“The purpose of studying economics is not to acquire a set of ready-made answers to economic questions, but to learn how to avoid being deceived by economists.”

>

One of the things that really perturbs me are disingenuous, intellectually indefensible commentary consisting of willfully misleading tripe. Up until recently, that territory has been owned by the WSJ OPED pages. This past weekend, the NYT was seen elbowing its way into the same space.

I call this approach to economic analysis Hackonomics.

An OpEd in the Sunday Times is classic Hackonomics. Unfortunately, it takes little craft to slip junk past the editors at the Times OpEd section. Impressive-looking academic or government credentials seems to be all that is required. (Its a shame they don’t have, say, a professor from the Princeton Economics department on staff).

Perhaps there is a fear of looking silly or economically ignorant, rather than asking anyone else about any of these “analyses.” What we get instead are pieces like You Are What You Spend. The authors are Michael Cox, and Richard Alm, chief economist and senior economics writer at the Federal Reserve Bank of Dallas. As my British colleagues would delightfully articulate, “their work is shite.”

To wit: These two gentlemen press forward the idea that the proper manner to review economic inequality should involve looking not at income differentials. Rather, this Fed duo favors a more direct measure of economic status: household consumption. They claim “the gap between rich and poor is far less than most assume, and that the abstract, income-based way in which we measure the so-called poverty rate no longer applies to our society.”

Their analysis is so problematic and their theory so full of holes, that, if time permitted, we could identify errors in nearly every paragraph. That sort of critique is best reserved for serious intellectual analysis of major importance. For Hackonomics, we will simply identify 3 major flaws, and then get on to more pressing and important work.

Let’s take a closer look at their arguments:

1. Income Disparity: Abstract? There is nothing “abstract” about income-based measures of poverty or wealth inequality. Merely calling income comparisons “abstract” does not make it so, nor does it make their position any less absurd. Instead, it reads as a transparent attempt by the authors to avoid any income discussion.

Why not discuss income? Perhaps the data is the reason: The share of national income of the wealthiest 1% rose from 14.6% five years ago (2003) to 17.4% in 2005 (Emmanuel Saez, University of California-Berkeley). And since 2005, the wealth disparity has grown even further.

Indeed, as several commentators have already pointed out, these same authors previously tried to make an income based argument that “the gap between rich and poor is far less than most assume” — and crashed and burned.

Next attempt, please.

2. Median/Average. The next intellectually corrupt trick is a classic statistical error. The authors look at average — rather than median — spending and income by quintile, and determine there isn’t much inequality in the United States.

How did Sunday’s silliness manage such a feat? They start with a variation of the median/average trick (Bill Gates walks into a bar . . .). Only this time, the perps are slightly clever. Rather than merely play with “average,” they oh so craftily break the spending pools into quintiles. This creates the appearance (see chart below) of relative equality on a per capita basis of spending equality.

Any statistician in the country will tell you this an embarrassing error of the highest magnitude.

Any statistician in the country will tell you this an embarrassing error of the highest magnitude.

The top quintile have an “average” income of ~$150k and an average spending of ~$70k. But “average” broadly misrepresents the top quintile. This twist ignores the vastly disproportionate income and spending habits of the top 1%, and the even more disproportionate top 0.1%.

Wall Street Journal columnist Robert Frank’s book, Richistan looks at the recent unprecedented rise of wealth in the U.S. The top 2 1/2% — over 7 million households — have a net worth of $1–$10 million. The top 1/2% — over 1.4 million households — have a $10–$100 million net worth. There are now thousands of households — top 0.1% — with a $100 million to $1 billion in assets. Oh, and there are now more than 400 billionaires — the top 0.01%.

