Today we start a new series: Blog Spotlight.

We put together a short list of excellent but somewhat overlooked blog that deserves a greater audience. Expect to see a post from a different featured blogger here every Tuesday and Thursday evening, around 7pm.

First up in our Blogger Spotlight: Tim Iacono and The Mess That Greenspan Made. Tim is a software engineer in his mid-forties, living in Southern California. He calls his blog is a "vain attempt to stave off a mid-life crisis, and here’s hoping that it’s going to work."

>

Today’s focus commentary is called Friends in High Places? and it address the controversey we discussed last week.

>

Friends in High Places?

Life is always much more fun when there’s a good

conspiracy theory to kick around. When the New York Times starts kicking it

around too, then it can really be

enjoyable.

Such is the case with the recent plunge

in the price paid for gasoline by formerly dour consumers leading up to an

election where the party in power is clearly having difficulty wooing the

electorate. It just so happens that the newly appointed Treasury Secretary used

to run the investment bank that controls the world’s most important commodity

index, which seven weeks ago cut the weighting of unleaded gasoline by nearly 75

percent, causing all commodity investments based on this index to sell their

unleaded gasoline futures.

For the same number of buyers, a glut of

sellers means lower prices, and voila! Prices at the pump drop precipitously,

consumer confidence rebounds, and the electorate develops a new spring in their

step.

Or at least, that’s what some would have you believe. . .

A

recent poll revealed that

42 percent of the respondents thought the White House had somehow manipulated

the price of gasoline so that it would decrease before this fall’s elections.

They were only slightly outnumbered by the 53 percent who believed there to be

no trickery involved.

Still, there are a few too many events that have

lined up so precisely over the last few months that it’s hard not to take

notice. A recent New York Times story

observed the changes made to the Goldman Sachs Commodity Index back on August

9th, particularly its fortuitous timing. Heather Timmons writes:

Wholesale prices for New York Harbor unleaded gasoline, the major

gasoline contract traded on the New York Mercantile Exchange, dropped 18 cents a

gallon on Aug. 10, to $1.9889 a gallon, a decline of more than 8 percent, and

they have dropped further since then. In New York on Friday, gasoline futures

for October delivery rose 4.81 cents, or 3.2 percent, to $1.5492 a gallon.

Prices have fallen 9.4 percent this year.The August announcement by

Goldman Sachs caught some traders by surprise. The firm said in early June that

it planned to roll its positions in the harbor contract into another futures

contract, the reformulated gasoline blendstock, which is replacing the harbor

contract at the end of the year because of changes to laws about gasoline

additives.Later in June, Goldman said it had rolled a third of its

gasoline holdings into the reformulated contracts but would make further

announcements as to whether the remainder would be rolled over. Then in August,

the bank said it would not roll over any more positions into gasoline and would

redistribute the weighting into other petroleum products.

Not

surprisingly, Goldman Sachs had no comment on the recent change.

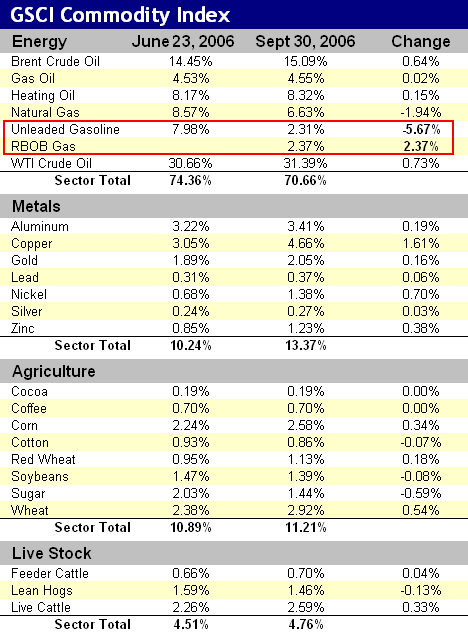

Having

looked at this commodity index some time ago as part of the work done for the Iacono Research website, the

weightings from late June were already available in spreadsheet form. A

comparison between the composition from a few months ago to the most recent data

available at the GSCI page of

Goldman’s website shows the following changes.

