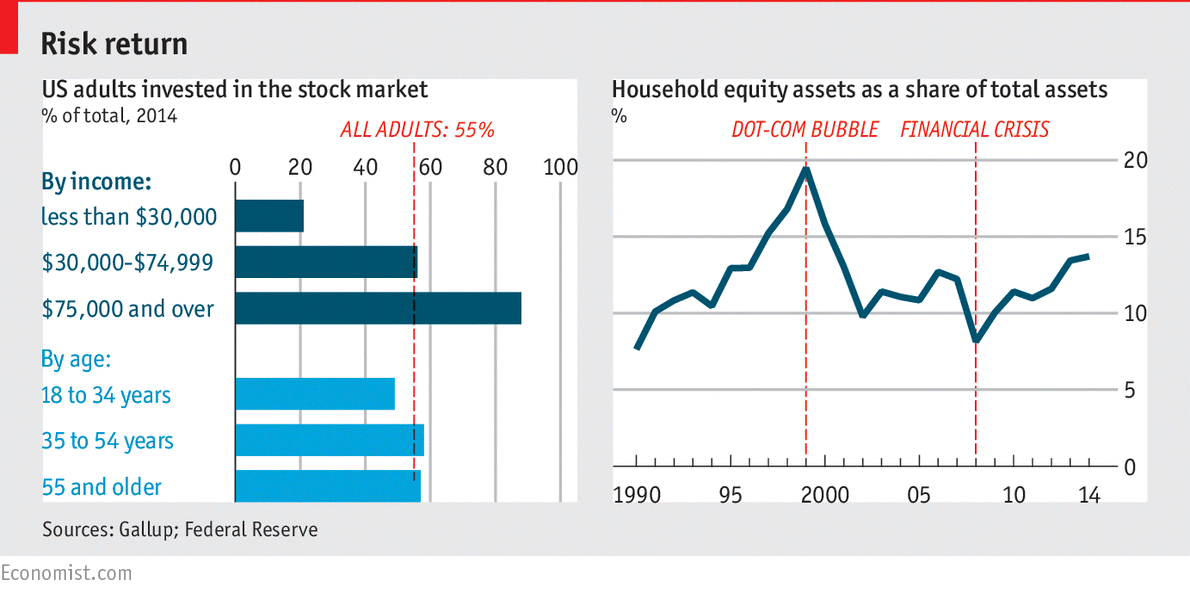

This is fascinating look at how exposed the average American household is to the equity markets. On average, about 55% of adults have equity exposure, and it amounts to less than 15% of their total assets.

I’d wager that is a very top heavy distribution both in percentage and asset size.

Source: The Economist

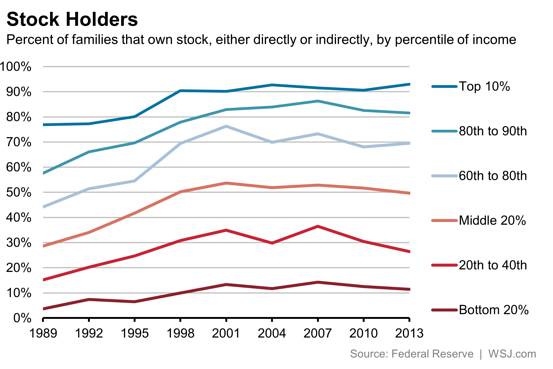

UPDATE: Distribution of equity holders by wealth decile

Mauka points us to this chart via Real Time Economics:

You may find this data interesting as well:

http://blogs.wsj.com/economics/2015/08/24/what-market-swings-like-todays-dow-crash-mean-for-inequality/

Edward Wolff at NYU did a set of estimates about stock ownership back in 2010.

1% of Americans own 35% of all public equities.

5% approximately 67% of equities

10% about 80%.

While the distribution of ownership is fairly broad in the United States, the consequential distribution is rather narrow. Americans who pay any attention to the stock market are generally clueless about ownership, outside of vague ideas about some notable investors and entities like hedge funds (which most associate with the BBB’s – billionaire bad boys – club).

One of the ironies about all this is, that while 5% of the public own two-thirds of the stock market, overall, that seemingly vast ownership is the smaller part of their net assets.

SecondLook, do those figures include 401K’s and IRA’s? If so, it would seem that the American worker has no retirement provision other than Social Security, which both political parties are determined to cut.

I believe the data about equity ownership includes all accounts types, including various retirement ones.

However, you have to be careful about the angst being pushed out – not surprisingly mostly by financial services professionals – in regards to how bad the American population is in terms of having enough assets through their final, non-working, days.

For example, when you see numbers about how little net assets American households have, those figures don’t tell you that they are averages with a range from people just entering the workforce to those about to leave, or have already left. In other words, surprise surprise, the older the household, the greater amount of net worth they have, whether home equity or other real estate, various stock and bond investments, and even nowadays some not trivial cash or cash equivalents.

More objective studies indicate that the near-retirement cohort, those with a decade of taking SS (a typical benchmark), are actually going to do reasonably well – with the obvious caveat that SS stays a major supplement during their final decades.

What I think is more salient, and what I suspect a lot of people who read blogs like this might not want to really accept, is that stock market largely owned by an elite class of families. Just as major public corporations are largely controlled by another, overlapping, elite class of senior managers.

Ne plus change and all that jazz…