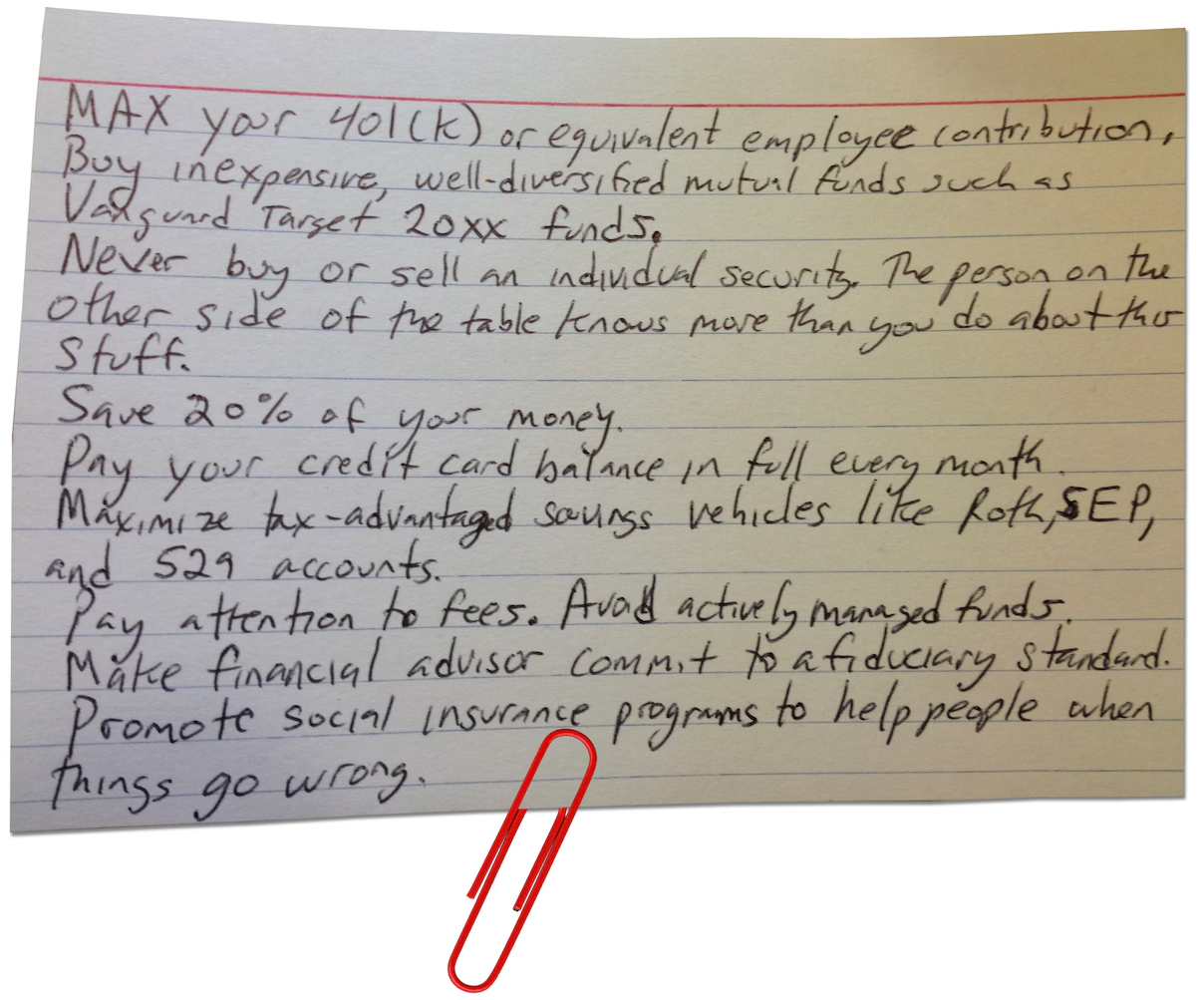

I love this short, sweet version of what to do with your capital; its an updated version of the index card strategy, via @buccocapital::

Few thoughts on retail investing since it’s popping up again on FinTwit:

– As I’ve said before, I think it’s probably the lowest ROI activity you can do if you’re trying to get rich. Focus on your career

– You should index 90% of your money

– You have zero edge day to day. Your…— BuccoCapital Bloke (@buccocapital) December 19, 2025

Previously:

The advice to ensure financial ruin? It fits on a 4×6 index card (September 13, 2015)

How to ruin your financial life, #badadvice (Washington Post, September 12, 2015)

Few thoughts on retail investing since it’s popping up again on FinTwit:

– As I’ve said before, I think it’s probably the lowest ROI activity you can do if you’re trying to get rich. Focus on your career

– You should index 90% of your money

– You have zero edge day to day. Your advantages are that you have duration, no mandate, and nobody forcing you to sell

– It follows that the fewer trades you do, the better. The more trades you do, the worse you will do

– Process is the only thing that matters. How rigorous is your process? How do you reflect on what worked and what didn’t? Do you even know why it worked? Otherwise it’s just luck. For most people is still probably just luck.

– Your biggest enemy is yourself. You have no institutional guardrails to stop you from doing stupid things

– If you are thinking of it YTD you have already lost. That’s not your game, and is a recipe for failure. Trying to beat the market every single year will cause you to overtrade, where you have a structural and insurmountable disadvantage

– It’s OK to just do it for the love of the game. Because it’s the greatest game on earth!