The Times article states that the adjustment prompted the sell-off of

The Times article states that the adjustment prompted the sell-off of

some $6 billion in unleaded gasoline futures contracts, some of these being

replaced by Reformulated Gasoline Blendstock for Oxygen Blending ("RBOB")

futures and, as shown in the chart above, the rest being distributed to other

commodities. Note that there was a hefty decline in the natural gas weighting as

well.

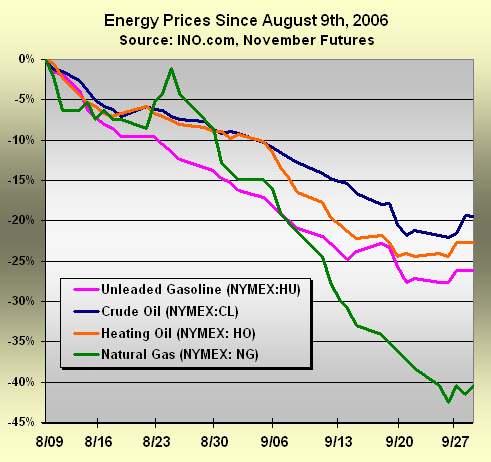

There have been many other factors at work contributing to plunging

energy prices over the last two months – the calming of tensions in the Middle

East, a mild hurricane season, and improving energy production around the world

– but the August 9th date serves as the peak for nearly all energy

products.

The plunge of unleaded gasoline prices around this time is

clear in the chart below.

So, indulging some conspiratorial inklings just a bit further, a

So, indulging some conspiratorial inklings just a bit further, a

reasonable question to ask is whether there might be a relationship between

falling gasoline prices and other energy prices. Were plunging gasoline prices

just part of a broad energy price deline or did it serve as a

catalyst?

The price of heating oil, for example is often affected by the

price of crude oil, and gasoline prices can impact how much traders will pay for

other commodities.

As it turns out, the end of the first week in August

marks a peak for almost all energy commodities – crude oil, heating oil,

gasoline, and more. But one look at the chart below and it becomes clear which

energy commodity led the others down.

With the exception of a brief exchange with always-volatile natural gas

With the exception of a brief exchange with always-volatile natural gas

shortly after August 9th, other energy prices appear to have been led down by the falling price of unleaded

gasoline. It looks like a contagion in the graphic above, spread by unleaded

gasoline and picked up by other energy commodities that were unable to fight off

its effects.

Not until ten days before Aramanth Advisors fessed up to

their bad energy bets on the weekend of September 17th and 18th did the plunge

in natural gas prices surpass that of unleaded gas. Of course, owning near ten

percent of all natural gas contracts just prior to that fateful weekend, the

actions of Aramanth traders leading up to their confessional likely exacerbated

this decline.

So, as far as conspiracy theories go, this is quite a good

one. The motivation for the commodity index change and the impact on other

energy prices will likely never be confirmed or corroborated, but it makes for

an interesting story.

Make a little change that causes $6 billion in

unleaded gasoline futures to be dumped onto the NYMEX, then watch prices tumble.

Stand clear, watching for traders like Aramanth to implode, and get ready to mop

up any other messes that arise during the process – all to relieve a little pain

at the pump, prior to the polls opening.

Some at the White House may be

patting themselves on the back figuring that the best thing they’ve done in

years was to get Hank Paulson to take the job at Treasury.

It’s good to

have friends in high places.

Then there’s this conspiracy theory from Woodward, via CrooksandLiars.com:

http://www.crooksandliars.com/2006/10/03/the-real-price-of-oil/

He writes a great story. Too bad he didn’t use the word “inventories” even once.

This snark likely jinxes my energy shorts to low inventory builds tomorrow, but I couldn’t resist.

Great pick, Barry, TMTGM is one of my daily reads. I hope you have Calculated Risk on the list as well!

I don’t suppose the drop in the price of gas could be related to Oil dropping from $78/bl to $59/bl. Nah, I am sure that has nothing to do with it.

Notice that a change in a gasoline index weighting would have no impact on the price of world crude oil. But conspiracy theories are just so fun and gets everyone’s heart rates running. And you don’t even have to do any due dillegence, just find any single item to focus on, ignore all contrary evidence, and presto, the conspiracy is born.

