What Buffett Saw in Baseball’s Greatest Hitter

Ted Williams understood the probabilities of a strike or a hit.

Bloomberg, February 29, 2016

Long before quants ruled Wall Street, before Stratomatic, before Bloomberg View columnist Michael Lewis conceived of “Moneyball,” the man destined to become baseball’s greatest hitter was also baseball’s first quant.

Ted Williams’ lifetime stats are astonishing: a .344 batting average, 521 home runs and a .482 on-base percentage. During his two decades with the Boston Red Sox, he was responsible for more than a fifth of the team’s runs. It isn’t a coincidence that he also wrote the book “The Science of Hitting.”

Several events had me thinking about this during the weekend. First, tomorrow is the opening day of spring training. Second, I spent some time last week listening to Emanuel Derman, a particle physicist who turned to finance, explain the rise of quants on Wall Street. Last, Berkshire Hathaway’s annual letter to shareholders came out, and it reminded me that a few years ago, Warren Buffett had recommendedWilliams’ book.

Buffett had referred to Williams in the context of making better decisions.

It seemed like a curious endorsement. That sent me to Williams’ book looking for parallels between batting and investing. I must admit, at first glance it seemed pretty tenuous. But thumbing through “The Science of Hitting” made it clear that parallels abounded. Hall of Famer Williams approached batting not as something done on instinct, but rather as a methodical, evidence-based process.

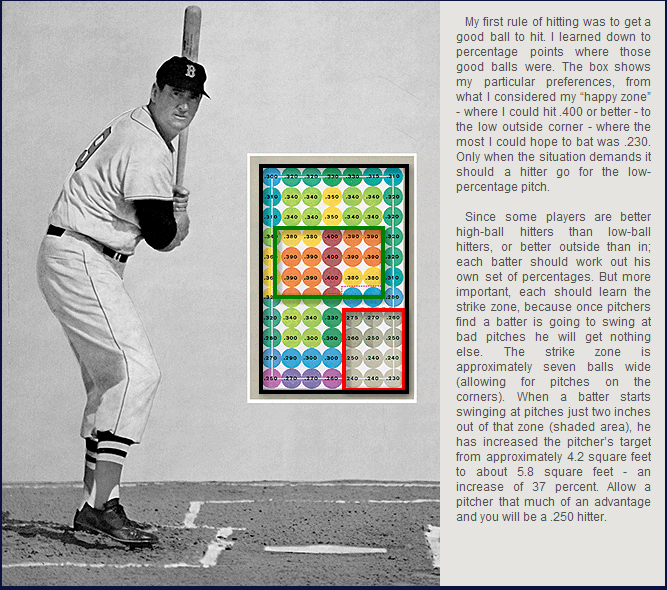

How can a baseball batter be described as a quant? Williams emphasized research, evaluated data and created specific rules for batting. Williams thought deeply about probability, made discipline a key part of the process and analyzed the strike zone mathematically. He noted that hitters who chased bad pitches (i.e., outside of the strike zone) gave pitchers a huge advantage: swinging at balls that were a mere two inches away from the strike zone made the strike zone expand from “approximately 4.2 square feet to about 5.8 square feet — an increase of 37 per cent.”

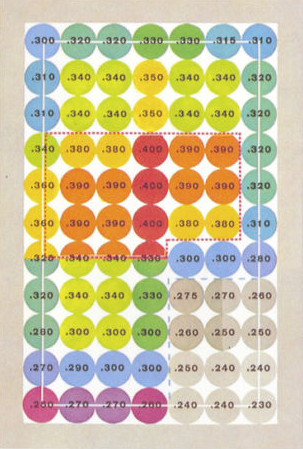

Have a look below at the heat map Williams created of the strike zone. It is more amazing that he created this without the benefit of super slow-motion video or even the use of the most rudimentary computers. Working with his own eye and his batting statistics, Williams manually broke down the strike zone into a set of mathematical probabilities. He imagined the zone as seven baseballs wide and 11 tall, or 77 likely locations for a strike.

Source: “The Science of Hitting”

Williams went way beyond classifying each pitch as a binary outcome — a ball or a strike. Instead, he developed a series of probabilistic results based on precisely where the ball was pitched and his own history of hitting each of the 77 potential strikes.

Compare his meticulous approach with the way in which many investors think about deploying capital. They don’t have a detailed plan, certainly nothing as data-driven as Williams’ approach. They rely on rumor, idle gossip, media pundits or gut feeling. Sometimes they make trades on a whim; other times it’s based on so much information that it makes them overconfident and more likely to fail. They rely on heuristics and myth, rather than cold hard evidence.

Williams had almost 8,000 at bats and he wrote that each one was an adventure. It wasn’t a random undertaking, but rather a deeply researched event into which he put enormous preparation. If more investors utilized a process comparable to that of baseball’s greatest hitter, they would be much better off.

Originally: What Buffett Saw in Baseball’s Greatest Hitter

Previously:

How to Invest Like Boston Red Sox Slugger Ted Williams (April 9, 2006)

Source: Farnam Street via Reformed Broker