Salil Mehta is a two-time Administration executive, leading Treasury/TARP’s analytics team, as well as PBGC’s policy, research, and analysis, including their first risk analysis function. Salil is the creator of the popular free statistics blogs, Statistical Ideas.

~~~

President-elect Trump convened at his New York home, a group of America’s most illustrious technology-company CEOs (including Tim Cook, Elon Musk, and Jeff Bezos), and proceeded to present to them:

“I’m here to help you folks do well. And you’re doing well right now. And I’m very honored by the bounce. They’re all talking about the bounce. So right now everyone in this room has to like me just a little bit.”

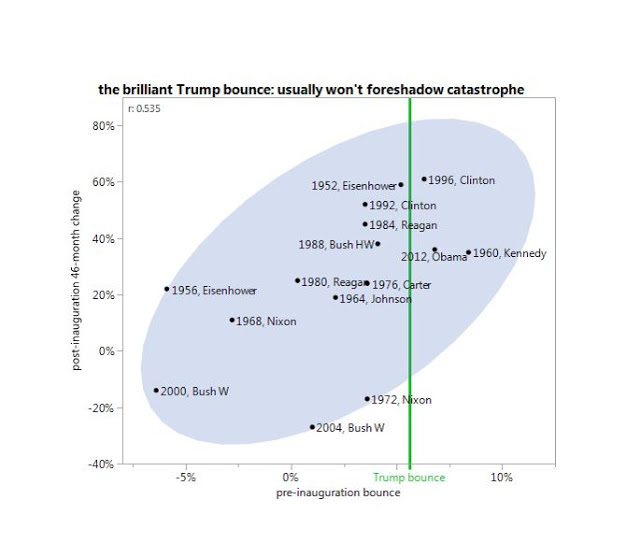

If “they’re all” pleasantly talking about the bounce, then why shouldn’t we? Despite many impotent warnings that the market would respond with a massive crash, the S&P 500 has instead charged ahead 5.6% on a continuous basis. From election, to inauguration. This bounce is the 4th best of the 17 elections on record since 1950 (the S&P 500’s birth year). So it’s fine, but not extreme. What’s perhaps even more distinct is that the market has been hushed along the way, with an average daily volatility of just 0.4% (the 2nd best on record!)

Now this combination is not only exhilarating for those invested in the markets (which we should all be), but what is even more alluring is the returns we typically enjoy from here (from inauguration, to the following election) is not as muted as mean-reversionists expect (link, link). See the vertical “post-inauguration change” axis, on the chart below, along with the bounds of the 90% confidence interval ellipse.

We should note that the irregular 2008 election was removed, as the crushing -11% “bounce” is not just to place on President Obama. It is also the worst on record! The market that year had already fallen into a chasm of the financial crisis, before President Obama even the opportunity to win the Democratic primaries. And as a result, the “post-inauguration change” we would have shown above is an un-surprising and respectable 55% (but fused together with the following 2012 term leads to a heroic 8-year market run!) We likely won’t exceed that in the coming few years, and much of this post-2008 performance was due to the smartly engineered rebound that I am other patriots in the Obama administration had worked intensely to see through (during the critical TARP bailout efforts).

The residual pattern however as shown through the shaded ellipse is forceful, with a blunt correlation of >½. We notice, per the vertical green line, that a strong bounce isn’t in any way a negative signal for the foreword 46 months before the 2020 elections! One decree is to shun being negative, as most (including mainstream media pollsters) were heading into the election. And appreciate that things may easily turn out satisfactory (even if not it is not as if anyone could accurately predict such demise a priori).

Of course many will still choose to chase for other corroborative information to suit their wants. And arguably there are many contexts one many want to consider, such as what political party was in office, did an incumbent candidate get re-elected, were we in a recession, contemporary geopolitical risks, etc. But with less than 20 elections in our historical sample, that’s simply too minor a data set, size for additional factor analysis.

So simply relish the market rise that we’ve had thusfar, and know that Monday will promise to be the start of what can be many more wonderful years. Despite the country’s partisan extremes, it pays to always be bullish on America. And do what you can to provide opportunities to one another, regardless of your station in life