My Sunday Washington Post Business Section column is out. This morning, we look at what the historical data might inform us about your portfolios for 2017.

What history tells us about your investments in 2017 looks at valuation, politics, rising interest rates, why guessing games for investing are worse than useless, how to use past data for context, and why the January effect is meaningless.

Here’s an excerpt from the column:

“We do not have a crystal ball, but we can think about what might happen in 2017. The secret is to avoid playing the guessing games that are common this time of year. Instead, we can consider various crosscurrents that might affect the economy, the markets and our portfolios. We can discern important factors at work here and now, and then use historical data to provide context for it all. (No forecasts are necessary).”

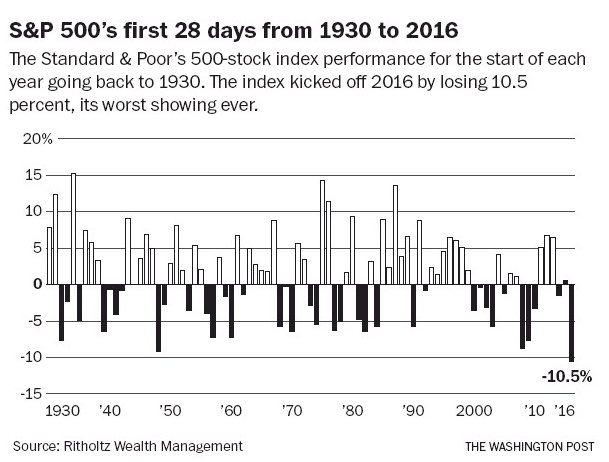

We also showed this chart noting January 2016 was the worst monthly beginning to the year ever; it was the basis of many SELL EVERYTHING calls. How did that work out?

Go read the entire column here.

Source:

What history tells us about your investments in 2017

Barry Ritholtz

Washington Post, January 1, 2017

http://wapo.st/2iDLfld