“Few outsiders think new stores, no matter how well-conceived, will get Apple back on the hot-growth path… Maybe it’s time Steve Jobs stopped thinking quite so differently.”

—BusinessWeek, May 21, 2001

24 years to the day — May 21, 2001 — a Businessweek1 commentary explained why the newfangled Apple Stores were destined to fail. This pronouncement motivated subsequent blog posts (notably in 2005 and 2021) and a full chapter in “How Not to Invest.”

In the spirit of this woefully misguided — but not atypical — exercise in the Dunning-Kruger effect, I want to share a brief excerpt from the new book:

“Sorry, Steve: here’s Why Apple Stores Won’t Work”

A year after Fortune’s Cisco debacle, BusinessWeek published a story on Apple’s foray into retail stores. Not just BusinessWeek, but many naysayers laughed off the inevitable failure of Apple’s push into retail. Numerous armchair pontificators freely shared their uninformed opinions as to why this concept was destined to fail. “I give [Apple] two years before they’re turning out the lights on a very painful and expensive mistake,” predicted retail consultant David Goldstein.

After all, established consumer electronics chains were all in decline, and the writing was on the wall. Gateway would soon close its retail stores (2004), and not long after, CompUSA would shutter its physical locations (2007).

Investors should always be on the alert for structural errors in media stories: Authors operating outside of their expertise; people unaware of recent developments; extrapolators extending present trends far into the future. It is an excellent reminder of exactly the kinds of errors investors should avoid. A fallible human being publishing their uninformed opinion in print should never be the basis for making any intelligent investment decision.

There are many genuinely revolutionary products and services that, when they come along, change everything. Pick your favorite: the iPod and iPhone, Tesla Model S, Netflix streaming, Amazon Prime, AI, perhaps even Bitcoin. Radical products break the mold; their difference and unfamiliarity challenge us. We (mostly) cannot foretell the impact of true innovation. Then, once it’s a wild success, we have a hard time recalling how life was before that product existed.

The Apple Store was clearly one of those game-changers: By 2020, Apple had opened over 500 stores in 25 countries. They are among the top-tier retailers and the fastest to reach a billion dollars in annual sales. They achieved the highest sales per square foot in 2012 among all retailers. By 2017, they were generating $5,546 per square foot in revenues, twice the dollar amount of Tiffany’s, their closest competitor. Apple no longer breaks out the specifics of its stores in its quarterly reports, but estimates of store revenue are about $2.4 billion per month.

That guy who wrote, “Sorry, Steve: Here’s Why Apple Stores Won’t Work,” I wonder what the rest of his portfolio looks like…

Finance seems to encourage this kind of forecasting. We are bad at this because we often lack awareness of what we do and do not know about the limits of our expertise; we do not truly understand the present, let alone the future. We often wishfully predict what we want to be true, rather than what will come to be.

