Looking for the Bear in the Bull Market

It isn’t always easy to tell when we’re in a short-term cyclical stock market or long-term secular market.

Bloomberg, March 20, 2015,

When discussing bull and bear markets, it sometimes helps to think of them as coming in two distinct flavors: Short-term cyclical markets and long-term secular ones. Knowing one from the other isn’t always easy.

A number of veteran market observers such as Raymond James’s Jeffrey Saut, technician Ralph Acampora, strategist Laszlo Birinyi and market historians Jeff and Yale Hirsch have made the argument that U.S. markets in 2013 entered a new secular bull market, much like the one that began in 1982. The 1982 secular bull market was preceded and followed by secular bear markets that featured lots of sharp rallies and sell offs, but netted investors nothing after more than a decade. Long-term secular markets tend to be driven by earnings, valuations and trend.

Others, such as Steve Leuthold of Leuthold Weeden Capital Management or Joseph Calhoun of Alhambra Investment Partners, disagree. They either find the data inconclusive if this is a secular market of any kind, or believe valuations don’t suggest typical secular-market returns. In other words, the stock-market gains since 2009 might represent nothing more than a big cyclical bull-market

rally.

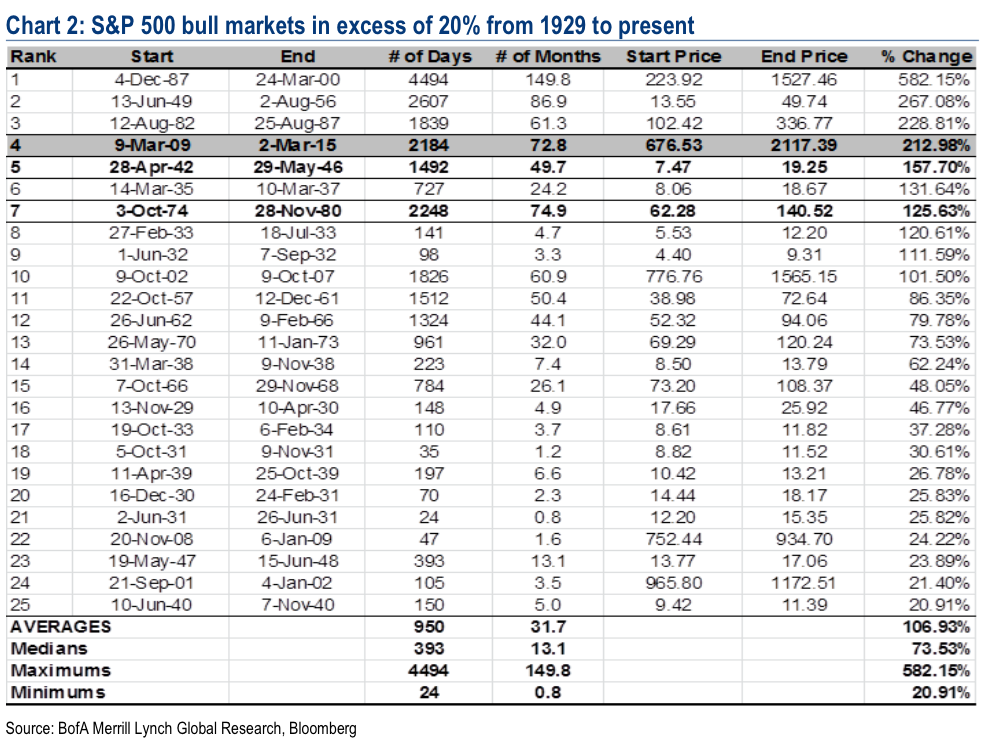

Cyclical markets, which often follow the business cycle, are shorter in duration and can move in opposition to the broader trend. They are driven by a variety of forces, but we very often see technical indicators, investor sentiment and Federal Reserve policy as crucial influences. BofA Merrill Lynch Global Research defines a cyclical bull market as “a rally of at least 20% without a 20% correction using daily closing basis S&P 500 data.”