Wonderful evidence based conclusions.

Tim runs a good blog, nice it see it selected.

jb

Barry….you must be kidding on this conspiracy bit. Please tell me you are. I thought you were above this.

How about a dumb crowded trade as an explanation instead. Inventory overflowing at the docks??

Jeezes

Someone needs to take their Haldol. This administration as hosed everything they touch. Katrina, Iraq, Afghanistan, pre911 intelligence, Social Security reform and on and on and on. To say they are smart enough to do anything right is quite a stretch.

Does anyone know how deep the oil futures market is? Btw, oil trades on many other global exchanges as well and while the Wall Street traders can exacerbate the trend in oil significantly, they don’t have the liquidity to create a trend, one point I agree with Jim Rogers on. $6 billion is p#ssing in the wind in the depth of the oil markets and it caused a 25% drop in oil? Nice blog but a little too conspiratorial on the oil thing. Plus, too many other quantitative and fundamental data points telling you oil was going to dump.

—

perhaps this blog would relive every day how the “maestro” decided to crash global markets in 2000 by raising interest rates for no reason other than bitter jealousy.

—

HAHAHHAHAHA that is the funniest troll I ever read. Yep, the market crash had nothing to do with obscene valuations or rampant speculative mania–it was because the Fed hiked rates a couple points!

And why did they hike rates? Because they were JEALOUS!

HAHAHAHAHA

But Tim is the crackpot. Genius.

I don’t know how deep the oil futures market is, but I do know it isn’t as deep as the U.S. Treasury market.

http://www.ustreas.gov/press/releases/hp118.htm

Poor choice BR. Maybe this guy does have a good blog, but this piece was pathetic conspiracy theory yellow journalsim.

