What Does the Longest Bull Market Mean?: Kaissar vs. Ritholtz

The run for stocks is now in the record books. So what?

Bloomberg, August 23, 2018

There’s lots of disagreement about whether the current bull market in stocks is now the longest in history. Bloomberg Opinion columnists Nir Kaissar and Barry Ritholtz recently met online to debate its longevity, whether it matters and if anyone should care. They previously discussed passive versus active investing and global equity valuations.

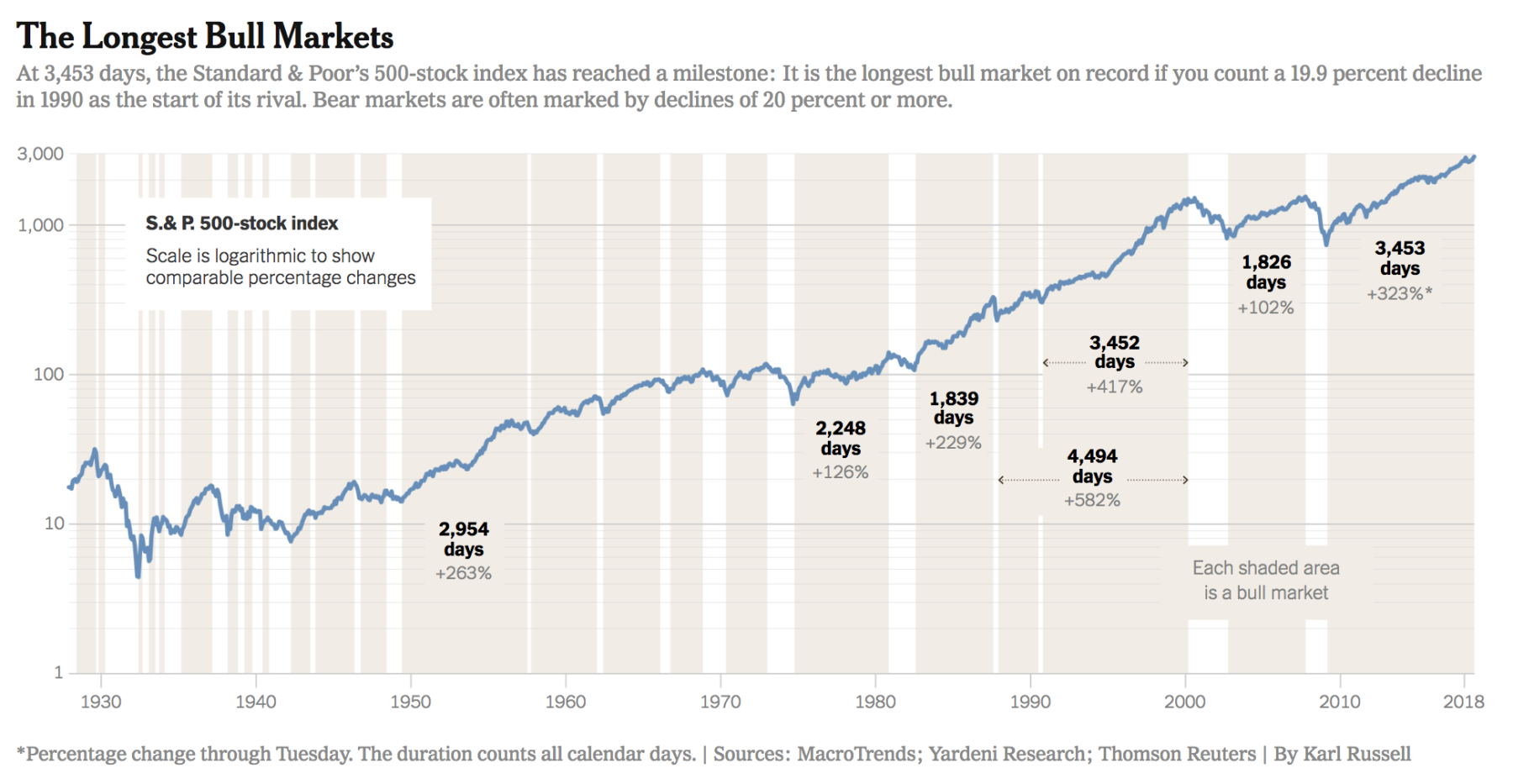

Nir Kaissar: The U.S. bull market became the longest on record yesterday. It’s been 3,453 days since the market hit bottom in March 2009, surpassing the run that began in October 1990 and ended when the dot-com bubble burst in March 2000.

Or did it? According to Yardeni Research Inc., the bull market that ended with the dot-com bust began in December 1987 — not October 1990 — and lasted 4,494 days. By that count, the current bull market won’t steal the record for another three years. And that assumes this bull run began in March 2009, a claim that Barry will undoubtedly contest.

It’s tempting to wave this away as frivolous banter among market historians. But that’s a mistake because this debate is about the future, not the past. By asking whether this bull market is the longest in history, investors are really asking whether it’s near an end.

It’s an unavoidable question. Underlying most portfolios are so-called capital market assumptions — estimates of how various investments will perform in the future. Those assumptions have a big impact on how the portfolio is constructed.

Which inevitably raises more questions: Does the length of a bull market say anything useful about the future? And are there more reliable ways to forecast what’s ahead?