This is not a bad thing per se. I am all in favor of economic freedom and wealth creation. But to pretend that there is little wealth disparity is simply nonsense.

~~~

3. Comparing Household Consumption:

Looking at Household consumption can yield some interesting insights — but it matters at what you look at. Our intrepid authors have avoided discussing the expenditures on necessities, and instead went a different way:

“To understand why consumption is a better guideline of economic prosperity than income, it helps to consider how our lives have changed. Nearly all American families now have refrigerators, stoves, color TVs, telephones and radios. Air-conditioners, cars, VCRs or DVD players, microwave ovens, washing machines, clothes dryers and cellphones have reached more than 80 percent of households.

As the second chart, on the spread of consumption, shows, this wasn’t always so. The conveniences we take for granted today usually began as niche products only a few wealthy families could afford. In time, ownership spread through the levels of income distribution as rising wages and falling prices made them affordable in the currency that matters most — the amount of time one had to put in at work to gain the necessary purchasing power.

At the average wage, a VCR fell from 365 hours in 1972 to a mere two hours today. A cellphone dropped from 456 hours in 1984 to four hours. A personal computer, jazzed up with thousands of times the computing power of the 1984 I.B.M., declined from 435 hours to 25 hours. Even cars are taking a smaller toll on our bank accounts: in the past decade, the work-time price of a mid-size Ford sedan declined by 6 percent.”

This is, of course, sanctimoniuos bullshit classic economic misdirection.

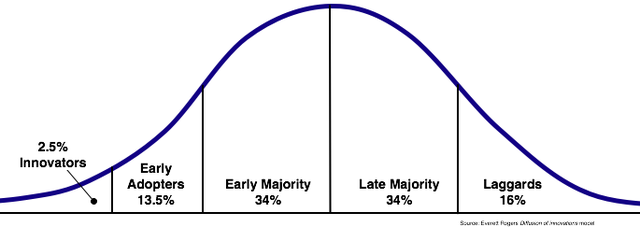

What the authors are revealing here are not rising incomes or societal similarities of wealth. Rather, their data and cost discussion are about Technology adoption lifecycle (Joe M. Bohlen and George M. Beal, 1957), later refined in Everett M. Rogers’ Diffusion of Innovations. New technologies and products come down in price over time, regardless of the state of economic equality in the broader society.

This is the oldest dodge in economics. That two Fed economists either fail to understand technology adoption cycles — or worse, have chosen to willfully ignore it — simply boggles the mind. If this is the best that Federal reserve researchers can produce, it does go a long way in explaining why our financial system is near crisis.

A quick review of this concept is in order, on the (hopefully) slim chance the rest of the Fed Reserve research group is as abysmally educated in the ways of technology and economics.

All of the above named products — Washing machines, phones, autos, TVs, VCRs, Cellphones, PCs — went through a well established adoption model. In the classic definition (see chart below), the first group of people to use any new technology are called “innovators,” followed by “early adopters,” then the “early majority” and “late majority,” and lastly, the “laggards.”

>

Technology Adoption Lifecycle

>

The impact of this adoption process and the manufacturing economies of scale are significant determinant of technology product prices.

Here is a grossly over-simplified discussion of how this works: When the innovators buy a product, they essentially are paying for all of the R&D costs, and other development expenses. You paid 365 labor units for a VCR in 1972 because they were a limited production, custom product that was practically hand made. When a PC cost 465 labor units, chip fabs were nowhere near as plentiful as today — and the biggest cost in early PCs were the exorbitant chipsets contained in them.

The early adopters pay less than the innovators, as factories get built to mass produce chips or tape transport mechanisms or cell phone keypads. What was a nearly custom made product becomes a merely limited-production, high-end one. Where the innovators paid for the R&D, the early adopters paid for the fabs and factories to be built.

The early majority doesn’t get the use of the product for the first few years, but they get a big price benefit of manufacturing economies of scale. Mass production of components bring prices down; successful products attract competition to the space, and soon more manufacturers are cranking out more units. Through competition, prices begin dropping faster and faster. The late majority gets even cheaper prices. Consider the laggards and the VCR today — they cost about $29 each.

None of this has any relevancy to problems of wealth distribution and inequality in America.

To understand the serious issue of relative inequality, you would not look at technological toys (unless you were idiots). Rather, you would consider the consumption of necessities — Shelter, food, medical care, clothing, education, transportation. Not only that, but you would not simply review the quantity, but also the quality of the products that get consumed.

Compare the top and bottom quintiles: Who is consuming fatty, high carb foods, and who is eating lots of protein, fresh fruits and vegetables? What about medical care? Do they have reliable access to any sort of family physician, regular check ups, doctor visits, ongoing treatments, preventative care — or is their medical consumption on an emergency room basis? What is the quality of their housing like — safe neighborhoods, with access to good schools? Or something less desirable?

If we are going to use consumption as a measure of economic equality, then look at the quality of essentials; measuring toys ain’t the way to go . . .

~~~

4. How do the Affluent Elite Spend?

Since the authors want to look at spending, let’s do just that. Only instead of their intellectual indefensible “average” let’s see how that top 0.5% spent their cash.

A study by a Prince & Associates last summer (2007) detailed the spending habits of the upper economic strata. They found this group spent their money as follows:

Dollars Spent Category - 2007 Spending per Affluent Elite Household

Category Category

Spending Spending

Summer Spending * 2007 * 2005 Change 2007/2005

Activity % $ Spent % $ Spent $Change %Change

Yacht Rentals 10.60% $384,000 9.50% $317,000 $67,000 21.14%

Redecorating 44.90% $129,000 30.90% 137,000 ($8,000) -5.84%

Villa Rentals 15.70% $106,000 13.80% $79,000 $27,000 34.18%

Experiential

Excursions 25.80% $103,000 22.70% $79,000 $24,000 30.38%

Jewelry/watches 73.70% $94,000 63.20% $63,000 $31,000 49.21%

Luxury Cruises 47.50% $92,000 43.10% $71,000 $21,000 29.58%

Charitable Giving 97.50% $82,000 98.40% $52,000 $30,000 57.69%

Vacation Home

Rentals 12.10% $82,000 11.80% $64,000 $18,000 28.13%

Out-of-Home Spa

Services 67.70% $61,000 48.70% $49,000 $12,000 24.49%

Summer

Entertaining 93.90% $56,000 92.40% $39,000 $17,000 43.59%

Luxury Hotels 95.50% $48,000 93.40% $36,000 $12,000 33.33%

Luxury Resorts 84.80% $41,000 82.60% $23,000 $18,000 78.26%

At-Home Spa

Services 53.50% $38,000 47.40% $26,000 $12,000 46.15%

Apparel/accessories 92.40% $34,000 86.80% $16,000 $18,000 112.50%

Audio/visual 51.50% $31,000 50.70% $14,000 $17,000 121.43%

Wines and Spirits

for Social

Entertaining 86.90% $24,000 77.00% $19,000 $5,000 26.32%

Wines and Spirits

for Personal

Consumption 84.80% $17,000 74.30% $11,000 $6,000 54.55%

2007 2005 $Change %Change

Total Luxury Summer

Spending/Household $622,202.02 $399,187.50 $223,015 55.87%

*Percentage of those surveyed spending in this category

Survey of Households with Net Worth $10 Million +

~~~

$384,000 for Yacht Rentals? $94,000 on Watches? Don’t forget Redecorating costs: $129,000. All that spending sure can work up a thirst! ($41,000 for Wines and Spirits).

Gee, it sure looks like we have some spending income differentials!

It is true – the rich are different: They spend a whole lot more money on luxury items than the rest of the country!

~~~

Bottom line: This is one of those absurd situations, where after you look at all the facts, and analyze the deceptive way the authors construct their arguments, you simply have to call Bullshit.

>

Sources:

You Are What You Spend

W. MICHAEL COX and RICHARD ALM

NYT, February 10, 2008

http://www.nytimes.com/2008/02/10/opinion/10cox.html

Super Rich Plan to Increase Spending

Elite Traveler, Prince & Associates Summer Spending Survey

May 18, 2007

http://tinyurl.com/ysda7x

Richistan

Robert Frank

Crown, 2007

Technology adoption lifecycle

Joe M. Bohlen and George M. Beal,

1957

Diffusion of Innovations

Everett M. Rogers

1962

Income and Wealth Inequality

Emmanuel Saez

University of California-Berkeley

http://elsa.berkeley.edu/%7Esaez/

Jesus!

