If the Dow Jones Industrials finish higher today, it will be the 13 consecutive daily rise.. This will be the first time that has happened since 1987.

Laszlo Birinyi is both a strategist and an astute market historian as well. I always find his firm’s commentary, reflecting both smart data analysis and a deep historical knowledge to be worthwhile.

I keep hearing people discuss how unusual it is for the Dow to be up 12 (going on 13) days in a row. Some want to imply a crash is coming, others are more interested in the aberration. Jeffrey Yale Rubin of Birinyi Associates simply looks at the historical data, does a little “outside the box thinking” and then fills in the blanks:

“Most know that [Feb 27] marks the twelfth up day in a row for the DJIA. And as it has widely been reported the longest up stretch was thirteen days ending January 20, 1987.

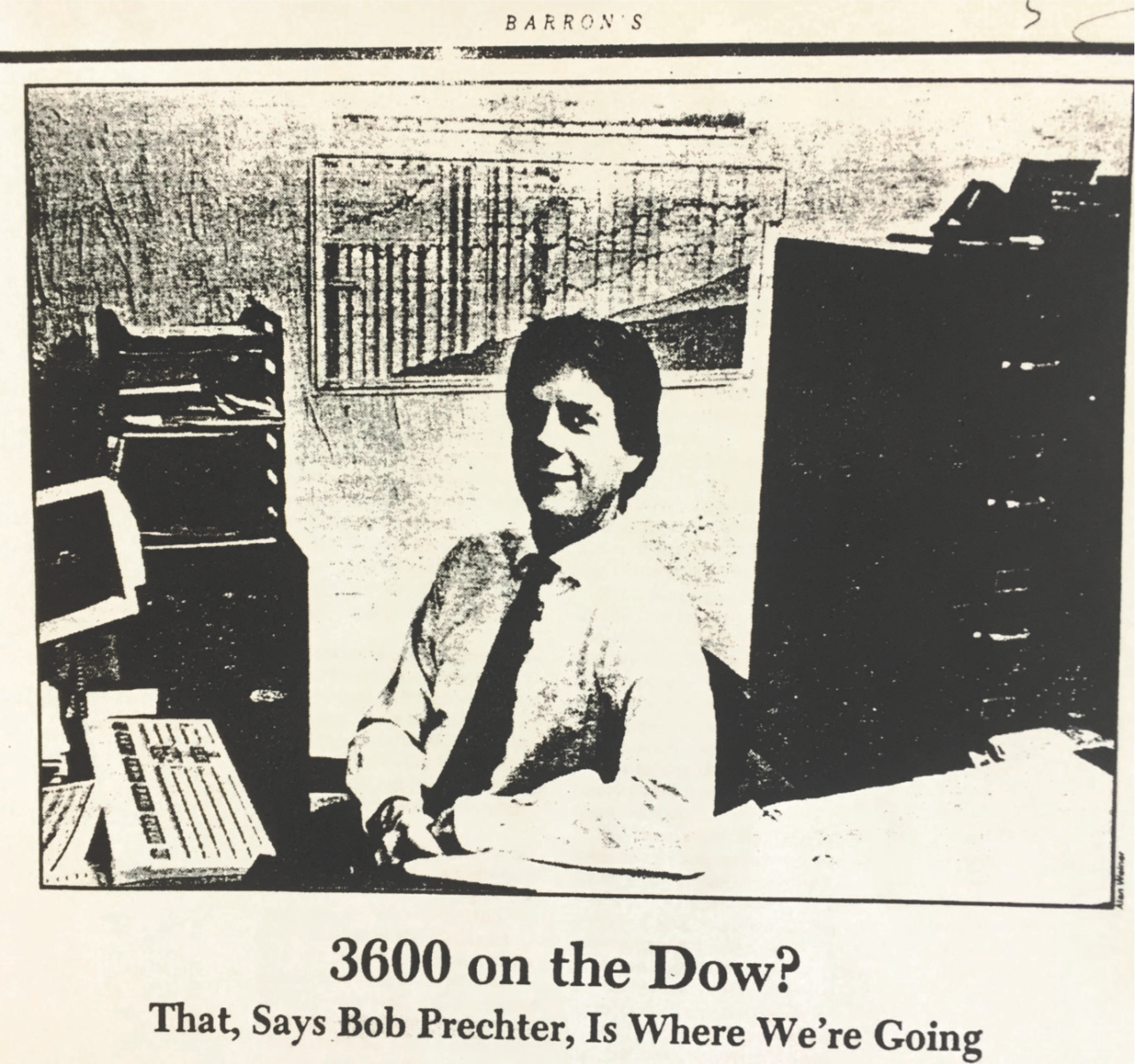

What has not been reported was why the market gained for thirteen straight days in 1987. It was not because of interest rates or earnings or talk of a tax cut but instead the gain was initiated by a long interview with Bob Prechter in Barron’s the weekend of January 3rd. (emphasis added)

Prechter was a highly respected trader, winning all manners of trading contests. An Eliot Wave analysts, he had a terrific run, like Joe Granville before him. Then he turned into something of a permabear, and his reputation as a guru slipped as the 80s and 90s market ran away from him. (I found his book Prechter’s Perspective to be a worthwhile read)

Barron’s January 3, 1987

Source: Birinyi Associates

Thats a valuable insight I suspect most of you had no idea about . . .