Each quarter, I prepare a detailed deck and call for Ritholtz Wealth Management clients.1 I start with about 100 ideas and charts, then work them down to 30 charts in 30 minutes. (Shout out to Chart Kid Matt for his excellent assistance) Selecting lots of great charts is easy, but curating them into a short, easily consumable half hour is the challenge.2

As I do my research in the weeks leading up to the end of the quarter, I have to fight my way through a lot of inaccurate financial data, baseless opinions, and misleading commentary. Much of it is not useful; some is out of context, and lots simply wrong. I fear that too much of what I see, read, and hear will lead its consumers to poor investment outcomes.3

I pulled five charts from the Q call deck to share with you; they counter some of the misinformation out there. I hope you find these useful and thought-provoking.

2025 US Equities Up Broadly

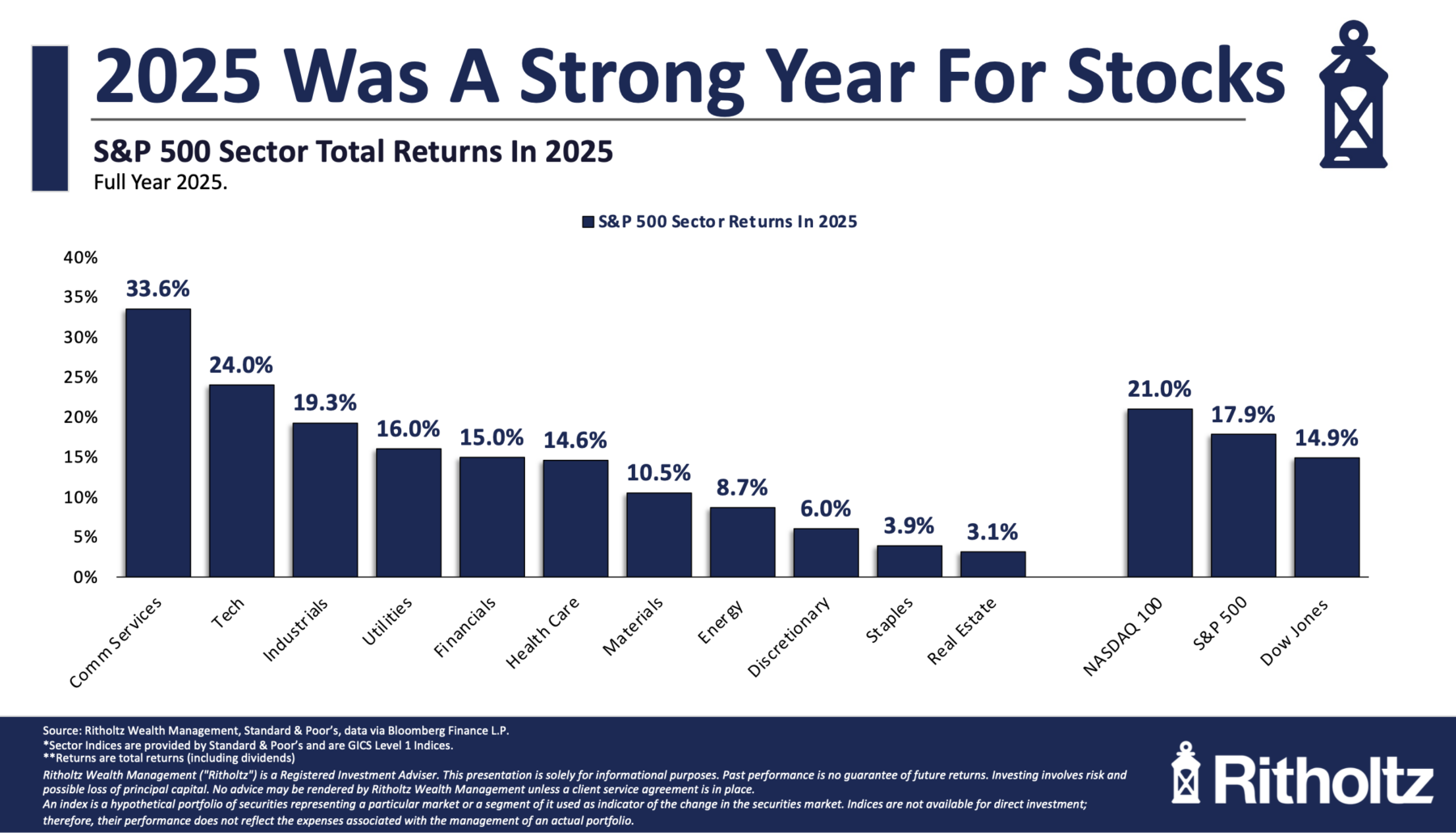

U.S stocks had a solid year, with the S&P 500 up 17.9% and the Nasdaq 100 gaining 21.0%. As you can see in the chart at top, gains broadened out beyond the Communication and Technology sectors (+33.6% and 24%), to the Industrials (+19.3%), Utilities (+16%), Financials (+15%), and Health Care (+14.6%). There were solid gains across most sectors, with Real Estate (+3.1%), Staples (+3.9%) and Discretionary (+6.0%) as the major laggards.

No SPX sector was in the red for 2025.

There were only 153 stocks in the S&P 500 that beat the index average; 350 were below 17.9% average.4 That’s narrower than I prefer, but not fatal.

The bigger news was global: After 15 years of U.S. equity dominance, the rest of the world began to catch up: International stocks rose 33% in 2025. This shift was driven in part by a weakening U.S. dollar, down almost 10%. Global trading partners are repatriating capital due to dissatisfaction with U.S. trade and security policies. While U.S. earnings remain solid, diversified investors are benefiting as international equities catch up