Remind me not to piss you off!

I am constantly amazed how certain people think that totally placing the welfare of businesses and hence their owners foremost in their version of economic thinking. Some times simple analogies can clarify a situation. To hear that importing more foreign goods with lower prices is beneficial for the average American is short sighted in the short run things are cheaper in the long run we are engaging in business that sends much of our treasure overseas while diverting a smaller part of it into the pockets of a small group of Americans. Not a balanced situation.

IF we view the United States as a robust athlete, we might view our trade balance as a situation where we are taking blood from the athlete and replacing it with plasma. Eventually the athlete, no matter what strong structure they posses become weak and ineffective. At some point that athlete gets traded to the minor leagues.

Now I am going to fill my car with gasoline imported from foreign shores and run out to Walmart (how do you say it in Cantonese?) and buy a nice flat screen TV on my 29% charge card. Such a bargain!

I don’t see the problem. If some of them poor folks get a part time job, the extra money could put them into a fine new doublewide, which is nearly the same as the houses in Friday’s WSJ last section. Yessiree. Put the wife to work and you can git yerself a new TV and drink better beer. According to them averages, it’s only a short hop from there to there to there. Those rich people ain’t no better than anyone else. Them poor people can git their average numbers pretty close to the rich folks’ if they try real hard. Maybe some can git their little girls to shake their asses for tips? That’ll make the number for sure.

You worry about hackonomics, I worry about the Murdockification of the WSJ. One-third of the front page of the 2/9/08 edition was devoted, above the fold no less, to the story of a 46-year-old woman, a married pillar of her community who sprung a 20-something love object from prison. The jump devotes 1-1/3 full pages, including a nice shot of the prisoner’s tattooed torso. The article is titled “The Heart Has Its Reasons.” I wonder whether the WSJ’s head had its reasons. At least hackonomics provokes an intellectual debate. What’s next for the WSJ? Space aliens?

Awesome Barry! A little economic education for us and huge smack down for the two hacks in Texas! Times like this remind me why I read you everyday. BTW, the NYT Op-Ed and WSJ editorial and Op-Ed offer endless fodder for this stuff. So don’t get too bogged down in it, DeLong, PGB and some others have you covered. Ben Stienery! Priceless!

If you look more into psychology theory you will see that human beings are not wired to think long term. Those who can are odd balls. There are only a few personality types that can think long term (more than 5 years) and the total number of individuals who can do this represent less than 5% of the population.

Capitalism is perfect for short term results. But we’re going to hit a wall. Socialism requires more long term thinking but we probably never have the right personality types leading us.

Helaine,

Maybe the WSJ will start putting ads for fine new doublewides in the Friday WSJ. That’s who they seem to be going after now.

I feel your pain. I almost canceled my almost free subscription after I read that issue. I can live with a hysterical WSJ editorial page. I never read it. But if they take the rest of the paper to a business hillbilly level, out it goes.

The NY Times is just getting ready for a News Corp takeover.

Barry,

Remember JK Galbraith’s old quote, “The modern conservative is engaged in one of man’s oldest exercises in moral philosophy; that is, the search for a superior moral justification for selfishness.” You have unearthed yet another example of how the spirit of Marie Antionette lives on in our own elite.

Barry:

Thanks for calling it like it is and not pulling any punches.

keep it up.

My daughter wanted to experience life in the Big Apple last year. She worked part of the time and was between jobs part of the time. Based on her income, she likely fell into the national poverty stats. Based on financial assistance from dear old Dad, she did OK.

The point is, these economics are concluding that not everyone who is listed as poor, is in fact poor.

I do not in any way wish to diminish the fact that there are many individuals and families who are suffering in poverty. However, I do not think we should disregard the findings of their study either.

Fellow on corner with cup: Okay, tell me again why I’m not poor…

I am so sick and tired of being told that Gen-X is spoiled and that people are rich when debt is supporting nearly all the excess. I did this calculation to show just how rich a family making 100K really is, and I show it to all the smug people who think know better…

Annual

Pay:: $62,614

Mortgage: $19,000

House Ins $720

Car1 $5,400

Ins1 $1,000

Gas1 $2,500

Other $200

Car2 $5,400

Ins2 $1,000

Gas2 $2,500

$200

BankFee $120

Life Ins. $1,500

Hydro $1,200

Heating $3,000

Tel: $480

Cell $480

Cable $480

Internet $480

Food $8,400

Daycare: $2,000

Clothes Kids $1,000

Clothes Parents $2,000

Work lunches $1,250

B-Days $200

X-Mas $500

Costs: $61,010

Savings: $1,604

This is based on a family making 100K in Quebec. And it does not include any leisure costs whatsoever apart from skimpy B-days and X-Mas!

If you live in a suburb, a young couple probably has to carry a 200K mortgage and needs to get by with 2 cars since schools don’t offer buses for everyone anymore and nothing is walking distance.

If you live in the city, you probably had to pay twice as much for your home so your mortgage is that much more expensive.

If you look at Statcan, it is quickly apparent that the ones who have benefited from the rise in markets and real estate since 1999 are 55+ and even at that, savings has contributed nothing to the rise in wealth, it was all asset price gains.

The biggest divide currently is generational! Who is really looking at this?

