Last week’s “Tune Out the Noise“ was my suggestion that investors should not get drawn into the firehose of distractions, partisan wrestling matches, and trolling generated by the new administration. My emphasis was on staying focused on the long term. This includes setting goals, having a financial plan, and acknowledging our collective inability to predict the outcomes of geopolitical events (either domestic or overseas).

This does not, however, mean we should become sanguine about how rapidly changes in the U.S. government may be occurring. Things are moving fast, and whether you support 47’s agenda or not, rapid change can lead to unintended consequences. The first month of Trump 2.0 has seen the boundaries of executive power tested, along with an aggressive change to the Federal workforce. How that plays out in the courts and the economy is as yet unknown.

I am not blasé about radical change. What is occurring gets portrayed in the media in a binary or black-and-white fashion. My belief is that understanding the world usually requires nuance, an understanding that things are often more complex than they appear to be.1

Rather than get sucked into the emotionality of a YES or NO framework, I suggest considering recognizing where risk factors are rising. “Move fast and break things” may work in Silicon Valley, but it is not what market participants want from the White House (or the Federal Reserve).

What risk factors at play? There are economic risks, market risks, systemic factors, currency risks, constitutional questions, and ultimately, the standing of the United States as a global superpower and ally.

Risk is always present, and reward is a function of taking intelligently calculated risks. But the possibility of a policy mistake – either on a modest or grand scale – is on the rise. Whether it comes from DOGE or the Budget process or a minor court case or a more serious challenge, we should be aware of the changing environment.

Let’s consider seven potential dangers that, while still presently small, are also increasing over the next 12 months:

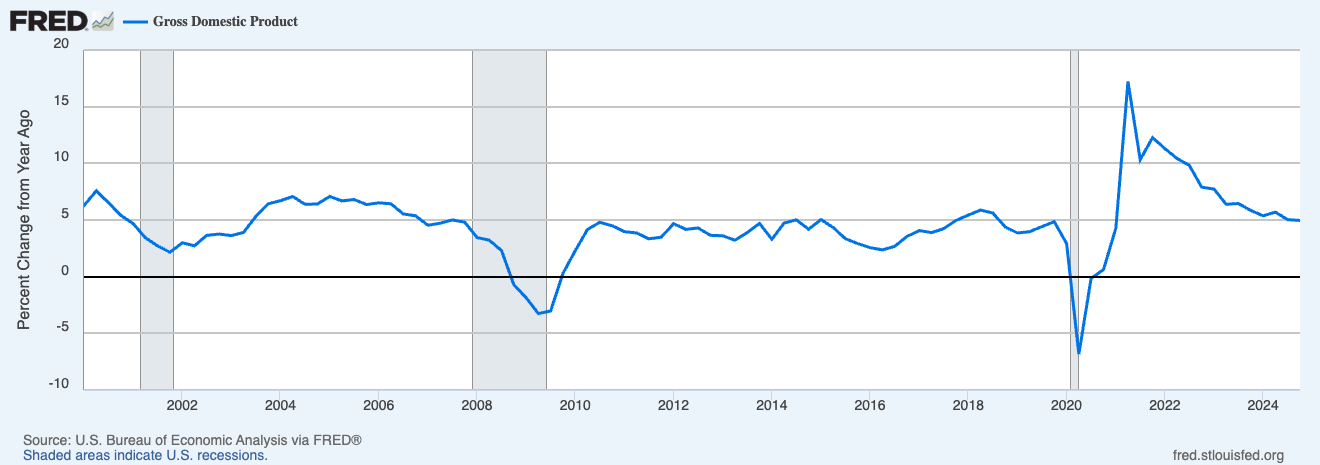

Recession: After several years of incorrectly forecasting a recession, Wall Street has finally acknowledged the strength of the underlying economy. But there are signs of moderation (not contraction) worth noting: Retail sales are softening, and durable goods have not done especially well lately (blame limited housing sales). Sentiment has been a drag for a while.

None of these suggest a recession is imminent. They do increase the vulnerability of the economy to a shock, and that is the risk factor here.

Probability of a recession: 15%, up from 5%

Volatility: We have already seen an uptick in equity price volatility despite notching a new all-time high in the S&P 500 index 9chart below). I believe ATH’s are the most bullish market indicator of all. Its the one at the end of the bull market that fails that test.

Five years after the start of the pandemic, the CBOE S&P 500 Volatility Index (VIX chart at top) was spiky but settling down. It is starting to creep up towards 20. This is nothing too dangerous, but it raises the possibility of more turmoil ahead.

