From Torsten Sløk:

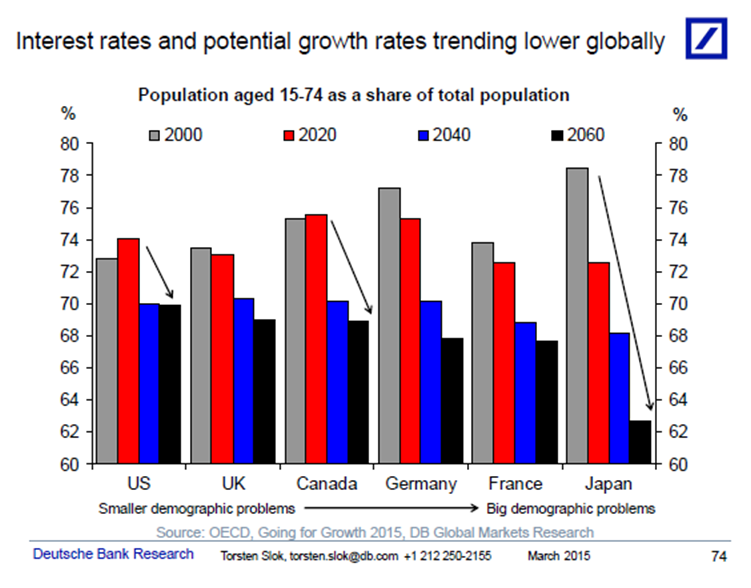

Demographic developments are putting downward pressure on interest rates globally. But it is important to remember that the trend seen in the chart below is structural and very slow moving. Around this long term trend we have the business cycle, which is driven by positive and negative changes in confidence. In other words, we have a structural trend and around that trend we have periods where consumers and companies are optimistic about the future and periods where consumers and companies are pessimistic about the future. When consumers and companies are pessimistic they hold back spending and in response the Fed tries to bring back optimism. This is exactly what has happened since 2009 and we have now finally entered a situation where consumers and companies are optimistic about the future again. In response, the Fed will begin to hike rates this summer and this will put upward pressure on interest rates and the Fed will continue to raise rates until they have managed to dampen optimism about the future to make sure that the economy doesn’t overheat. The bottom line is that demographic trends are important as a long-term driver of growth and rates but over the coming 2-3 years stock markets, interest rates, and exchange rates will not be driven by the long-term trend seen in the chart below but by the optimism we currently are seeing among consumers and companies and how well the Fed is able to prevent the economy from overheating.

Global demographic trend omits ChIndia?

Its important to keep in mind that the US and Canada can adjust population relatively easily through immigration. UK has a more limited capability to do that while the other countries have relatively rigid identities built into the their cultures and find full absorption of immigrants difficult.

China, India, Africa excluded? I saw an expert predicting that African population will increase by a factor of 2-4 in the next 35 or so years.