Barry Ritholtz: I am fascinated by this topic! Over the years I have spent a lot of time thinking and writing about it (see this).

I have found the conventional wisdom on determining the age of bull markets to be mostly wrong. No, bull markets do not begin from bear market lows. If this bull began in March 2009, then did the postwar rally from 1946 to 1966 actually begin in 1932? Did the 1982-2000 bull market start at the bear-market lows in 1974? Of course not — but that’s where the claim this bull market began in March 2009 leads to.

When did this bull market actually start? There are many ways to measure a bull market, but the most reasonable way is from when it makes new all-time highs. In this case, that means the start of this bull market was March 2013. The recovery from the financial-crisis lows, retracing the plunge from October 2007 to March 2009 is not, in my opinion, part of the bull market.

So no, bull markets don’t start at bear-market lows.

There are other ways we can debate the issue of whether or not this is the longest bull market ever, but perhaps we should discuss an even more important question: Does it really matter?

Bull markets do not simply die of old age; they don’t reach a certain length, and then keel over. What kills them are things that hurt corporate revenue and profits: high credit costs that makes borrowing costly, or inflation that makes input costs like natural resources, energy and labor more expensive. Or just a good old-fashioned recession — and even those don’t always kill the bull.

NK: I have two answers to your question. In one sense, the debate about whether this is the longest-running bull market is just as useful as any conclusion because it reminds investors that bull markets don’t last forever and that this one has gone on longer than most. Even by your count, this bull run is among the longest since 1928. If that realization prepares investors emotionally for the next downturn and thus prevents them from making bad decisions, that’s all for the good.

In another sense, the conclusion only matters if it says something useful about the future. What fascinates me is that many investors — particularly adherents of passive investing — don’t realize how much prognostication goes into their portfolios. The vast majority of portfolios rely on assumptions about future returns. If you assume that the market will continue to deliver its historical return of 10 percent a year, as many do, or that the return will be closer to 6 percent for the next several years, as JPMorgan Chase & Co. does, or that the return will be negative, as Jeremy Grantham’s GMO does, you end up with three completely different portfolios.

The most reliable — but far from bulletproof — way to gauge those future returns that I know about is by looking at valuations. High prices are correlated with lower subsequent returns, and vice versa. I’m not aware of any such relationship with the length of bull markets.

BR: Well, yes and no. Reminding investors that this too, will pass is always useful. Anytime we can get people to think in terms of cycles and longer time frames is a good thing.

Have a look at the chart in the New York Times as an example. Why are 1987 and 1990 resets, but 2011 and 2015 are not?

If, as we both agree, bull markets are a function of valuations relative to economic fundamentals (plus investor sentiment), then the length of the bull market is not very relevant to future performance. Other factors besides age are much more significant than what is mostly hype.

The bigger problem as I see it is how the age of the expansion is often used to frighten investors, prompting them to sell what they have and buy something else — usually at a high commission and sold by the person making the claim.

Consider the phrase “long in the tooth” as an example used to describe this bull market. A quick search reveals articles that used this language every year since 2010. You can do the same exercise with words like “aging,” “old,” “tired” or “longest” and see the same sorts of claims — all of which have so far turned out to be wrong.

NK: However you count, it’s hard to argue that there’s predictive information in the length of bull markets, and the numbers show why.

There have been 22 bull markets since 1928, excluding the current one, according to Yardeni. Thirteen occurred between 1928 and 1948 and lasted on average just under a year. Those bull runs clearly didn’t die of old age.

The nine since 1948 ran much longer, lasting on average more than five years. Leaving aside that those nine episodes are too small a sample to say anything empirical, the problem is that they represent a huge range of outcomes. The shortest bull market lasted roughly two years and the longest stretched 12 years and everything in between, which suggests that something other than old age killed those bulls.

Your point about fear-mongering, with which I agree, raises another question: Does the length of a bull market say anything about the magnitude of the subsequent decline? The data, however limited, suggests not. The second- and third-longest bull markets since 1948 were followed by the least and third-least severe bear markets, as measured by peak-to-trough declines. And the correlation between the length of those nine bull markets and the subsequent declines is a negative 0.16, which is to say no meaningful relationship.

Even so, we shouldn’t discount the behavioral risks. Investors are paying handsomely for U.S. stocks – the same stocks many of them wouldn’t touch a decade ago for a fraction of today’s price. I worry that the longer this bull runs, the more investors forget or abandon the hard-earned lesson of previous downturns: Namely, that markets move in two directions. Old age may not kill the bull, but it still might harm investors.

BR: You and I are debating an issue from somewhat different perspectives, looking at various aspects of history and data, but ending up at separate conclusions that are not so very different from each other.

I say: the bull market began in 2013, but regardless, we should be looking at the longer term secular markets and not get distracted by the occasional cyclical countermoves, such as those one-year rallies from 1932 to 1948 that ended up flaming out.

You say: the length of a bull market does not say anything useful about how various investments will perform in the future, nor does it tell us anything about the magnitude of subsequent declines. What is useful is understanding what current valuations suggest about future expected returns.

I hope readers find this exercise helpful toward both their understanding of market cycles and how these issues affect their investments.

~~~

I (along with Nir Kassair) originally published this at Bloomberg, August 23, 2018. All of my Bloomberg columns can be found here and here.