Bond yields continue to swing. What has been strange about this cycle is that consumer lending for cars and homes has seen interest rates go up as the FOMC has cut rates. The Bloomberg Aggregate Bond price (inverse to yield) has moved a lot over the past three years, and price swings are at risk of getting even wilder.

Probability of a Market Dislocation: 20%, up from 10%

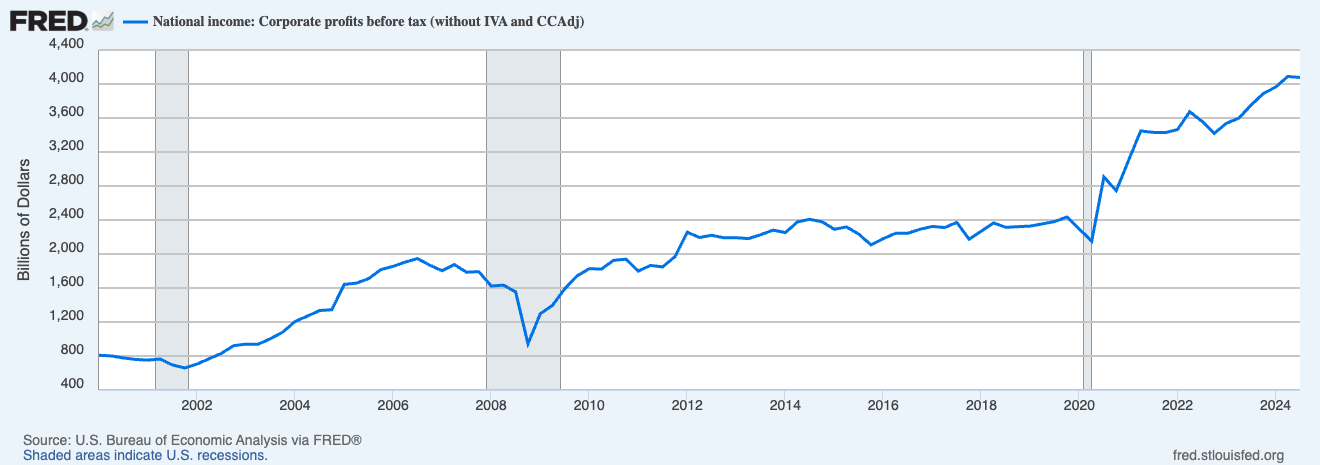

Profits and Valuations: Not only markets but corporate profits are at or near all-time highs. Investors want to see profitability stay up, as it leads to the psychological underpinning of a healthy market. That manifests itself in investors’ willingness to pay more and more for each dollar of company earnings, e.g., P/E multiple expansion.

We sometimes forget how much sentiment and comfort levels can drive consumer spending and corporate revenues. Sentiment has been very tough to read since 2020, with partisanship driving very low consumer sentiment while spending remained robust.

Probability of a Profit Fall: 25%, up from 15%

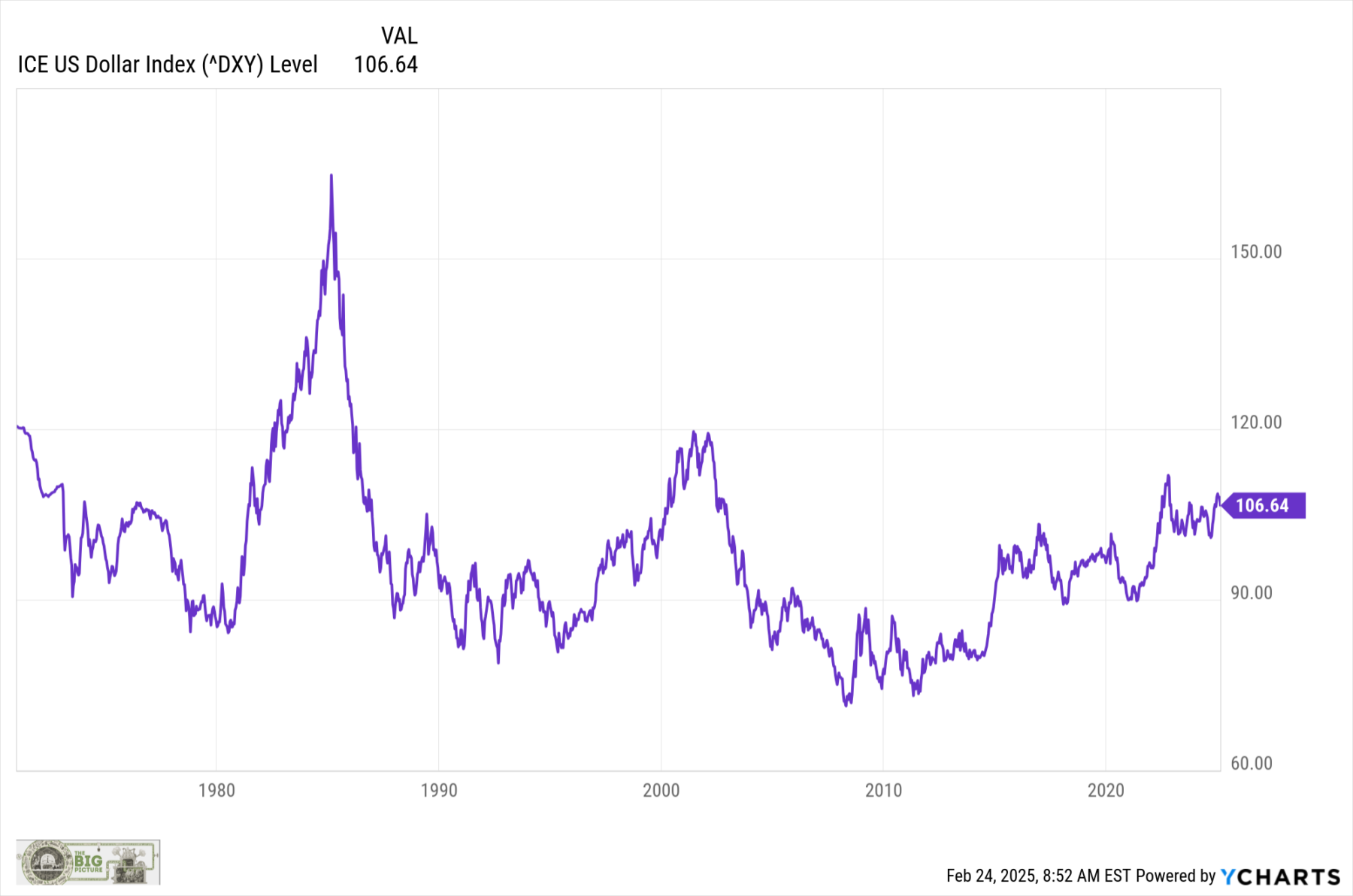

The Collapse of the US Dollar: Various parties have been forecasting the collapse of fiat currency for centuries (occasionally being accidentally correct) and the collapse of the dollar for decades. Nothing has challenged the dominance of the US Dollar — not the Japanese Yen, the Chinese Yuan, or the (lol) Euro. Might Bitcoin be that digital replacement? It’s possible, but as of today, it’s not likely anytime soon.

Since the end of World War Two, the USD has been America’s “exorbitant privilege” as the world’s reserve currency. However, several factors threaten this privilege: wide-scale tariffs, the embrace of alternative digital currencies, the breaking of long-standing alliances, and dallying with dictators.

Since the end of World War II in 1945, the rise of the United States as the world’s dominant economic, military, and cultural power has led to a relatively peaceful 75 years in the Western Hemisphere. Pax Americana has greatly benefited the U.S. and its allies. Putting that at risk would be one of history’s greatest unforced errors.

Probability of a Dollar Collapse: 12ish%, up from 3ish%

Geopolitical Chaos: These next three are harder to assess. Our first four risks were (somewhat) quantifiable. We now enter the realm of squishier, harder to assess risk factors. In each of the above, we have a good idea of what the outcome set looks like in advance, but we do not know what the specific results will be. Now, we enter a more uncertain realm, where we have no idea what the full range of possibilities is, but we do see greater dispersion.

The Middle East, Ukraine & Russia, China, Russia (alone), Europe, Greenland, Panama Canal, and even Canada are potential flashpoints.

Domestically, while there is an uptick in social unrest, there are other forms of chaos to be considered. The CDC/NIH is not reporting new information on disease outbreaks. This is concerning, especially in the midst of a measles outbreak in Texas and the bird flu outbreak nationally.

Not reporting these does not make them go away, but does increase the risk of a bad (or very bad) outcome…

Probability of a Chaos Event: 33%, up from 15ish%

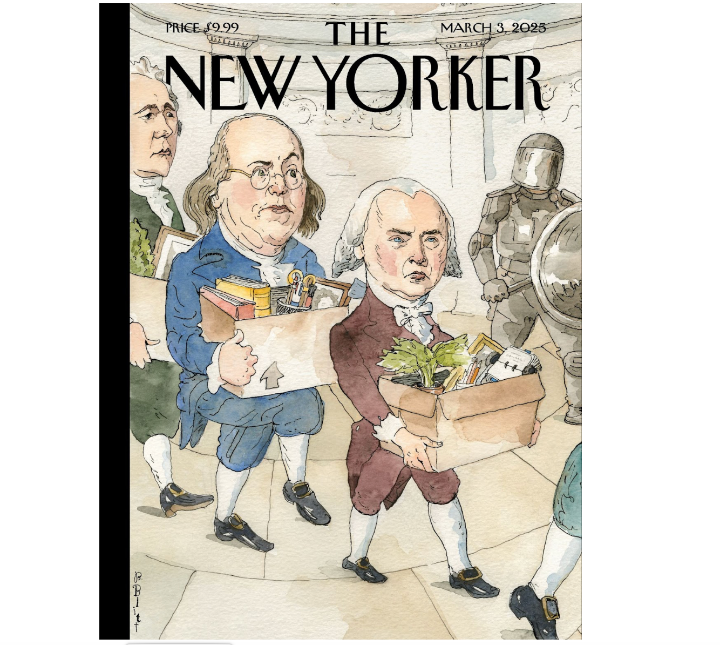

Constitutional Crisis: It’s hard to tell what is bluster and negotiating tactics and what is real. The Executive, Legislative, and Judicial branches are on a collision course. Musk is a wild card; 47 may have disowned Project 2025 during the campaign, but it seems as if he is adopting it whole cloth. Assuming we take the current trend to its (il)logical conclusion, the odds of bad things happening keep rising.

I honestly have no idea how this plays out…

Probability of a Constitutional Crisis: 45%, up from 15ish%

Failed Sovereignty: Could the unthinkable occur? Could the experiment of self-rule and democracy come to a screeching halt? I am loathe to contemplate such an outcome, but it was unthinkable since the end of WW2. Sure, there have been crises, from the Civil War to Dred Scott decision to Civil Rights movement and more recently the challenges from GFC and the Citizens United v. FEC case.

But in recent years, the idea of the United States failing as a sovereign nation failing was truly unimaginable. That is no longer the case.

