and employment growth over a decade, California has smoked the rest of the country – left it in the dust. The fact that California has trounced the rest of the country over the course of a decade tells me much more than a relatively small loss over the course of three quarters. Three quarters does not necessarily a trend make; forty is a different story.

Let’s have a look:

Over the 10 year period from 2014 to 2023, CA has grown its QSR workforce by 31.5% to only 19.5% for the US ex-CA:

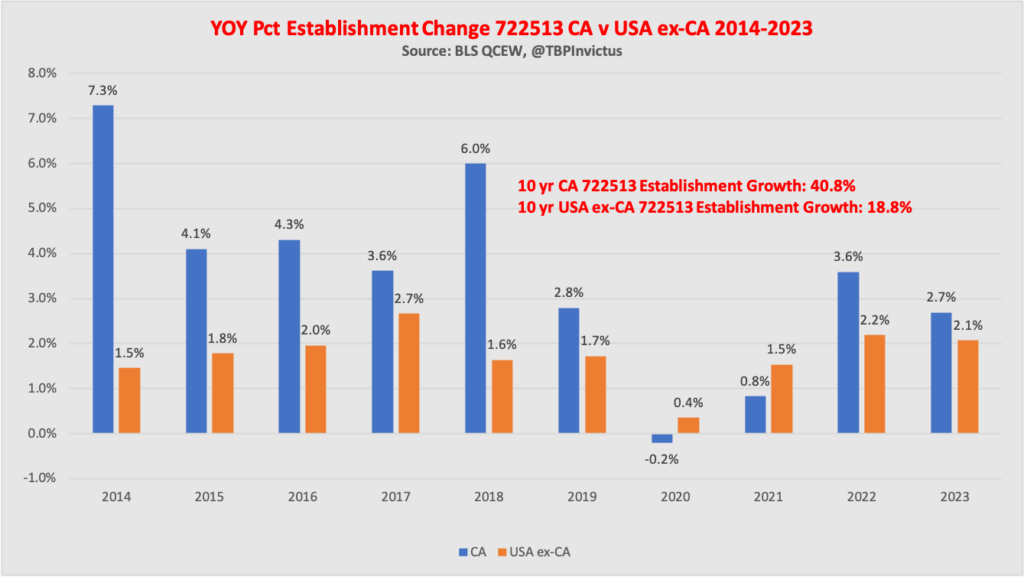

In terms of QSR establishment growth, the story is just about the same, but a bit more dramatic: CA has grown its QSR establishments by 40.8% to just 18.8% for the US ex-CA:

Let’s note for the record that California was growing its QSR industry – employment and establishments – far in excess of what the rest of the US was doing while raising its minimum wage all along the way (see graphic up top). So, the question must be asked: How’d CA pull off such significant growth in its QSR industry while paying people more and more and more? At every point along the way, every entrepreneur/franchisee knew what he was up against and took the plunge regardless.

I didn’t know the history of CA’s minimum wage (above) until I undertook to write this post. That fact that it’s gone up repeatedly over the past decade while the (allegedly) cost-sensitive QSR industry has thrived should tell us all we need to know. Yet this battle will continue to be waged, facts be damned.

~~~

A few final thoughts.

The SF Chronicle ran a piece in October citing an academic study that had a generally positive take on the new minimum wage:

“Wages increased by 18%, employment numbers remained stable, and menu prices increased by only 3.7% — the equivalent of a 15-cent increase on a $4 burger. The $20 hourly wage floor represents an increase of $4 per hour from the statewide minimum wage of $16 in California.”

The Chronicle also noted the following about the Economic Policies Institute:

“The results [of the study] defy a lot of the doom-and-gloom predictions made when Gov. Gavin Newsom signed AB1228 back in September 2023. Many of them originated with a survey conducted by the Employment Policies Institute, a think tank founded by a former restaurant industry lobbyist named Richard Berman — once described by TIME Magazine as “the wage warrior” who “has been publicly railing against the very idea of a minimum wage since at least the late 1980s.””

And a Business Insider piece noted:

“Restaurant executives told Business Insider that California’s new $20 minimum wage for fast-food workers has at least one clear silver lining for their businesses: Better-quality candidates are applying for jobs.”

And, finally, from the source of the initial error that kicked this all off, WSJ reporter Heather Haddon tells us that “Mandated pay boosts for workers are helping reduce turnover at chains,” and that has to be a good thing.

Previously:

Never Mix Payroll and Household Survey Data (November 29, 2024)

Misunderstanding Seasonal Adjustments

See also:

The fast-food industry claims the California minimum wage law is costing jobs. Its numbers are fake (June 12, 2024)

Can Stanford tell the difference between scientific fact and fiction? Its pandemic conference raises doubts (Oct. 15, 2024 )

Sources:

Comparing employment from the BLS household and payroll surveys

California’s Businesses Stop Hiring, Lee Ohanian, Hoover, August 7, 2024

What’s the impact of California’s minimum wage hikes? Economist behind new study says there’s consensus (San Fran Chronicle, October 20, 2024)

Silver Lining in CA’s New Minimum Wage (Business Insider, June 14, 2024)

A Day in the Life of a California Fast-Food Manager Who Makes Up to $174,000 (Wall St. Journal, June 17, 2024)