Perhaps the most overlooked element in the “affordability hoax” is the president’s own role in it.

Before we get into the details, a few preliminary caveats. First, as COVID-19 ran wild, lockdowns were beginning, and a vaccine was still off in the future, there was genuine panic spreading through the government. A Hobson’s choice was presented: do nothing and watch the unemployment rate jump to 10-15%. Or, get cash into people’s hands, keep them at home, and watch an inflation spike the same amount.

It was a choice of the lesser of two evils, and I believe the president made the right choice in March of 2020. At least, as far as the first CARES Act was concerned. This was a nearly $2 trillion stimulus, the largest fiscal stimulus as a percentage of GDP since World War II.

Before you accuse me of hindsight bias, this was the conversation I had with Wharton Professor Jeremy Siegel in May 16, 2020 (transcript). Siegel was the first person to raise the inflation issue in real time, prior to the surges occurring.

“I think we’re going to have a huge spending boom next year and I think for the first time, and I know this is a sharp minority view here, for the first time in over two decades, we’re going to see inflation.”

-Prof Jeremy Siegel, May 16, 2020

At the time, no one was extrapolating the inflationary impact of the Covid fiscal stimulus – except Siegel. Note that May 2020 was three months into the pandemic, and still a full six months before the 2020 Presidential elections.

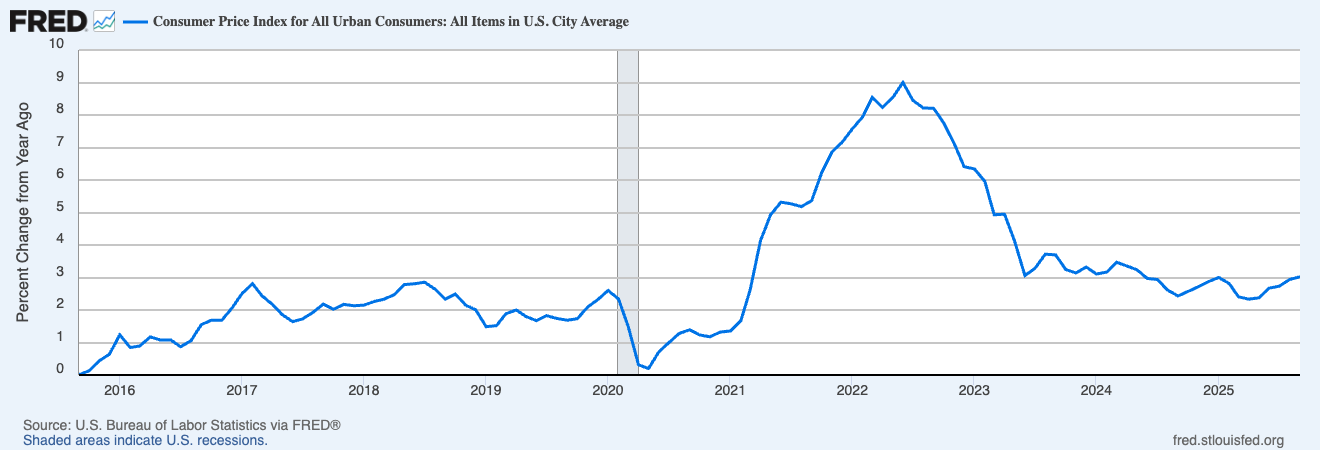

Like all complex issues, the inflationary surge was caused by numerous factors, starting with Covid-19 itself. Add Congress to both Presidents Trump (CARES Acts 1+2) and Biden (CARES Act 3) as key factors; Consumers who overspent without regard to cost and Corporate Greedflation; Some elements had been in place for decades: Just in Time Delivery (supply chains) and the shortage of new homes are good examples. The Russian Invasion of Ukraine didn’t help, nor did the wanton spending of Crypto wealth. But I stopped listing factors at 15, and I am sure there are more.

Why bring all of this up now?

Because “affordability” today is not a hoax; and to hear POTUS say such things while nobody mentions his responsibility in creating the worst inflationary surge in modern history is disingenuous.

And I will repeat my caveats here again (but I expect the worst kinds of partisan analysts to ignore them):

- There were no good choices, only less bad ones

- 10+% Unemployment versus 10+% Inflation were our options

- Most of us would prefer Inflation over Unemployment.

I asked people during the surge which they would have preferred, and it was no contest.

Note this academic paper (“Economic Discomfort and Consumer Sentiment“) found people disliked unemployment twice as much as they disliked inflation; this paper (“The Happiness Trade-Off between Unemployment and Inflation“) found unemployment was disliked five times as much as inflation in Europe.

Which brings us back to Siegel, who saw all of this coming in real time:

“But with this liquidity in the economy, I expect moderate inflation, not — I’m not talking about hyperinflation. And so, I’m nowhere near that. I expect inflation to move up next year to two, three, four percent, five percent and maybe run again in 2022 the same way.

So, cumulatively, I expect inflation may be to go up — the price level, consumer price level go up 10, 12 percent over the next few years, maybe 15.”

-Prof Jeremy Siegel, May 16, 2020

The Inflation surge was visible to anyone looking at the impact of the single largest fiscal stimulus since World War 2. The point of all this is simply that we should be honest about what happened then, and transparent about the impact of the pandemic on higher prices today.

Higher prices are not a hoax; there is lots of blame to go around — including President Trump during his first term. He made the right choice of the lesser of two evils.

Previously:

MiB: Jeremy Siegel on the Covid Stock Market (June 20, 2020)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

Which is Worse: Inflation or Unemployment? (November 21, 2022)

A Dozen Contrarian Thoughts About Inflation (July 13, 2023)

The Least Bad Choice (September 28, 2023)

Revisiting Greedflation (November 16, 2023)

Inflation is Obvious But Wage Gains Seem Invisible (June 27, 2024)