@TBPInvictus here.

In July 2012, Kansas Governor Sam Brownback penned an op-ed titled “Tax Cuts Needed to Grow Economy” in the Wichita Eagle. This was to be an experiment in supply side, trickle down economics; Kansas was to be the petri dish:

“Our new pro-growth tax policy will be like a shot of adrenaline into the heart of the Kansas economy. It will pave the way to the creation of tens of thousands of new jobs, bring tens of thousands of people to Kansas, and help make our state the best place in America to start and grow a small business. It will leave more than a billion dollars in the hands of Kansans. An expanding economy and growing population will directly benefit our schools and local governments.”

So, four years later, how’s it going? Well, it’s going so poorly – Kansas is such a shit show – that as of June 8, the state’s Department of Revenue had failed to even post the previous month’s woeful numbers, which are usually up by the second of the month:

Response to an inquiry, which did include a press release, was that “it looks like the release did not upload.” Really? Did the fact that this was one of if not THE worst press release about the dreadfully abysmal Kansas economy have anything to do with the no one “remembering” to upload it? (BR: Maybe Brownback is hiring people from the Christie administration).

But wait, there’s more! The numbers have been so bad, Kansas has been failing so miserably, that Governor Brownback wants answers! From the release:

Governor Brownback tasked Budget Director Shawn Sullivan with implementing a full, independent review with outside experts to evaluate current procedures related to revenue estimating and budgeting. The review will evaluate the existing consensus revenue estimating process to determine why it fails to provide accurate estimates for budgeting purposes, make recommendations for improving the quality of fiscal notes, and analyze existing tax policies.

Brownback seems unable to accept the possibility that his policies are an epic failure. Rather than even consider that his tax policies are “sub-optimal’ for economic growth, the Governor looks first at the procedures being used to provide estimates.

A classic case of Cognitive Dissonance writ large.

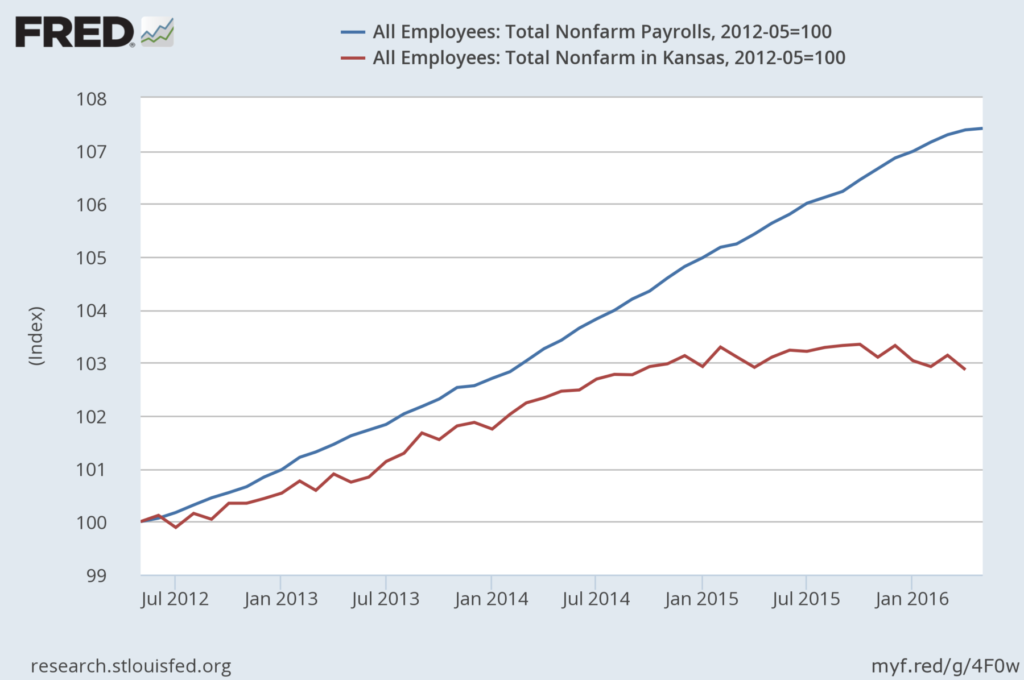

Its been four years since the Brownback plan was signed into law. The rest of the country has recovered all of the jobs lost to the great recession, and then some, creating over 10,000,000 jobs, with employment now above the pre-crisis peak. Meanwhile, over the same period, Kansas rose modestly at first and stalled out well over one year ago:

Maybe it’s not that the”procedures related to revenue estimating budgeting” suck, but instead, it’s the thoroughly debunked trickle down economics that Brownback is so enamored of that have failed.

Final thought, via the Eagle:

“Large company layoffs and struggles in the aviation, oil and agricultural industries point to an overall sluggish economy which contributed to lower-than-expected revenue receipts,” Jordan said in a statement. “This is a trend reflected throughout the region.”

Scott Drenkard, director of state projects for the Washington-based Tax Foundation, a think tank that studies tax policy, disputed that explanation.”

What's been said:

Discussions found on the web: