Source: Bianco Research

“Its enough to give a long-term investor some hope for the future of finance.”

Here’s a bit of role reversal for you: Mom and Pop were content to ride out the market’s volatility this past month, more or less sitting tight. Meanwhile, the pros were driven to the point of near panic.

What was all the fuss about? Take your pick. Perhaps the China slowdown will cause a global recession. Maybe the Federal Reserve is going to raise rates and kill the bull market. Oil prices might fall too far, destroying emerging markets. Or the U.S. economy is about to go belly-up.

Whatever the fear was, someone was there to give it voice. The downside of the Twitter era is that everyone has a megaphone, and any lack of wisdom of insight is no a deterrent to broadcasting it. This month, that described Wall Street and not Main Street. It was the pros who lost it.

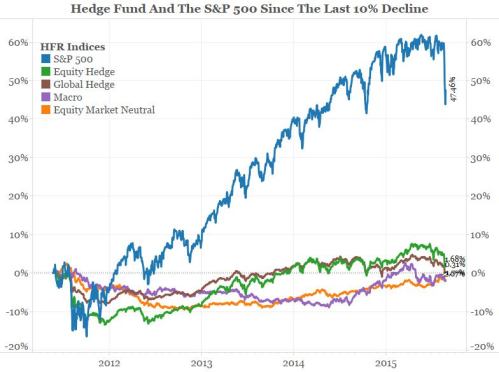

Start with hedge funds. After missing a generational rally in which the Standard & Poor’s 500 Index tripled, hedge funds finally began going long U.S. equities — just before the China trap door swung open. TheWall Street Journal reported that many funds got shellacked this month, giving up all of their year-to-date gains in a week. Bridgewater, Omega, Third Point and Pershing Square all took a beating, but only Omega seemed to be positioned to capture the bounce-back rally (note that I am not objective, as you can hear in my Masters in Business podcast with Omega founder Leon Cooperman).

Beyond the hedge funds, the algorithmic traders seemed to have run amok as well. It is a natural human response, to borrow from Daniel Kahneman’s book “Thinking, Fast and Slow,” to react emotionally first and logically second. However, no one can think faster than a machine, and the algos managed to engage in some very fast, and what looked like emotionally driven trading. As we saw this week, that sort of behavior was amply punished. My colleague Josh Brown summed it up in a post, “Computers are the new Dumb Money:

You want the box score on this latest weekly battle in the stock market?

No problem: Humans 1, Machines 0

Because if you think it was human beings executing sales of Starbucks (SBUX) down 22% on Monday’s open, you’re dreaming. And if you believe that it was thinking, sentient people blowing out of Vanguard’s Dividend Appreciation ETF (VIG) at a one-day loss of 26% at 9:30 am, you’ve got another thing coming.

Sometimes instantaneous is too fast; occasionally the best thing to do is absolutely nothing. As Gillian Tett of the Financial Times noted, computers have come to dominate the trading volume of stock exchanges:

Orders are being executed at lightning speeds in huge volumes. But there is another, often overlooked implication: these machines are being programmed to link numerous market segments together into trading strategies. So when computer programs cannot buy or sell assets in one segment of the market, they will rush into another, hunting for liquidity.

All this is part of a long series of adaptations by Main Street investors to the newest new thing, and the countermoves by the (alleged) pros. In response to this, Mom and Pop have wised up: they trade less and invest more. They are tuning out more of the noise, sending CNBC ratings to record lows. They are eschewing stock pickers, and embracing index and exchange-traded funds. They have figured out that the way you beat high-frequency trading is with low-frequency investing.

Speaking of which, the new dumb money got scalded by ETFs. Although U.S. equities as a whole never fell more than 6 percent, there were widely held ETFs that temporarily lost one third of their value.

Ben Carlson described this as the ETF flash crash:

In the early minutes of the stock market open on Monday morning things got a little crazy. After a huge whoosh down in overnight futures trading, the NASDAQ fell almost 9% while the S&P 500 was down around 6% right after the opening bell. Watching it in real time was a sight to behold. Less than 15 minutes later, a huge chunk of those losses were recovered. Many individual stocks saw even larger moves.

Mom and Pop outwitting high-frequency traders; hedge funds being beaten by Main Street. It’s enough to give a long-term investor some hope for the future of finance.

