Oh, dear.

That seems to be the general sentiment amongst the retailers. U.S. October retail sales probably increased 2%, according to the International Council of Shopping Centers (ICSC) and UBS. The estimate has declined from as high as 2.5% last month.

Thomson Financial reports that two-third of retailers’ October sales missed analysts’ expectations.

The excuse making was in full flower, as numerous reasons were profered: ongoing housing market problem, the credit crunch, high oil, warm weather, etc. Also occurring at the same time: Consumer confidence fell to the lowest level in two years, and sales of new homes declined 45 percent in September from a peak in July 2005.

Gee, ya think either of those elements might have had an impact on Retail Sales?

The big winners were Target (TGT) at +4.1% and Costco Wholesale (COST), which posted a 9% gain.

>

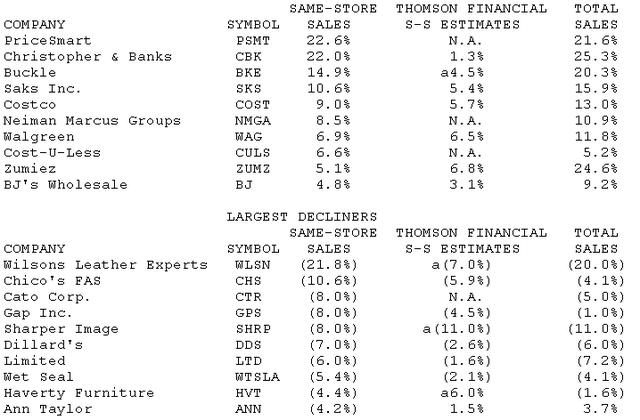

Largest Gainers and Decliners, Retail Sales, October 2007

Source:

October retail sales spooked

Parija B. Kavilanz

CNNMoney.com, November 8 2007: 7:50 AM EST

http://money.cnn.com/2007/11/08/news/economy/oct_retailsales/index.htm?postversion=2007110807

October Retail Sales: Largest Percentage Gainers/Decliners

Dow Jones

November 08, 2007: 10:08 AM EST

http://tinyurl.com/yprkgx

U.S. Retail Sales in October Trail Analyst Estimates

Heather Burke

Bloomberg, Nov. 8 2007

http://www.bloomberg.com/apps/news?pid=20601087&sid=alkX5kNi3kSE&

Slow Sales of Cold-Weather Items Continue to Hurt Clothing Chains

KEVIN KINGSBURY

November 8, 2007 10:42 a.m.

http://online.wsj.com/article/SB119452397863386405.html

If anything, this may prove deflationary going forward, as retailers will cut prices to lure buyers in.

But Federal Reserve governor Frederick Mishkin told us that consumer spending would not be affected by the fall in home prices.

As usual, more Fed propaganda…

“In America you can always find a party. In Russia the party always finds you.”

More like people pulling back now so they can have something to spend for Christmas. You can do without the new fall wardrobe if you have to.

Oh, and if Chicos would go back to having great natural fabric clothes again instead of all the rayon they are pushing at their older “target market”, I might buy more stuff there again, too.

I HATE rayon.

I’m sure the weather will play a factor in why these retailers missed , yet again…..

But not the actual reality of people not having the credit or cash to buy things…..

Funny that way…

Ciao

MS

Thank god John Chambers thinks that the economy is doing well…Oh, wait, no , he changed his mind…Shucks!!!

Boom2bust,

Loved your Russia joke! As an ex ex pat I can’t help but marvel at the strength of the Ruble.

We are already in a recession. The ‘new’ American joke

“They pretend to pay us, we pretend to work.’

Okay, it’s time for CNBC to get rid of this Dennis Kneale character. If I have to hear him say one more time that the banks’ writedowns are inconsequential because they are “non-cash charges”, I am going to puke. Does he think that these writedowns do not affect shareholders’ equity?

The man has not said one intelligent thing in all his rapidly increasing time on CNBC. Seriously. Whether or not I agree with Kudlow and his fellow perma-bulls, Kneale is clearly out of their league in re level of intellligence. CNBC, stop parading this guy out there, or I will shift my viewership to Bloomberg faster than I already am.

Look out below…….