Floyd Norris looked at this op-ed too, and has a great quote from Paul Kasriel, (Northern Trust, Chicago), who actually considered the question of consumption via *borrowed money*:

“So, yes, the poorest 20% of households might be enjoying increased “prosperity” today relative to 1975. But if the households in the aggregate are spending more than their incomes and the richest 20% are spending less than their incomes, then it must be that the “bottom” 80% are spending considerably more than their incomes. That is, the bottom 80% have become “prosperous” by going into debt up to their eyebrows. I sure hope the consumer durables they have purchased with borrowed funds have a long useful life because the bottom 80% are likely to find it more difficult spending more than they earn inasmuch as household credit availability is tightening significantly.”

http://norris.blogs.nytimes.com/2008/02/11/borrow-and-spend/

When gramps was a young man, he used to crawl in a hole in the hill behind his house to dig coal out by hand. Every day. That’s after working all day and attending to the farm. The hole is still there.

I hate to bust in on the all-Barry-all-the-time cheerleading, but if someone states their statistical methodology explicitly (for example, that they are computing mean incomes by quintile), how is this an “embarrassing error of the highest magnitude”?

Where exactly is the embarrassing error? Using means actually overstates the income disparity relative to using medians, so that can’t be the issue.

Is it that they use quintiles? Would you prefer deciles? Centiles? These would in fact highlight the disparity more clearly than quintiles. Which quantile would make you happy?

Would love to read substance here rather than rants to the rah-rah crowd…

Having grown up in Dallas and escaped its clutches, I can tell you most certainly that the city is not an environment which fosters critical thinking.

Rather, it is an alternate reality where up is down and down is up, and superficiality trumps substance.

Consider the following:

http://www.drem.org/

Yo, Moonpies–

Try reading. Not only did the authors not say ‘mean’ (they said ‘average’), Barry went into quite the explanation (below) as to the distortion their approach will cause. A distortion the stat crowd knows will happen when using this approach to the author’s incredibly misleading ‘arguments’.

Would love to read substance in your comments rather than lame critiques.

“Rather than merely play with ‘average,’ they oh so craftily break the spending pools into quintiles. This creates the appearance…of relative equality on a per capita basis of spending equality.

“Any statistician in the country will tell you this an embarrassing error of the highest magnitude.

“The top quintile have an average income of ~$150k and an average spending of ~$70k. But average broadly misrepresents the top quintile. This twist ignores the vastly disproportionate income and spending habits of the top 1%, and the even more disproportionate top 0.1%.”

Friend, it is scarcely news that even the Fed nearest to Warren Buffet’s home town is way out of touch with reality. One of the functions of grand financial mess-ups like the sub-prime crisis is to make the Fed take notice of the real world.

Nevertheless, if you concentrate on income inequality you are still some distance from what every Jill and Joe in the Wal-Mart understands is the real issue – equality of opportunity; in this context equality of opportunity to consume. The best available measure of that is the distribution of wealth. In looking just at inequality of incomes you risk radically understating inequalities in opportunities to consume.

Susan:

Bingo!!!!!

1. The median versus average argument. Remember the median can be higher or lower then mean (average) depending on skewness. I don’t know what that is in this case.

2. One of the most silent yet undermining factors in the economy is the large debt burden being place on young people today (say under 30). Do some quick math on this. The average student loan amount is somewhere like 30,000 per student at graduation. The average starting salary is roughly still 35,000 per year. (who gives someone with no job in school 30,000 to 200,000 in student loans anyway, the new subprime, that’s another discussion, should we all be short student loans)

Consider the monthly payment 15 years fixed rate on a student loan of 30,000 is about 300.00 per month. That’s at 4% fixed. The rate these days is almost 9%.

That average salary after tax comes to roughly 2,000 per month.

After student loan payment that drops to 1,700 per month.

I ask you this. In what major city can you live for that, let alone save for a house, retirement, emergencies ect.

There was a study done not long ago about records numbers of college graduates living at home.

Last point, Imagine living on 1,700 per month. Then picture after 5 years of working hard you have made your way up to 60,000 per year. That puts you at roughly 28 years old. Right on the verge of family life. Now look at housing prices. Where can you buy a house for 60,000 per year?

Are economy has sucked for a long time. We buy into the fact that GDP growth, corporate income mean something they don’t. Like was pointed out those numbers are completely biased by the disparity of wealth.

Look at the depression timeline that was posted on this site about a month ago. There was a massive disparity of wealth right before the great depression. Then it was the birth of technology in farming that hurt so many. Now it is the use of global trade and cheap labor.

Oh look GDP is up 2% because walmart sold ten more tv’s to a person on credit, made by a 14 year old for 40 cents an hour. The economy is fine. You don’t need a union, immigration is good, outsourcing is good.

There is a reason economics was called a dismal science for a long time.

Like all statistics, they can be used to support whatever conclusion you want to reach from the outset. Those who engage in hackonomics don’t give a shit about whether others see it for what it is. They have a purposefully driven agenda and they’re sticking to it irrespective of the opinions or insights of others. The BLS, NAR, WSJ OPED pages are classic examples of this. Such is the nature of the beast with stakes this high.

Barry,

understanding the desire to keep the access portal open……but come on, I’ll say it for you

the ALL TIME WORLD CHAMPION of haconomics……

the envelope please

Larry Krudblow!!

second place isn’t even on the track!!!!

fyi my blogger friend

a black hole is kinda like a bathtub drain in the whole universe – supposedly

maybe where our human energy is sucked into, when it gets there in a few light years

Some of you jerkoffs learn economics at Harvard or MIT. Well, the only way I get into them places is if I could squeeze inside a test tube and find a spot to hibernate inside the chem lab. I learn my economics from Science Fiction, a much better (and fun) way to learn anything. There is an old SciFi story about a guy who freezes himself for 500 years, put 10K in a savings account that paid compound interest daily and when he came back to life he had two million in his account and figured he was set for life. Not so fast. To begin with a cross town ride on public transportation cost $500; a phone call cost $50; and so on. The things that he needed five hundred years ago “nobody used any more.” Instead there were a thousand things he never imagined would be in existance and a ton of things that were absolutely required by the monolithic government. Everything was done by debit card and to buy anything at all one had to use one. There was mandatory health insurance that cost whatever, mandatory car replacement every five years, weekly medical exams and monthly MRI exams; required rental payments that ran like $20,000 per month (the cheapest house ran fifty million dollars), and you got things like automatic sex which also cost money. I could go on, but the fact is that as we go on “things” become useless and new things become necessary, most required by government. Our hero in this story was killed by the government as soon as his bank account dropped to 20K, which was the cost of killing and disposing of him.