We look at the Dunning-Kruger effect later, but the key takeaway is most of us are not very good at metacognition—estimating our own skillsets. Learning what we do and don’t know—working within our capabilities— that’s challenging enough, without other people’s bad forecasts in our heads.

~~~

To be fair, “Sorry, Steve” reflected the consensus of the investment community in 2001. We were in the midst of the tech/dot-com implosion; Apple had been barely saved by Microsoft in 1997; retail specialty stores were already running into trouble.

To be fair, “Sorry, Steve” reflected the consensus of the investment community in 2001. We were in the midst of the tech/dot-com implosion; Apple had been barely saved by Microsoft in 1997; retail specialty stores were already running into trouble.

But everything in this article was already reflected in AAPL’s price.

A decade later, Daring Fireball’s John Gruber reflected on “Sorry Steve,” observing, “Apple’s retail foray was surely doomed. His case was based on a severe misunderstanding of Apple as a company, of its relationship with its customers, and of its then-potential for the coming decade.”

As we soon found out, that potential was immense. As in trillions of dollars in value creation.

This entire embarrassing debacle is a stark reminder of critical elements for media consumers and investors alike:

1. Media opinion and commentary are mostly speculation, no better or worse than anybody else’s.

2. All experts are experts in how the world used to be.2 This is especially problematic at major inflection points.

3. When it comes to predicting the future, especially consumer tastes, nobody knows anything…

We often give excessive and frequently undeserved credibility to media outlets, including television and magazines. Certainly, the folks who own printing presses and well-equipped studios must know what they are talking about? They wouldn’t merely be filling broadcast hours and column inches with speculative bullshit because that is essentially their business model?

Perhaps…

For more examples of media errors and the strategies you can use to counteract their most pernicious effects, I humbly suggest reading “How Not to Invest.”

See also:

A Big Misunderstanding John Gruber, (Daring Fireball, December 20, 2012)

Popular or Best? (January 1, 1998 About This Particular Macintosh, January 1998) (TBP)

Previously:

Wall Street Remains Clueless as Ever as to Apple’s Products (January 14, 2005)

Wall Street Still Doesn’t Understand Apple, Ritholtz Says (Bloomberg, August 24th, 2021) 3

Why the Apple Store Will Fail… (May 20, 2021)

Nobody Knows Anything (May 5, 2016)

Source:

Sorry, Steve: Here’s Why Apple Stores Won’t Work

Cliff Edwards

BusinessWeek, May 21, 2001

__________

1. This was before Bloomberg purchased BW in 2009…

2. Paul Graham (2014), “When experts are wrong, it’s often because they’re experts on an earlier version of the world.”

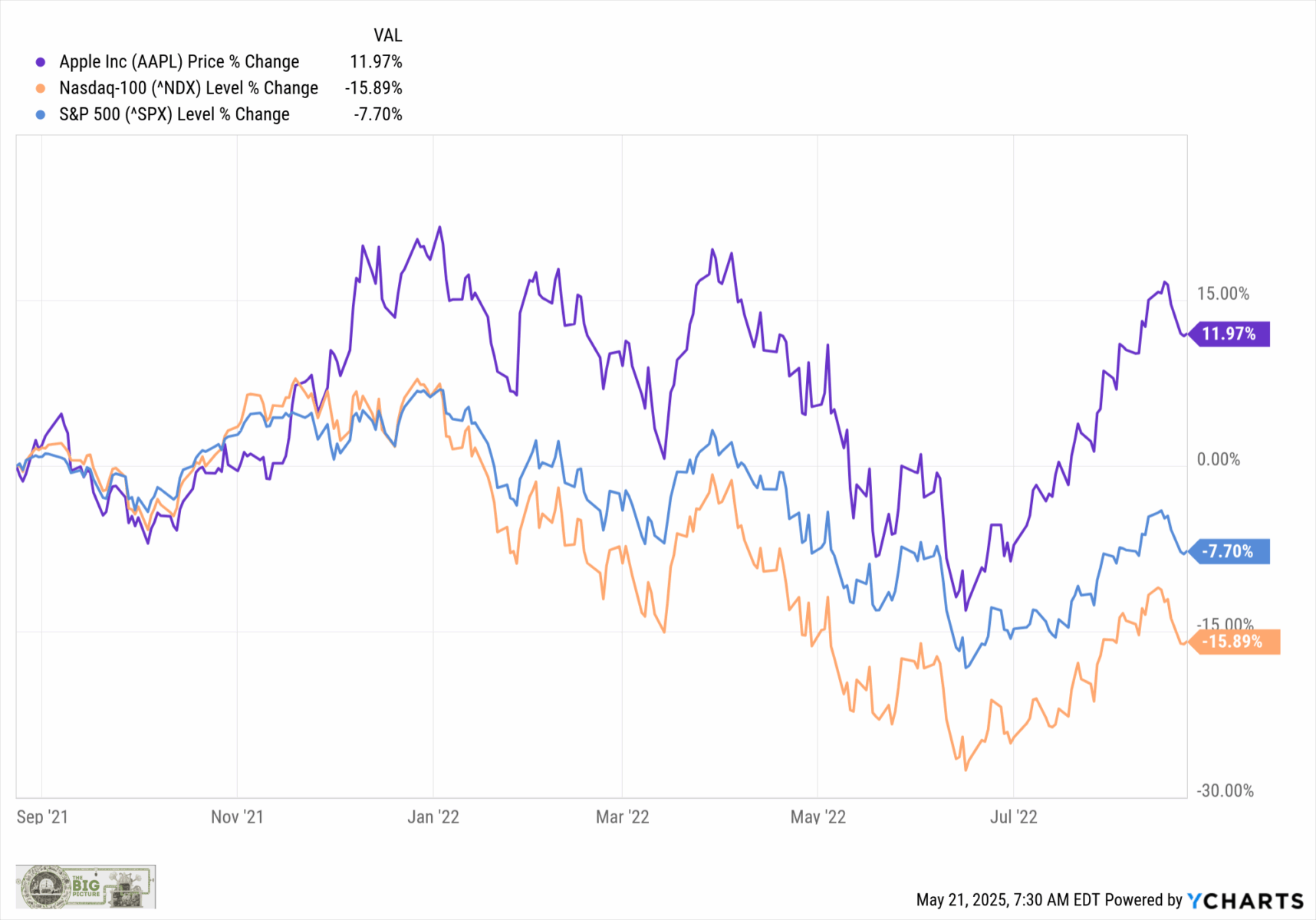

3. Over the next year, AAPL would gain 12%, versus losses in the S&P 500 of -7.7% and the Nasdaq 100 of -15.9%.

3. Over the next year, AAPL would gain 12%, versus losses in the S&P 500 of -7.7% and the Nasdaq 100 of -15.9%.

For more information about “How Not to Invest” and where to buy hardcovers, e-books, and audio versions, please see this.