Frankly, expected more from you. Discredits your bog and your macro views IMHO. Also, not so sure you are the independent [politically] that you claim–but I’ve suspected that for sometime now…

~~~

BR:

The terms of this are simple: I selct the blog and blogger whose work I like, and they submit a piece; I neither select that piece or edit it. I do not want to assume the role of an editor. The blogger is trying to capture some eyeballs, and its up to them to submit what they think is their best work.

In addition to liking Tim’s blog, I give him credit for selecting a topic we initially looked at fairly incredulously. Not only did he address the subject in a well prepared and thoughtful manner, but did so in a way that also attracted the MSM — Slate’s Dan Gross discusses the subject here: The Oil Conspiracy

Its up to you to decide if you think the work is persuasive — but so far, I’ve mostly seen ad hominem attacks, and no real response to Tim’s arguments…

I doubt that Big Picture’s views are discredited , this just adds a little something to chew on

Conspiracy theory? Ridiculous! That’s like saying they’d fabricate evidence to go to war. Oh wait…

The bond market may be bigger but the players are massive comparatively. And, using unfair advantage doesn’t mean they can make bonds crater 25% in a month. Big players can move secondary issues or specific components of any market short term including bonds and stocks. Pet stocks are a reality and so likely is the concept in the bond markets when a major player throws their heft.

It’s total paranoia, gun toting, right wing paramilitary, Oklahoma City, Waco hogwash to say a rebalancing of the Goldman Index caused a 25% drop in oil. I can show you a slew of data supporting the drop in oil well before that balancing based on REAL quantitative and fundamental data and it doesn’t require you to forget your Haldol to believe it.

Part of what’s great about this blog is its challenge to think more about different issues. It seems that many here agree with Barry’s Bearishness and housing market take, so I think this was a good choice to keep the readers here thiking and asking critical questions.

Yes, having the crude oil price would have been a good addition – did falling crude trigger the gas prie decline, or did the gas price dcline trigger falling crude?

Maybe Wall St doesn’t have enough $ to complete run the petroleum markets, but they may know enough and have enough clout to put in place a trigger to start a selloff or unwinding of overbought positions?

BDG123

you’re just upset because Barry didn’t highlight your blog !!!!!

BDG:

I’m in agreement with you. I just wanted a reason to show that press release. It didn’t get much play in the MSM or the blogsphere and I find it fascinating someone can possibly push around treasurys.

BTW, is the Air Force covering up an alien landing in Roswell, NM circa 1947?

So the same company that predicted $100/b oil, then changed its mind and – by re-weighting its index after a call from Paulson – sent gas & oil prices plummeting??

Sure. Besides, Goldman never cared much about its credibility to begin with.

To the poster that said:

“Someone needs to take their Haldol. This administration as hosed everything they touch. Katrina, Iraq, Afghanistan, pre911 intelligence, Social Security reform and on and on and on. To say they are smart enough to do anything right is quite a stretch.”

It does seem that way at first blush. Ignore for a moment what BushAdmin has screwed up (near-everything) and look at what they have been successful with. You’ll find that they’ve are not fools. They have simply focused their efforts into areas that enhance the well-being of a relatively small group:

– Energy companies have made millions and enjoyed relaxed restrictions

– Haliburton, et.al. have literally been raking in billions

– Tax cuts for the wealthy

– Their almost single-minded devotion to aggregating power.

-etc.

Sure, they lost Social Security, but BushAdmin has been *very* sucessful for certain businesses and demographics. They have excelled in areas in which they devote their efforts.

Why not give the question due consideration? After all, conspiracies have happened before. If there isn’t one here, then we can hope to dismiss the idea after considering the evidence. If there is one, we could fail to see it by dismissing the idea beforehand.

Barry’s writing has been a constant flow of fresh air in a world full of dogmatic thinking, prejudiced leaps of logic and hypnotic media repetition. In my view, his approach is the right one regardless of success with any particular issue. That’s why I keep reading.

By the way, this

i got as far as the subtitle: “How 18 Years of Easy Money Have Changed the World.” it was all i had to read to identify crackpotism at its worst

is a fairly appalling example of jumping to conclusions. If this reader had bothered to read even a single entry of Tim’s blog, he might have seen why Barry chose to spotlight it first! Or perhaps I credit Mr. Anon with too much intelligence.

“Why not give the question due consideration? After all, conspiracies have happened before.”

Name some.

During a meeting in the Oval Office, according to Woodward, Bush personally thanked Bandar because the Saudis had flooded the world oil market and kept prices down in the run-up to the 2004 general election.

Wikipedia has a whole list of them:

http://en.wikipedia.org/wiki/Conspiracy_theory#Real_conspiracies

but once they’re proven true, they’re not generally referred to as conspiracy theories anymore, hence the impression that no conspiracy theories are true

The assassination of Julius Caesar, the Panama Canal Scandal, the Teapot Dome Scandal, Abscam…there’s a famous video of U.S. Rep. Richard Kelly stuffing his pockets with cash during the 1980 Abscam sting operation. “Does it show?” he asks.

By the way, I apologize for that comment about anon’s intelligence–it was terribly rude and a lapse of judgement on my part. The point of all this has little to do with intelligence and much more to do with good or bad habits of thought, which we learn from and pass on to others around us.

I like Tim’s blog. I think it is interesting.

However, one should be cautious when reading a software engineer’s analysis of financial markets and the economy. There is no substitute for training and experience.

The terms for the Blog Spotlight are simple: I select the blog and blogger whose work I like, and they submit a piece; I neither select that piece nor edit it. I do not want to assume the role of an editor. The blogger is trying to capture some eyeballs, and its up to them to submit what they think is their best work.

In addition to liking Tim’s blog, I give him credit for selecting a topic we initially looked at fairly incredulously. Not only did he address the subject in a well prepared and thoughtful manner, but did so in a way that also attracted the MSM — Slate’s Dan Gross discusses the subject here: The Oil Conspiracy

Now that gas prices is above $3, it time to bring this topic back. Check out the 6 month

chart of gasoline prices here in California at

http://www.californiagasprices.com/retail_price_chart.aspx

Low prices almost exactly during Nov 2006. As the church lady used to say on SNL “Very convenient”

I’d definitely recommend Mr Bednar’s own blog as well: http://njrereport.com

(as well as the national best-of-bubble-breed http://thehousingbubbleblog.com , but you knew that already I’m sure ;)