End of the USA of A: Non-Zero possibility, up from unthinkable.

~~~

I engage in these thought experiments so as not to get too caught up in my own bias bubble. Last week’s Tune Out the Noise was written for the purpose of avoiding an emotional error. This week’s analysis is to make sure I am considering all of the worst-case scenarios that emotionality might lead to…

UPDATE March 3, 2025

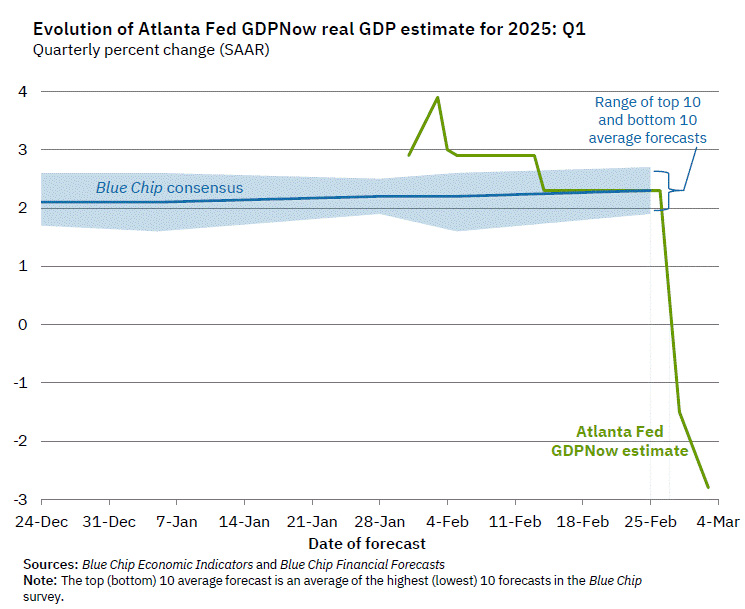

On March 3, the GDPNow model nowcast of real GDP growth in Q1 2025 is -2.8%

UPDATE February 28, 2025

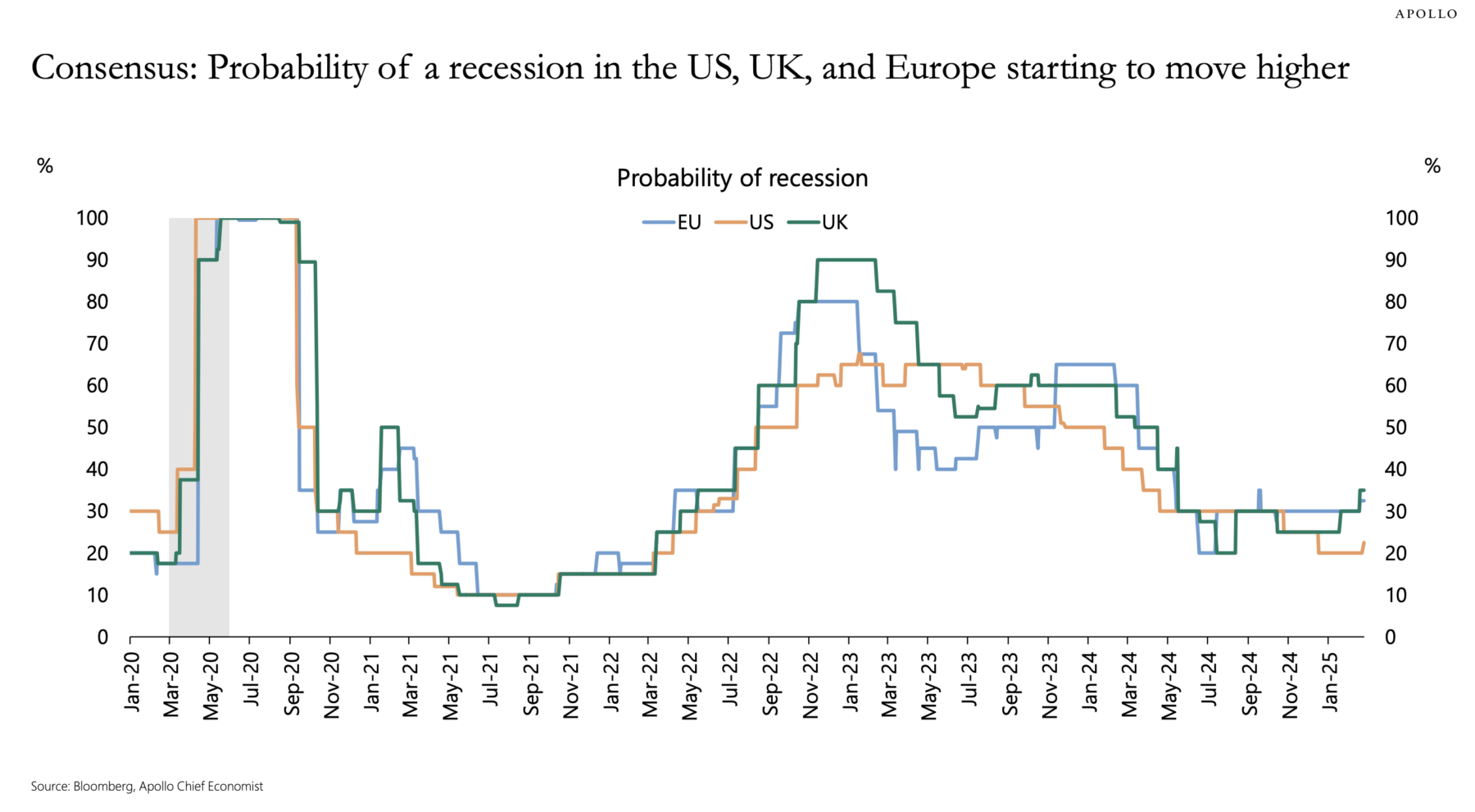

Torsten Slok of Apollo points out that Recession probabilities in the US, UK, and Europe are rising:

Source: Apollo

Previously:

Tune Out the Noise (February 20, 2025)

How Much is the Rule of Law Worth to Markets? (August 2, 2021)

Archive: Politics & Investing

See also:

The cost of American exceptionalism (Sam Ro, Feb 24, 2025)

Trust in a Black Hat World: Investors and Advisors: You’re On Your Own (Dave Nadig Feb 21, 2025)

Governments are people, my friend (Optimistic Callie, February 18, 2025)

On Bubble Watch (Memos from Howard Marks, Jan 7, 2025)

__________

1. I want to distinguish between traditional media, which does a poor job informing us, and algorithmic Social Media, which is purposefully aimed at something else entirely. The latter is, at its core, a very successful human engineering schema that learns what keeps you engaged, and then keeps feeding you that. Emotionality, angst, outrage, and even hatred are how it captures eyeballs, hours, and clicks.