Which is to say that to compare wealth from one era to the next is an absurd exercise destined to yield a fake result.

Measuring incomes in the present tense is pretty cool, but work time to acquire things is pretty cool too…so long as you are calculating work time at the same wage, which is of course insane.

Anyway, back to a great SciFi epic I’m now reading about this hooker who……

Did the authors mention how the study of lottery science could quickly improve the lives of poor people? Authentic lucky numbers are available over the internet and from reputable companies that advertise in the back of some periodicals.

Good to see the daily kos crowd migrating in here… flawed or not one of the important points is that poor people are often poor because they spend too much money.

All of this is good and fine and statistical.

The bottom line is that the American middle class, as we have come to know and live it, is disappearing. The trend is overwhelmingly downward. There are many reasons for this, but the straw that broke the camel’s back was globalization. Globalization cannot afford an American-style middle class. The proof of this is in the relatively recent phenomena of Illegal immigration and outsourcing of jobs.

There will be social upheaval.

The trend is clear to the casual observer – despite the tortured numbers.

“FUCK THE POOR!”

History Of The World, Part 1.

I always find it amazing the amount economic drivel that is thrown out to justify income disparity.

“Globalization cannot afford an American-style middle class. ”

Anywhere, ever? For all time? Not in the US, not in China, not in India, ever? Rather Malthusian, don’t you think?

How did we ever afford one to begin with, trade wars? Trade wars are good? Smoot and Hawley had it right?

Barry,

I made it as far as your first section covering Income Disparity before realizing that there wasn’t any need to go any further as it appears that the income data was cherry-picked. Assuming you weren’t going for satire by demonstrating the kind of Hackonomics against which you’re railing, here’s where you went badly off track. (And if you were going for satire, well done!)

The reason there’s such an increase in the percentage share of income taken in by the Top 1% of income earners from 2003 to 2005 is because 2003 represents the near-bottom of the economic fallout following the bursting of the Dot-Com Bubble and subsequent recession for the Top 1% of income earners in the U.S.

The good news is that you don’t have to take my word for it. Here’s the year-by-year data, graphically presented. For good measure, here’s the post from which the chart was taken.

As you can see, the income earned by the Top 1% of income-earners in the U.S. bottomed out in 2002 and had only barely begun rising in 2003. By 2005, the collective income earned by individuals represented by this group in these years had recovered to where their counterparts had been in 2000 as the economy recovered quickly after this point. That change came with a huge difference – it took a lot more people to make that aggregate level of income in 2005 than it did in 2000!

When you have sold your soul you have nothing else left to sell other than reasons why you sold in the first place.

Not in the US. Not in China. Not in India. It is impossible for the majority of the people, any people, to be above average.

1st> the wealthy do support the economy by spending in excess, ie: the trickle down method, but the apparent disparity is the carving up of the pie to the living population of laborer consumers and them freeloaders we laborers fear

___

MA tell me again why I’m not poor – public or private education? / luck? / parents? / smart as a tack? / trial and error bailouts?

___

D’s got Canadian healthcare system – low income Americans may have better insurance on the material assets

___

Steve not many have fuel reserves or garden+livestock space anymore – our world requires a community county state country

Fed economists either fail to understand technology adoption cycles — or worse, have chosen to willfully ignore it

“Willful ignorance” could be the motto of the entire Bush Administration. A willingness to twist data to fit ideological diktats is what gets you ahead, and gets your hackery promoted in the corporate media.

“Their analysis is so problematic and their theory so full of wholes, that, if time permitted, we could identify error in nearly every paragraph…”

Holes….and errors.

That said, this American middle-class mom sure ain’t prosperin’.

Ironman,

Knitpicking the % increase of the income of the top 1% is being disengenous. Looking at the chart you provide it’s clear that they are making more. Barry relied on an academic paper. Considering the fact that BR has assets to manage and writes several posts on his blog I would consider that he has still made his point. Just eyeballing and smoothing both the recent high and low points on the top 1% it’s apparent they are still taking a higher share and have seen more growth than anyone else. The rise in the number of people in the top 1% does not alleviate the fact that the top 1% is still taking in more and long term has had their share grow by more than anyone else.

Overall does the actual % amount invalidate his point? No, it doesn’t. The trend is still there. It’s nice to see you just knitpick one point and not address anything else in the post.

Ironman-

Nice chart.

It shows that over a 20-year period, income increased~300% for the top 1% of AGI earners.

For the other groups, the increase was ~50%.

That’s great evidence increasing income disparity.

(Let’s not get bogged down over a three-year period when the long term trend is clear.)

I saw Krugman’s article last night and my only reaction was WTF?? He barely takes these guys to task.

I have an Econ degree from lowly UCSD and from my vantage I saw holes you could drive a truck thru.

Anyway, thanks for taking out the trash Barry!!

Isn’t rising income inequality just another way of saying that we are in a bull market?

If you don’t like the world of rising income inequality, you really won’t like it when we get your wish and have a big recession.

Then we’ll have all the income equality you can handle. I’m sure it will be great.

So folks in the bottom quintile earn $9,974 and spend $18,153 a year. Apparently, the bottom quintile is dominated by people spending down their savings and by people taking on lots of credit. I thought it was dominated by poor people who generally spent everything they earned and didn’t have any savings to spend down or credit lines available to them. I guess the poor people I know, and those that turn to the local welfare agencies, are statistical anomalies.

The authors should be cranking out a new book on this amazing land of Pooristan. If the poor can spend twice what they earn, maybe all should be doing so and to hell with a stimulus package.