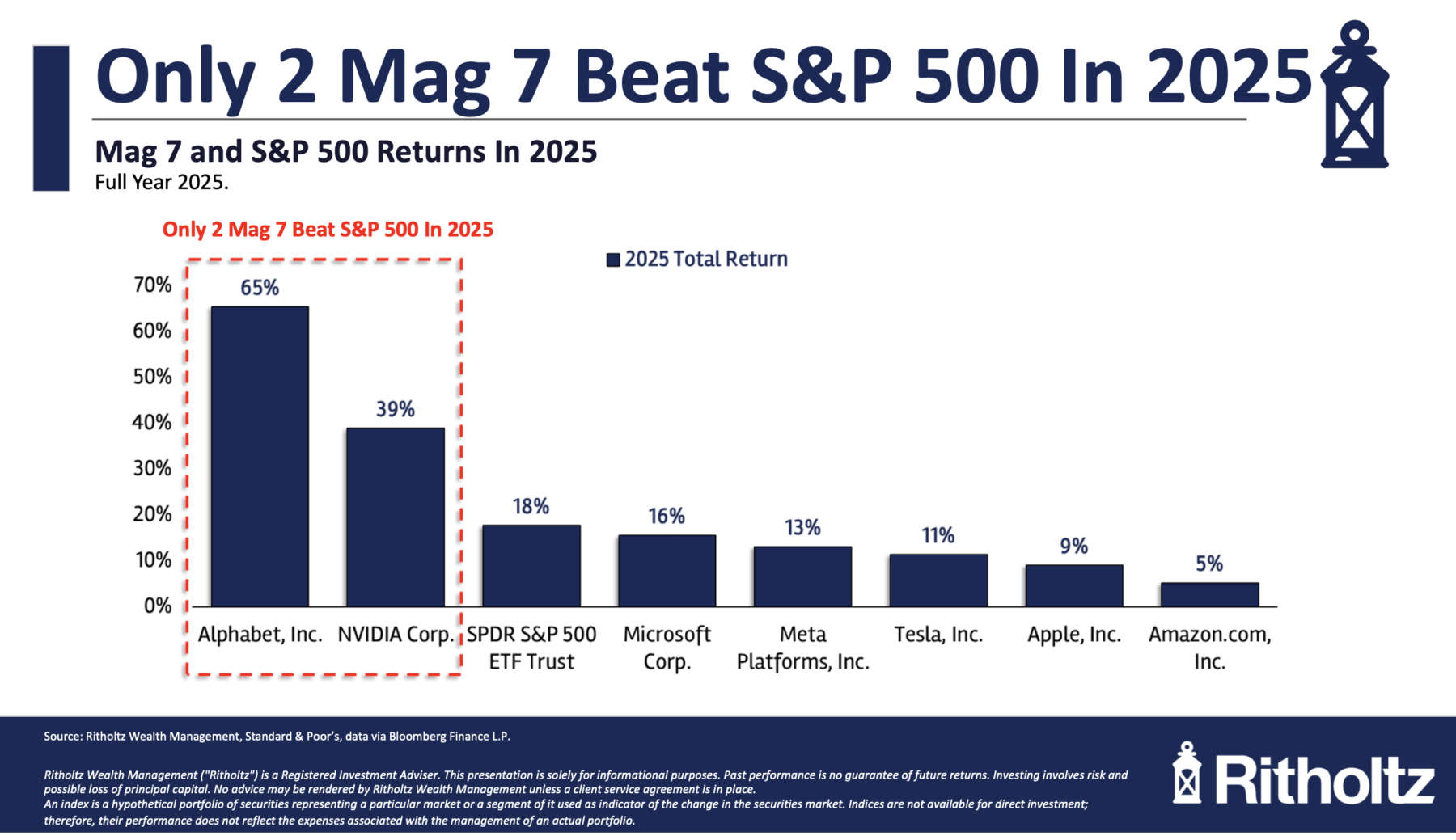

The most surprising chart in the entire deck is this one: Only 2 of the “Magnificent Seven” outperformed the index. TWO!

After hearing for so long from the Concentration Bears that the Mag 7 would be the end of us all, this single datapoint perfectly frames the issue with their arguments.

Perhaps the Mag 7 dominance is fading; if five of these seven companies underperformed the S&P 500, that means the other 493 companies are catching up in both price appreciation and (eventually) earnings growth.