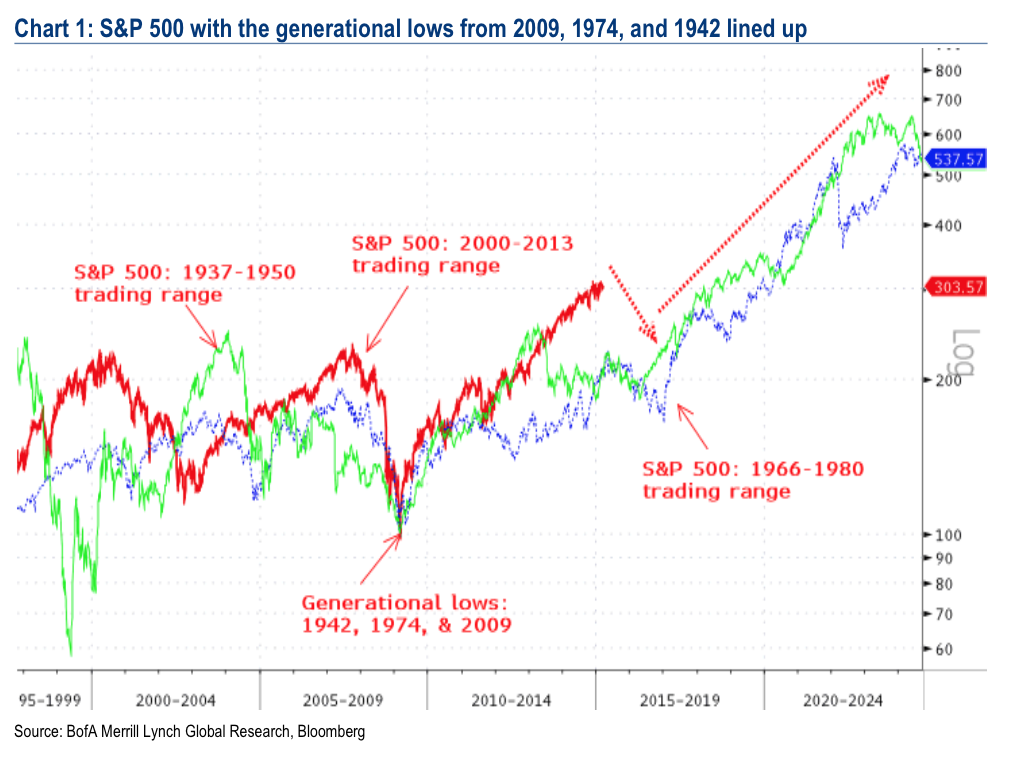

Stephen Suttmeier of BofA Merrill Lynch likes to line up the generational lows (1942, 1974, and 2009) as a way to compare secular markets across history. As you can see in the chart below, looking at markets this way suggests we are still “within the early innings of the SECULAR bull market signaled on the April 2013 breakout in the S&P 500,” Suttmeir wrote in a research note to clients this week. (Emphasis in original.)

Suttmeier does see a risk of a cyclical bear market, though one that is short and relatively shallow. The average cyclical bear market going back to 1929, according to Suttmeier, lasts 10 months and leads to a decline of 35.4 percent. However, these shorter cyclical bear markets tend to be less severe during secular bull markets. In other words, if we experience a modest bear-market cycle this year within the longer bull market he wouldn’t be surprised.

(Corrects third paragraph of column published March 20 to cite Douglas Ramsey, chief investment officer of Leuthold Weeden, not Steven Leuthold, who has retired.)

Originally: Looking for the Bear in the Bull Market

I’m inclined toward the secular bull camp. As long as the fed doesn’t tighten too much, really spiking the dollar, we could see strong equity markets worldwide for some time. Social media, which I regard as an increasingly fast feedback loop, may suffer a shakeout at some point, but I’m not sure that most people care anymore about what used to be called privacy, and the companies seem to be adapting and expanding their reach in ways that may not make them as vulnerable as they may appear to an older generation of investors.

This is a great topic. I try and think about the structural and cultural components that would produce a bull or bear.

In my view we are in a cycle Bull market. This market may be a bit over valued at the moment, but it is still a Bull. Companies and the government are relatively lean, balance sheets are strong, and the disruption created by internet technologies is largely complete. Companies are going to work their people hard. People are going expect the government to function without significantly raising taxes. These are the seeds for market success. In my view I think that companies will turn profits for some time so provided we do not find our way into another war things look pretty good for those who want to work or have capital.

– I am firmly in the “Cyclical Bull Market” camp. To see that one has to go back in time. In that regard the past is an excellent guide to see what’s in store for the future.