Either that or the dataset is garbage.

Like all statistics, they can be used to support whatever conclusion you want to reach from the outset.

Did you hear about the statistician that drowned in a river whose mean depth was 6 inches?

Actually, it might have been Barry who said some time ago “if you torture the data long enough, you can make it say anything you want it to.”

You gotta love those summer spending numbers. $17,000 for wine/spirits for personal consumption — that is about $200/day! Some nice juice…..

This exercise in hackonomics is deeply flawed from the beginning, but it is consistent with what this “crew” has been peddling since the Reagan years — there is a strong incentive to make the argument that the “rich are pretty much the same as the rest of us, they just took advantage of the bountiful opportunities the US has to offer.” That way, if you’re not rich, it is your own dang fault.

So, much crap has been spewed about economic mobility, when in fact economic mobility in the US has declined over the last 25 years. The Gini index, which measures economic disparities, has also gotten significantly worse in the US since the ’80s.

The other problem with this approach is that the entire premise is flawed — even for the super-rich, consumption is constrained by the fact that one person can only eat so many steaks. A super-rich person could eat every meal at the French Laundry and still their food consumption numbers would not reflect their wealth disparity in comparison with a poor person.

The income that rich people make which is not consumed flows into investments which make them richer. How hard is that to understand?

I found this article pretty interesting about how revenue is being shifted from corporate balance sheets to individuals.

The Truth About the Top 1%

http://www.cato.org/pub_display.php?pub_id=8759

Average real wages in the US have barely budged in over 40 years. There was a slight uptick in the mid-90’s, but that’s about it.

The federal reserve has created the appearance of real income gains, but that’s all it has created–an illusion. In the meantime, as American wages have stagnated or declined, real wages overseas have exploded (a $1/day is a whole lot more than a $1/month). Real wages in America will again rise when overseas competitors’ wages have more or less reached parity w/ ours.

But even considering that the middle class is stuck, and some rich are much richer relative to it, I still don’t know of any Americans that are going hungry. In fact, quite the contrary: Many of us, particularly the supposedly most impoverished amongst us, are grossly obese (about 30% in some areas of the country).

During the Cultural Revolution in China, Mao f—ed up the economy so bad that the pigs were starving–never mind the humans–and they would eat their human’s masters feces as it was coming out. China’s economy is just now beginning to fully recover.

Yes, $60,000 is not enough to live like a prince in America. But quit whining you bunch of pussies. It is more than enough w/ which to feed, clothe and shelter a family.

And nobody, but nobody owes you even that. It is practically there for the taking here in America, but a few bad moves by our government, and poof! that might be gone too. Count your blessings, even if they aren’t always equally bestowed.

There is also the issue of mobility between quintiles. I believe many Americans scattered throughout the lower four quintiles believe that they too will end up in that vaunted top 1% and tolerate stagnating real wages, a broken health care system, etc., because someday they will strike it rich and they don’t want a flatter income distribution. The trouble is–U.S. upward mobility is less than we would like to believe. And less than in other rich industrial societies. Think some of Saenz and Piketty’s work delves into this.

from WSJ:

Notable & Quotable

February 9, 2008; Page A9

From an Feb. 4 interview with Thomas Sowell in FrontPageMagazine.com on his new book, “Economic Facts and Fallacies”:

Q: What’s an example of a fallacy from your book?

A: One is the income gap between rich and poor. It’s maddening to me to keep hearing how the rich are getting richer and the poor are getting poorer, and so on. The fundamental difference is the difference between talking about abstract statistical categories and talking about flesh-and-blood human beings. Since the book came out, for example, there’s been a study released by the Treasury Department based on income tax returns. There, they are talking about following the same human beings over a span of years, which is wholly different from following income brackets over a span of years, because in all the brackets more than half the people change in the course of a decade. So what happens to a bracket is an abstract question; what happens to the flesh-and-blood human beings is different.

For example, for the flesh-and-blood people who were in the bottom 20 percent of taxpayers in income in 1996, their average increase of income over the next decade was 91 percent — so they almost doubled their incomes. Meanwhile, for the people in the top 1 percent — presumably the rich who are getting richer — their average income declined 26 percent. That’s diametrically the opposite from what we’re hearing from nearly every newspaper and practically every political platform.

But of course it’s also true that if you look at the income tax brackets, the distance of the top bracket from the lowest bracket has increased. One reason is that the very lowest bracket is zero, so it can’t go any lower. So as you pay people more and more money and as the economy grows and skills become more sophisticated, obviously the ratio from the top and the bottom is going to increase.

See all of today’s editorials and op-eds, plus video commentary, on Opinion Journal1.

And add your comments to the Opinion Journal forum2.

URL for this article:

http://online.wsj.com/article/SB120251765671955489.html

Income disparity is real, no doubt. The rich have been getting richer, and they are doing so by goating the working poor into spending beyond their means while at the same time systematically sending their jobs overseas.

All of this has happened not in secret, but very much in the open, and the serfs have peacefully, almost silently, allowed it to happen.

Might be time for people to check those labels, and God forbid refuse to buy it if a) you don’t really need it b) it’s not made in USA.

Impressive-looking academic or government credentials seems to be all that is required. (Its a shame they don’t have, say, a professor from the Princeton Economics department on staff).

______________________

It’s a shame you’ve chosen a “social scientist” as the object of your blind affection. You didn’t happen to fall under his spell over, say, a lunch of “jumbo shrimp?” Talk about looking for love in all the wrong places! BTW: the NYT has fact checkers, too. I think they’re less overwhelmed by Professor Krugman’s CV than you.

This is based on a family making 100K in Quebec.

And savings has contributed nothing to the rise in wealth, it was all asset price gains.

The biggest divide currently is generational! Who is really looking at this?

