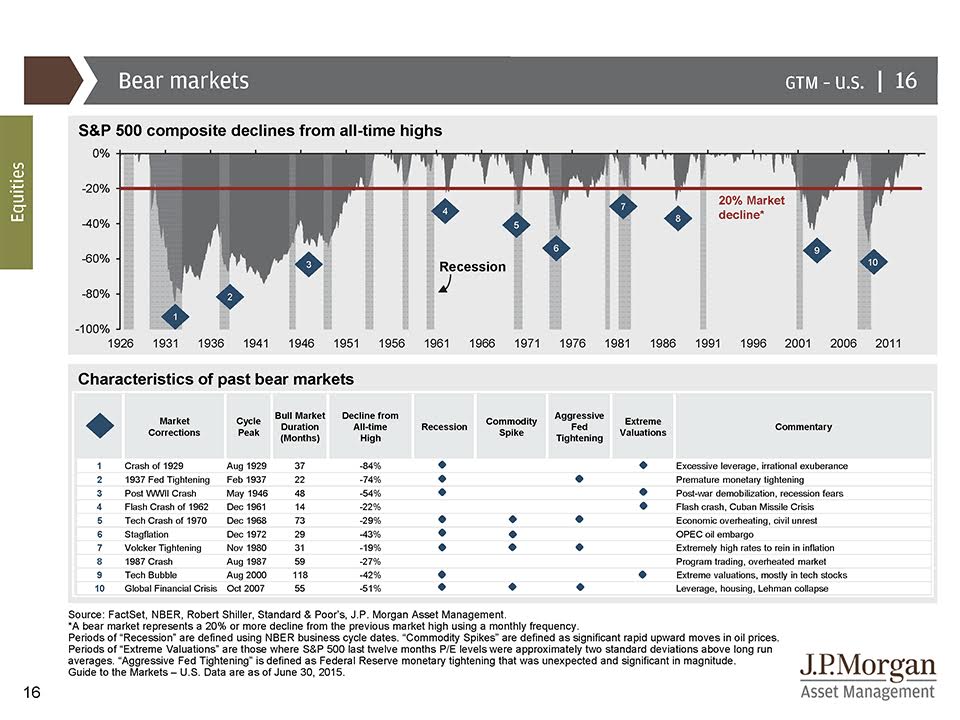

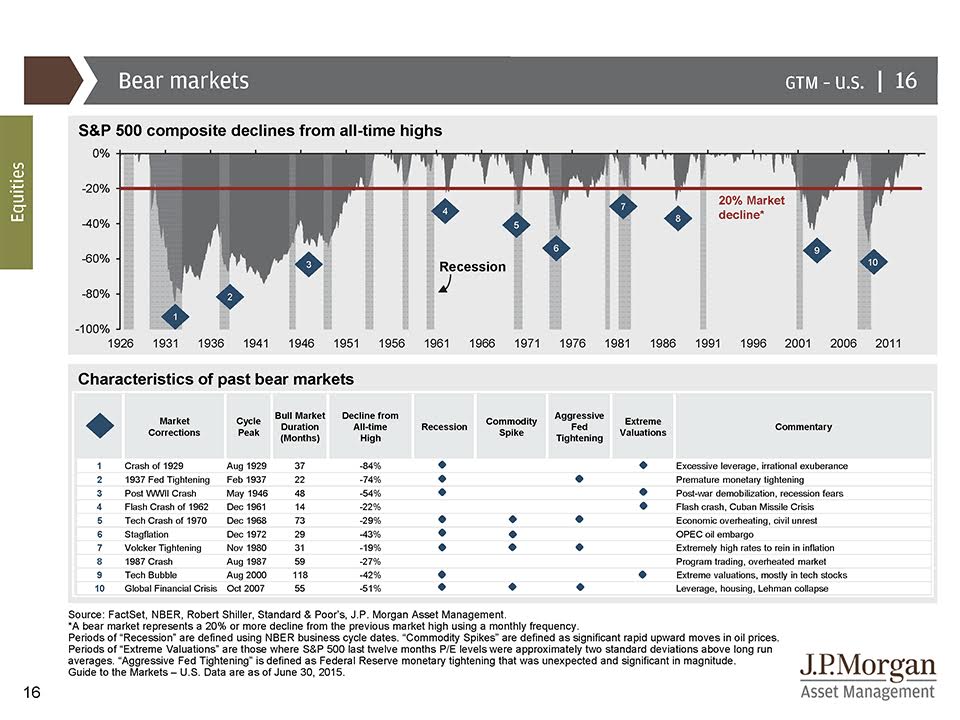

Today is as good a day as any to show this chart from my favorite quarterly slide deck:

click for ginormous graphic

Source: JP Morgan

August 11, 2015 1:00pm by Barry Ritholtz

Today is as good a day as any to show this chart from my favorite quarterly slide deck:

click for ginormous graphic

Source: JP Morgan

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

Interesting they don’t list “Extreme Valuation” as a cause for the 2007 Financial Crisis bear market. The reason that stocks “only” fell 42% in the 2000 crash was because much of the S&P 500 was not significantly over-valued and value funds were almost untouched by that bear market while the NASDAQ did an 80% swan dive. However, everything had gone up a lot by 2007 and everything went down a lot in 2008-2009 which is why the stock market dropped 52%. Most valuation measures were among some of the highest peaks for those measures in the past century in 2007, as they are today.

http://www.advisorperspectives.com/dshort/updates/Market-Valuation-Overview.php

Valuations are intellectual creations. They are not always right.

I suppose the point here is that there is a huge correlation with bear markets occurring only from recessions, and since have not been in a recession for a while (since spring of 2009 – although perhaps a touch of depression lingers on), this current volatility should not be construed as indicating the onset of a bear market.

Unless it happens to unfold that way.

Pretty cool chart. I’m really shocked that the tech bubble and financial crisis look so similar given how much worse the latter was on the real economy.

rd’s comment addresses this — the dot-com bubble represented only a tiny slice of companies and a relatively few people, while the housing/mortgage market impacted millions.

Or put another way, the stock market and the economy are only very loosely connected.

If the “we were never wrong” clowns were only running for POTUS it would be bad enough but to actually have them running congress, the supreme court and certain Fed banks too, well …it’s just downright disheartening.

If It’s A Day Ending in ‘Y’

Charles Plosser wants the Fed to raise interest rates.

We could have another recession any time and boneheaded policy could make it worse any time.