Ciao

MS

Goog off over 50….take note of that…..when has Goog ever been down more than 7% on a non earnings related piece of news???

I bet never…

Ciao

MS

BTW….The Street is on overdrive trying to get you not to sell.

http://www.thestreet.com/s/cramers-10-reasons-to-be-bullish/newsanalysis/investing/10389115.html?puc=_tsccom

Look at the time it was “written”…

Do we sense a little panic in Cramer land?

I guess Doug Kass threw him a bone

http://www.thestreet.com/s/kass-this-bear-sees-a-year-end-rally/newsanalysis/newsonthego/10389050.html

Does the phrase “wall St. Journal Op. Ed” mean anything here?? I sure think it does.

Ciao

MS

Back on topic,

RTH breaks August low.

“Okay, it’s time for CNBC to get rid of this Dennis Kneale character. If I have to hear him say one more time that the banks’ writedowns are inconsequential because they are “non-cash charges”, I am going to puke. ”

I’m on my 3rd bucket. Bottom of the barrel they must be picking him. The only other guy worse, actually two of them, would be David Malpass or Jerry Boyer.

With a 4% GDP it’s obvious why we keep getting these sell offs… These low flying companies must be punished… All the Growth must be in small business…. or undocumented workers are taking 3% of our GDP home with them… Damn fruit pickers are stealing our growth.

(sarcasm intended…. slow coach)

Dennis Kneale is a tool…BTW If anyone is looking for a buy check the 52 week low list…NOT!!!!!

1370 line on the sand… $SPX

i am excited to watch MAD MONEY tonight. Love to hear what he will say.

Costa-

I already know what he is going to say…..

what does he ALWAYS say when it goes against him???

Save yourself some time and read it right here:

http://www.thestreet.com/s/cramers-10-reasons-to-be-bullish/newsanalysis/investing/10389115.html?puc=_tsccom

Ciao

MS

I want whatever he was smoking when he was smoking wrote that article. 9 of those 10 are things that are causing economic problems. This is my favorite “There are some very strong bull markets out there. Health care cost containment, agriculture, oil and oil services, infrastructure, tech and aerospace defense. There are a lot of sectors that work. ” Wow, very strong agrument.

Ron Paul rips Benny-boy a new one

http://www.youtube.com/watch?v=yAwvlDJgJbM&eurl=www.ronpaulnation.com/

Barry,

Federal Reserve Chairman Bernanke just said the U.S. economy is slowing noticeably and inflation outlook has a large upside risk. I believe the word he is looking for is called Stagflation, or Stagflation Jr.- a portmanteau of the words stagnation and inflation, just like 1979-1980 under Carter.

Hi,

I enjoyed checking out your blog. I’m a recent grad in Silicon Valley, and I’ve just started a company that is mapping the blogosphere to our world. I noticed that your blog has great content and a good-sized readership, and it would be great to have you on the map. Here is an example of a blogger in Georgia who’s plugged in: http://www.verveearth.com/landing/#type=user&id=772. It can be fun to explore different localities.

It’s an easy process to get on board, and I can be reached at clayton@verveearth.com for questions or feedback. If you resonate with the vision of painting a global canvas of voices, please give VerveEarth a mention.

Cheers! -Clayton

Whatever it takes to get oil headed back down to reality, I’m all for it. Time for that bubble to deflate a little and for all the “brilliantinos” in gold, oil and commodities to put their profits to work in other investments… or take some pain for being greedy.

The high-end stores are a great indicator of a slow down or recession. When the rich stop spending it is time to start getting nervous.

Bernancke is such a puppet……and not even a good one. he really is just clueless and is totally dependent on a script. You almost could hear him say “line?” after the last drubbing by Paul.

Is anyone really surprised by anything that the Fed (or any other administration “official”) spouts off on.

Ciao

MS

Clayton,

why don’t you pull your upper lip over your head and swallow!

Ron Paul let the Benster have it and Benny had a stupid smirk on his face and really had nothing to say other than how the numbers aren’t that bad. We all know these numbers are bogus.