Posted by: D. | Feb 12, 2008 9:14:35 AM

D. Interesting post. Couple of points. Quebec is the highest taxation jurisdiction in North America, so it is the least comparable with US states. Quebec also has a taxation problem from hell in that all the operating factors prevent easy tax cuts, declining population, high government costs relative to population, an annual decifit and massive amounts of debt per capita all demand steady high taxation for the forseable future.

Very interesting about the savings. It means we are just spending too damn much.

As for the generational, here’s the good news, people die and leave their assets to their offspring. Thank God cause that debt has got to get paid somehow.

Northern Observer:

Actually thanks to our subsidized daycare, Quebec is the best place in ALL of North America for a couple with 2 or more children.

We might be spending too much, but try to spend less! There are huge structural problems that must be overcome to do so. Look at the list of expenses, the only place where you can cut is in the cars or the home. But if you get a cheaper home, you need a second car because it’s in the boondocks! I guess you can always get really cheap cars like Ladas… Also, if you have 3 kids, try to fit 3 mandatory car seats in a small car, not to mention those stupidly huge strollers!

If you move in the city (Montreal for example), family homes cost an arm and a leg. If you go for cheaper areas, then your quality of life is way below that of the earlier generation(Boomers).

And I’m not counting on a huge generational transfer of wealth. There will be one but only for the top 5%! The vast majority of Boomers only have enough for themselves, if even that. Many of them will have to use a reverse mortgage or refi because their wealth is in their homes. So their kids will inherit a mortgage! Many are still paying for their Gen-X/Gen-Y kids and don’t realize that they won’t have enough for retirement by doing so.

kckid816, Greg,

In your critiques, you’re assuming that the exact same people stay in the exact same income percentiles over time. They don’t. The most common change is for those at the lowest end of the spectrum to move up. The second most common change over time is for those at the highest end of the spectrum to move down. No matter how you slice it, they’re not the same people from year to year.

Barry knows well the risks of drawing conclusions from cherry-picking data, whether sourced from an academic paper or not. I would expect he would do the same for me purely out of professional courtesy – you can only get a flawed result from making a serious decision based on limited data floating in a vacuum. And there would be nothing personal meant or taken in the criticism – it simply comes with the territory if you care about getting good analysis!

For what it’s worth, the total income taken in by the Top 1% is roughly 300% bigger in real terms over the 20 years from 1986 to 2005 for two reasons: the real economy nearly doubled from the size it was in 1986 and the number of people in the top 1% increased more than five-fold over that time. Maybe a better question is “why wasn’t the total income taken in by the Top 1% even more than that?”

$17,000 for wine/spirits for personal consumption — that is about $200/day

easy – if spirits includes cocaine for you and your dozens of friends as long as your buying

Maybe a better question is “why wasn’t the total income taken in by the Top 1% even more than that?”

Maybe the money went straight to equity without passing through the income statement! If you get bought out by a large public firm and get paid in shares, you can actually use a derivate as to not have to pay tax on that capital gain.

Don, comparing extremes like:

(a) the US with

(b) China under Mao

yields little guidance unless someone’s advocating a Mao government.

It makes me wonder whom you were trying to educate.

>> I still don’t know of any Americans that are going hungry. In fact, quite the contrary: Many of us, particularly the supposedly most impoverished amongst us, are grossly obese (about 30% in some areas of the country).

McDonald’s dollar menu and subsidized corn syrup are cheaper and more readily available than healthy food. That’s what a lot of poor people eat.

>> but a few bad moves by our government, and poof!

“By our government”? That’s too short a list of culprits.

The top 1% earners in a strong bull market are always going to be people who have successfully used leverage and paper to expose themselves to those areas which have gone up.

If they weren’t sucessful, they’d be in another quintile. The bottom quintile are people who are probably not working fully time. THe mid quintiles are people who earn money from W-2 earned income. Their income is going to rise slightly- cost of living increases.

Comparing the top 1% in a bull market will always show so called income disparity.

When you don’t get income disparity when comparing the top 1% watch out. Something is really wrong with the economy then.

Too bad my life has been deemed bullshit. With AGI way over the top “fifth”, I do not qualify for any tax rebate, but consumption is around $13,000/person. I have a Y2001 cell phone, have not had a vacation in 5 years, we can’t afford a flat screen TV, my car is 2006. Apparently, I’m so rich I don’t need to care about when it is going to break down.

Oops. The car is 1996, and giving me shocks every time I put the key in the door.

With income disparity and consumption parity, you either need savings or a mountain of debt to create that consumption parity. And since we have one of the lowest savings rates on the planet…………

This is why I like The Big Picture so much. I read the article in NYT and was skeptical of the rosy conclusions, but couldn’t figure out why. Thanks again Barry. You’re a good guy.

This was great. Mind you that Greg Mankiw put this Hackonomics piece on his blog sine comment as if were something decent. I wonder if Greg has read Krugman’s takedown or your post?

The NYT op-ed seems to have been weak but the relative equality of consumption (vs income or wealth) is an interesting issue that’s worth exploring.

Unfortunately, the comments section of your blog is becoming an unreadable vat of stupidity. You may want to start deleting some of the sillier posts.

Don,

Yes you can live day to day on 60,000. That is not the point. But at some point you have to stop working (aka retirement). I know only pussies stop working a real man works until he dies at his desk. My argument is that the younger generation doesn’t have enough to save. Like I said before even making 60,000 (in a major city) these days is barely month to month living, no savings, no retirement. The problem is that there are no company retirement plans no post employment health insurance anymore. Do you know how much you need to save for a decent inflation protected retirement? Try between 1- 2 million. You show me how a kid 28-29 who wants to start a family that can save that kind of money. Someone earlier made the great point that real income hasn’t grown much, very true. I remember to when I was a govt. analyst. We got 3.3% cola raise per year. Meanwhile our INS premiums went up like 7%. Economies and middle classes are built on strong foreign demand or cheap inputs (labor, materials). Our own economy grew after WWII because we were really the only country left who had manufacturing capabilities. Now foreign demand is met with cheap goods made with cheap labor. That is the key to everything.

