Source: WSJ

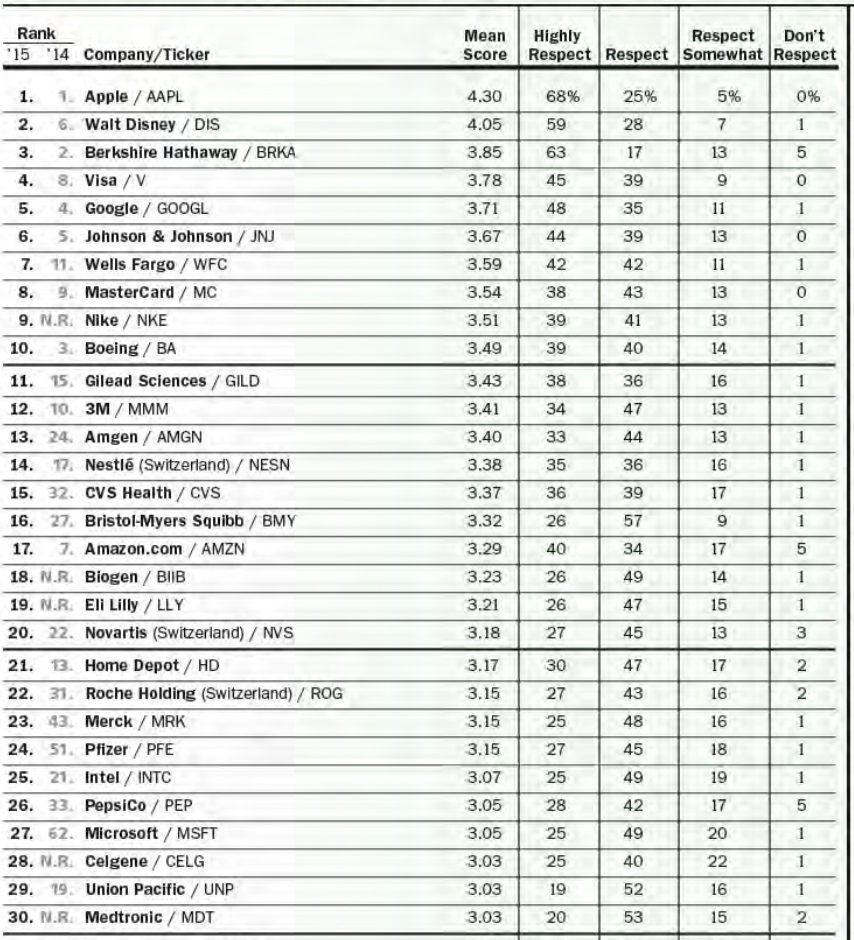

The World’s Most Respected Companies

July 1, 2015 12:30pm by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Posted Under

Previous Post

Gold Can't Find a BidNext Post

Trends in Groundwater Storage from NASA

And in what way is respect measured?

What factors are contributing to the “score”?

~~~

ADMIN: “We asked investors how much – or how little – they respect each of the world’s largest publicly traded companies”

Interesting overlap of names on this list with those on another list . . .

“Eight of the biggest U.S. technology companies added a combined $69 billion to their stockpiled offshore profits over the past year, even as some corporations in other industries felt pressure to bring cash back home.

Microsoft Corp., Apple Inc., Google Inc. and five other tech firms now account for more than a fifth of the $2.10 trillion in profits that U.S. companies are holding overseas, according to a Bloomberg News review of the securities filings of 304 corporations. The total amount held outside the U.S. by the companies was up 8 percent from the previous year, though 58 companies reported smaller stockpiles.

The money pileup, reflecting companies’ incentives to park profits in low-tax countries, has drawn the attention of President Barack Obama and U.S. lawmakers, who see a chance to tap the funds for spending programs and to revamp the tax code. That effort is stalled in Washington, and there are few signs that tech companies will bring the profits back to the U.S. until Congress gives them an incentive or a mandate.

‘It just makes no sense to repatriate, pay a substantial tax on it,” said Joseph Kennedy, a senior fellow at the Information Technology and Innovation Foundation, a policy-research group whose board of directors includes executives from Microsoft and Oracle Corp. “Computing and IT companies especially have a lot of flexibility in where they declare their profits.'”

See list on link . . .

http://www.bloomberg.com/news/articles/2015-03-04/u-s-companies-are-stashing-2-1-trillion-overseas-to-avoid-taxes

Boeing?

“Admired”?

After what they did with the 787?

Truly a 21stC datapoint. Egads!

… it strikes me that a fund manager could build a rock-em, sock-em ETF out of this list of 30 companies, with half the dollar holdings being equal dollar amounts of the first 10 on the list, and a third of the dollar holdings being equal dollar amounts of the next 10, and the last 10 having a sixth of the dollar holdings spread equally across those stocks … while there are some slackers in the list, the capacity for heavy lifting from the bulk of these companies is impressive …

… being respected is a pretty strong representation of value in nearly all areas of society …