I thought the funniest thing was the analysis following the testimony on CNBC where Steve L. and Rick S. got into it. Rick basically stated Ben looked inconsistent. Steve felt like he was and blessed us with his analysis only to have Rick retort with how the market didn’t give a shit about what an analyst had to say or what he had to say but rather followed the money. It was great. If Rick wasn’t on I wouldn’t watch.

When Paul grills Bernanke on the “fact” that when the Dollar tanks 10% due to bad policy it is the equivalent of stealing 10% from the savers especially the fixed income people.

Bernanke said something to the effect that a route on the dollar shouldn’t really effect anyone living in the US Economy unless they were buying foreign goods.

Try to buy something made in the US; good luck even items labeled “Made in the US” have a some regulated percentage of foreign components. The only reasons the lower and middle classes are surviving this unreported inflationary spike is due to cheap foreign stuff, everything from clothes to furniture to consumables to even poisonous toys for their children.

Ridiculous!!

Barry,

I think the wheels are already in motion to bring oil down. Much like housing it will falter simply because the market cannot support it.

Not only that, many in my area are simply refusing to drive anywhere whether they can afford it or not. Want to give oil companies the finger? Stay home this Thanksgiving, Talk everybody you know into staying home this holiday. Refinery fires, possible storms, global demand. Lions, Tigers, and Bears Oh My! What BS.

Stagflation here we come!

“Bernanke said something to the effect that a route on the dollar shouldn’t really effect anyone living in the US Economy unless they were buying foreign goods.”

When you hear a comment such as that from Bernanke you have to wonder about exactly how insulated is his world of academia and can he really be that disconnected from reality.

In general, the comments are “polite” that you can’t help but get the impression they want to go to a side room and ask what they are really thinking. It’s an utter waste of time. Paul was the only one that had appropriate tone.

Well exactly Stuart and seriously, how much of the stuff you buy is actually made here? Do you really think domestic goods will stay low when the competition is going up?

I think Greespin really hated BB and is laughing his friggen Arse off after that performance.

Ken H-

Or use bio-diesel like I do. I hope whatever-“flation” results that the momentum to alternative energy continues. News with FSLR and the stock price show that if solar can become cost competitive with fossil fuels, we’re in a whole new era, that might just bring jobs and growth to boot…

and of course, at 3 o clock there they go

But still, the sales were up 2% – that’s not terrible is it? If they were down 2%, then I could understand the alarm, but how can sales being up 2% be a problem?

Some humor to lighten your day.

From Dana Perino (WH press secretary) regarding the president’s water bill veto (overridden today):

‘The president is standing up for the taxpayers…’

Barry,

Bernanke acts like he is not worried, I don’t think those people care about the average saver. It hurts us, that they don’t care, so we have given-up trying, and yes we will spend more on Christmas.

PS. So “Mad Money” CNBC, Jim Cramer said he was just kidding about the bowe knife in Cuomo picture, bullies always say that.

HUH? You guys watch CNBC with sound on?

Your gonna lose brain cells that way.

Big Ben didn’t sound so big today. He sounded like he was somewhat nervous – wonder why? There is going to be a lot of social unrest within the next several years. No, I am not John, from Patmos…but things just don’t look good.

Ben Bernanke looked so good today, I got a song for him by Carly Simon called, “You’re So Vain”.

Originally the song was called “Bless You Ben”; I kid you not. It went, “Bless you Ben, you came in, where nobody else left off.” this song gos to the melody of “You’re So Vain.”

I think the Fed is Vain, and all they want attention, Don’t Cut, Do Cut, it’s the ‘good cop-bad cop dance’ with CNBC.

October US retail sales are at or near recession levels. Food inflation boosted warehouse sales.

Wal-Mart sales increased 0.4% on heavy discounting; +1.1% was expected. WMT’s sales are flat ex-Sam’s Club (+4.2%, food) and are down 0.3% ex-gasoline.

Target same-store sales increased 4.1% (+2.4% exp). Costco same-store US sales jumped 7% (food).

The Int’l Council of Shopping Centers said October sales increased 1.6%, the worst October in 12 years.

Bloomberg’s Same-store Sales Index increased 1% in Oct; year-to-date sales are +1.5%. The only reason for being positive is the warehouse clubs index increased 5.3%.

It’s the food inflation, stupid!