Yes life now is easier then ever. Across the board people have more then ever. The problem is this isn’t sustainable. Consumers can’t keep supporting debt loads because eventually they have to stop working. No cash flow no debt service.

This whole current lifestyle is predicated on cheap capital. What is interesting is when this capital starts to shrink. AkA when the largest generation world wide the baby boomers start to retire and draw down there savings. This means interest rates rise and an economy fueled by debt dries up. Or maybe (as seen currently) sovereign wealth funds step and our whole economy is propped up by the capital supplied by oil exporting nations. Hmm that will be the day.

I am a bit confused as to why income inequality is most appropriately measured as 99.5% against 0.5% or 99.99% against 0.01%.

We know there are a small number of massively rich people. Does this small group create massive public angst about income inequality?

When I hear income inequality, I don’t think of Bill Gates or the CEO’s for Fortune 100 companies making 5 million a year. I think about lawyers, docters, specialized engineers, people in the top 20% of income and how they compare to people in the lower rungs. Am I wrong or isn’t that how other people look at it too? If there are a few people you aren’t aware of who fly off to exotic locations to drink $500.00 a glass wine on their $20,000 an hour yacht is that who people get upset about? Are these people even on people’s radar?

It seems to me the people who create the concern are the 20% who would be so much better off that many on the lower rungs feel like they are somehow being left out or taken advantage of because they see everything this 20% has that they have no means to achieve.

And I think the point was that for most all of the 20% except the very few at the very top of it, you will clearly see they have more money and so they have a nicer car and a better house but for the most part they are not living so large that people think its some kind of gross fleecing of the rest of the working people to support them.

Everyone seems to kind of understand that there is this small group of the super rich that live a priveledged life and it makes most everyone sick but they know these people have always existed and generally most people don’t want to be them anyway because they see their lives as totally superficial. Now if that group grew to 20% of the population who could live so far above everyone else then you would have your revolution.

So I guess my question is why is the top 0.5% and their vastly disproportionate incomes so important to the income disparity argument?

Yo DarkOne,

First, please explain your distinction between “mean” and “average.”

Second, you have not addressed the fact that Ritholtz’s criticism is incoherent. The average income of the top quintile will be higher than the median income of same, simple fact. The averaging process does not hide or distort anything here. There is no legitimate argument against computing and interpreting this statistic.

I am all in favor of economic freedom and wealth creation.

But the problem is a lot—probably most—of the wealth at the top is accrued economic rents.

Nice job but a possible bit of confusion on one set of numbers. You sited “the top 2.5% — over 7,000,000 households” with net worth between $ 1 million and $ 10 million. Dividing 7 million households by .025 yields a U.S. household universe of 280,000,000. This is clearly too large a number as it roughly approximates todays US population. 110-115 million is probably a much closer estimate of the number of households. So it is possible that 7,000,000 households have the requisite net worth constituting about 6.3% of households or that 2.5% of households have the requisite net worth, comprising 2,750,000 households or even that 7,000,000 people live in the 2.5% of households with the requisite net worth. Same pieces of arithmetic hold for the other thresholds, of course. Anybody know?

Nice job but a possible bit of confusion on one set of numbers. You sited “the top 2.5% — over 7,000,000 households” with net worth between $ 1 million and $ 10 million. Dividing 7 million households by .025 yields a U.S. household universe of 280,000,000. This is clearly too large a number as it roughly approximates todays US population. 110-115 million is probably a much closer estimate of the number of households. So it is possible that 7,000,000 households have the requisite net worth constituting about 6.3% of households or that 2.5% of households have the requisite net worth, comprising 2,750,000 households or even that 7,000,000 people live in the 2.5% of households with the requisite net worth. Same pieces of arithmetic hold for the other thresholds, of course. Anybody know?

Nice job but a possible bit of confusion on one set of numbers. You sited “the top 2.5% — over 7,000,000 households” with net worth between $ 1 million and $ 10 million. Dividing 7 million households by .025 yields a U.S. household universe of 280,000,000. This is clearly too large a number as it roughly approximates todays US population. 110-115 million is probably a much closer estimate of the number of households. So it is possible that 7,000,000 households have the requisite net worth constituting about 6.3% of households or that 2.5% of households have the requisite net worth, comprising 2,750,000 households or even that 7,000,000 people live in the 2.5% of households with the requisite net worth. Same pieces of arithmetic hold for the other thresholds, of course. Anybody know?

“I am all in favor of economic freedom and wealth creation.”

Sure you are bucko, only an idiot would suspect otherwise

Hackonomics, Part II

A quick follow up to last week’s Hackonomics discussion, where we looked at how little alleged wealth inequality there is in America. Part of our critique was that dividing the US into quintiles was a variation of the median/average error, and only ser…

“There are three kinds of lies: lies, damned lies, and statistics.” — Benjamin Disraeli

This is insanely helpful. This article was incredibly frustrating to me, and I couldn’t articulate why.

I’m in healthcare, not macroecnomics and alarm bells went off for me because the analysis was clearly not capturing health care spending. For most families, this is a pretty significant cost (whether they’re aware of it or not)–even more so when averaged rather than reported as a median. At an average policy cost of $10,000-$12,000 annually for a family, there’s no way these numbers of $900-$4,000 made any sense, especially at the $150+ end of the income distribution, where nearly everyone is insured. Any methodology that excluded such an enormous household cost can’t be valid even if one agrees that we are what we spend. It also totally hid the fact that a lot of families in those two bottom quntiles were spending nothing on healthcare, because they were uninsured. Although, obviously, this was by design.

Also, did the “taxes” column include property taxes? Because if it did, I don’t understand how something that’s dependent on housing in the “consumption” category can be correctly categorized as “non-consumption” spending.

Thanks for explaining the math to those of us who were shaking our heads and saying “these numbers do not add up.”

The bottom line: we have entered the age of “neo-feudalism”.