Originally published here: Mom and Pop Outsmart Wall Street Pros

Well I panicked and rebalanced after we hit that 10% down (from the top). Now it looks like we may hit that 12.5% upside (from the low) that will force me to rebalance in the other direction. If my calculator keeps throwing me back and forth like that, I may have to get me one of those fancy million dollar computers that the hedgies have.

Pop.

Good God. That rebalancing means you are selling high and buying low. That will NOT be acceptable in the modern world of hedge fund management.

You need to look at those guys fly fishing together to prove that you need to help to buy and sell at the wrong time!

Looking at a simple re-balancing is BORING!

What about TAXES! You don’t want to pay TAXES on those Gains to further Obama’s agenda!

If 10% is your trigger then you didn’t panic. You stuck with your plan. I did worse. Due to my failing eyesight (or maybe I was too tired) I inadvertently rebalanced my S&P 500 fund into the Money Market fund, that’s 50% of my portfolio, when 1% was supposed to go to small-cap fund. Then the small cap fund hit the 10% down trigger and sold. At least it sold on a rising day, not at rock bottom. So I took a big hit just doing my monthly rebalance and my tolerance trigger. Wouldn’t even be screwing with it if bonds paid a decent rate.

The combination of 401ks and Target Date funds are probably creating a revolution in investing behavior. The office I work in has 100+ people. Not one has a degree or background in accounting or finance but nearly all are college educated. Based on my discussions with some people over the past couple of years, more and more of them have shifted their 401k investments into TD mutual funds . Nobody was talking about the stock market at work in the past two weeks. It is likely that most people haven’t even looked at their 401k accounts over the past couple of weeks (I did once last weekend).

I think we are quickly moving into an environment where the small investors can have a high percentage of their financial assets in relatively low cost, well-diversified investments with good growth potential over time, and most importantly are “fire-and-forget” requiring very little effort on their part and essentially no active involvement in transactions.

So I think that we may be solving the behavioral problem during the accumulation phase so that people can really just focus on how much they need to save from their paycheck. What I am seeing is that the sharks are coming out when people are getting near retirement with a focus on getting those rational investments into their hands where they can start piling on fees while providing “advice”. Most of the college-educated folks in my office have no idea that their “advisors” they have on the side for IRAs do not have to meet a fiduciary standard or that there is a battle between the Obama Administration and the financial industry over this. Many people don’t know what being a fiduciary means.

The next big frontier for small investors is probably asset allocation during retirement and withdrawal strategies to match with Social Security etc. That is where the main predator-prey relationships will be occurring in the coming decades.

Buffettization of America.

And all the sound of fury of the “technicians” “indicators” signify nothing.

TIAA-CREF raised their expense ratios on funds in IRAs a few months ago, and I finally got around to moving my IRA to someplace cheaper. Here is the time line:

I called on Monday 8/17 to arrange the transfer.

TIAA cut the check at 9 AM on Tuesday 8/18, so I missed out on the bloodbath for the rest of the week.

The check from TIAA got to the new place on Monday 9/24, but I couldn’t access the money. Missed another bloodbath.

On Tuesday morning I was irritated because the market was bouncing back so much, so I called and they talked me through getting the money into a stock account. I put it into a mutual fund and the transaction wouldn’t clear until after the market closed. I would still be getting shares at a 10% discount from what I sold them for the week before, so I didn’t mind losing a few percentage points of totally undeserved gain. Of course the market cratered again Tuesday afternoon and was down another couple of percentage points when they processed the transaction.

Putting my retirement savings into a low overhead index fund has certainly worked for me.

My Ameritrade software has a feature for panic times. It froze and let me blind. No vision, no movement. TA DAAA! or maybe TDamtd on ice….

Missed buying the dip, did NOT miss the run back up…..

I woulda backed up the truck and bought, except I happened to be abroad at the time, and slept through the whole thing. I did happen to have mostly by accident, several limit orders in place at prices below the lowest support levels, and a couple of those managed to trigger, so I woke up to find I had acquired a couple of high quality positions at bargain-basement prices. Nevertheless, overall I feel I missed a rare opportunity. So now I have learned to deliberately have some cash stashed in high-quality, low-price limit orders because it is impossible to time the market.

Be assured: this WILL happen again.

Just be patient for the guys who want to be on TV (and in Trump’s cabinet) to get margined out.

It may happen Monday, or after the next Fed meeting, or before it, or not until next year but you WILL get another chance. Be patient. Wait… wait in the weeds.