Valuation

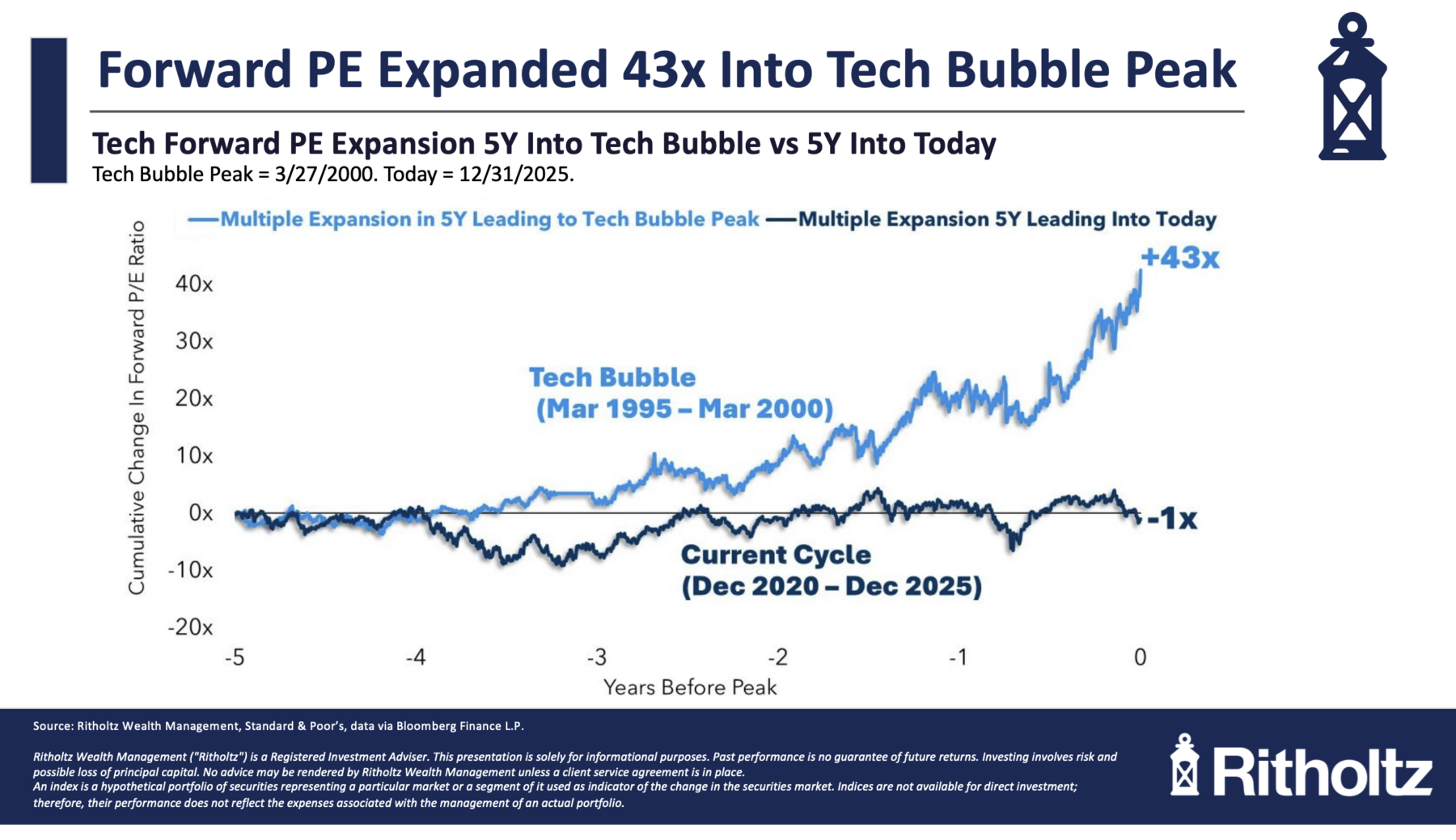

I wonder if the persistent “bubble callers” would be surprised by this chart: Valuations are (mostly) flat.

Unlike the dot-com era, which saw P/E multiples expand so dramatically, P/E multiples have remained flat for the past five years. Forward P/E ratios for core AI companies like Meta, Google, Amazon, and Microsoft have also remained stable or declined.

Debt

Bubbles are typically driven by excessive leveraging, but current debt growth remains a fraction of what was seen in the 1995–2000 era.

Debt was essentially flat for five years, with only a 9% increase in 2025. Compare this to the last few years of triple-digit debt growth in the 1990s: +111%, +152%, and +187%!

Earnings

If I could only see one data point to guess how markets have performed, it would have to be earnings.

Earnings grew at a robust pace. Unlike the dotcom era, the AI “boom” is supported by tangible business results rather than pure speculation. Sure, AI is not cheap, but there is an enormous difference between “expensive” and “Bubble.”

For example, despite predictions that AI would kill its core business, Google successfully integrated AI into search and saw its stock rise 65% in 2025. That is impressive, and not at all bearish for the rest of the S&P 500.

~~~

I continue to advocate that investors must manage their information consumption aggressively: filter out the noise that is misleading, irrational, and not data-driven. You want to pursue information sources with a good track record and a defendable process (not merely lucky), with a measured temperament and a long history of smart insights.

One day, this bull market will end. Your job is to allow your portfolio to compound, and avoid getting panicked out of it prematurely…

See also:

The Concentration Bears Have Steered You Wrong

Josh Brown

Downtown, Dec 13, 2025

The Probability of Loss in the Stock Market

Ben Carlson

A Wealth of Common Sense, January 9, 2026

Previously:

10 Datapoints for Thanksgiving (November 26, 2025)

Rational Exuberance? (November 24, 2025)

A Short History of Bubbles (October 24, 2025)

The Probability Machine (August 28, 2025)

All Time Highs Are Bullish (June 26, 2025)

__________

1. If Compliance gives me the OK, I’ll release the full deck and call in the near future.

2. “I have made this longer than usual because I have not had time to make it shorter.” – Blaise Pascal, “Lettres Provinciales,” 1657.

3. I even wrote a book about the impact of all of this bad information!

4. “A+ B” shares (BRK, GOOG, etc.) send the total over 500.