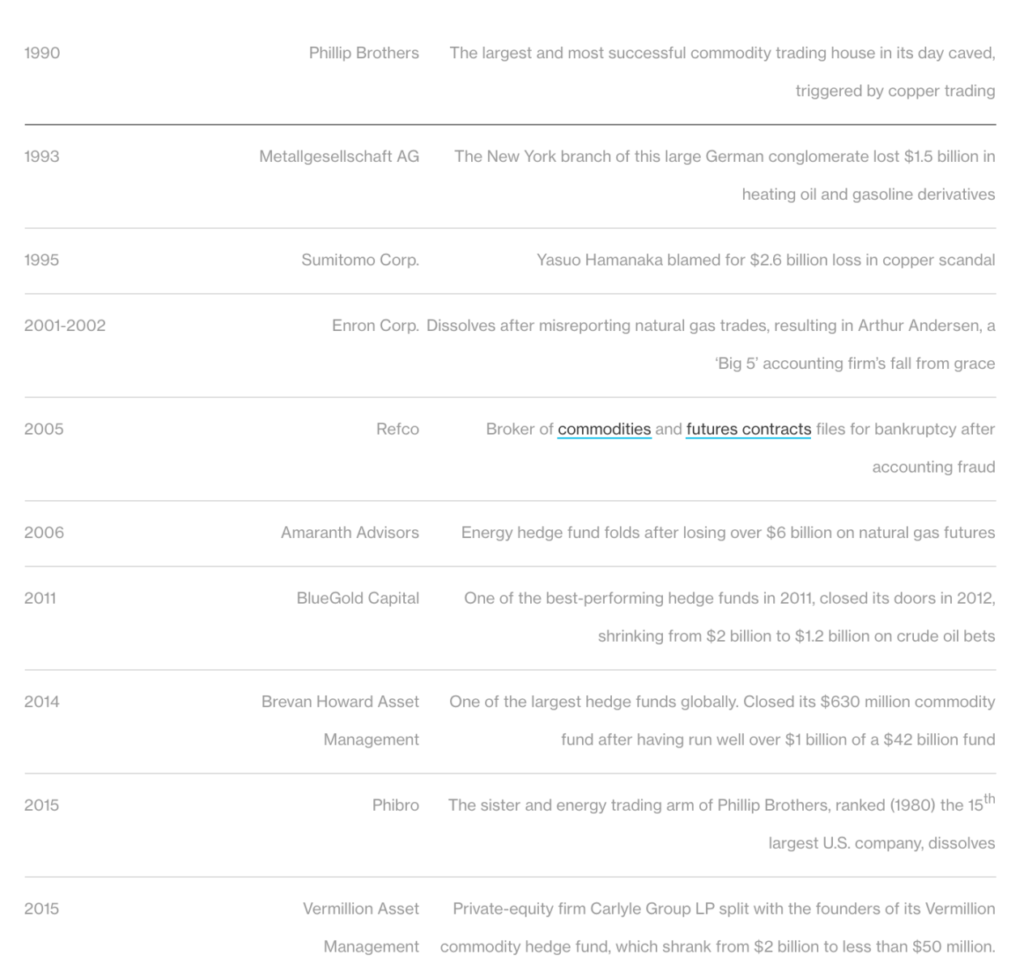

The number of trading houses has dwindled, and the institutional, pure-play commodity hedge funds that remain are few:

click for ginormous table

There is a fascinating article by Shelley Goldberg at Bloomberg Prophet discussing why commodity traders are “fleeing” the business:

“Profiting from commodity trading often requires a combination of market knowledge, luck, and most importantly, strong risk management. But the number of commodity trading houses has dwindled over the years, and the institutional, pure-play commodity hedge funds that remain — and actually make money — can be counted on two hands. (See list above of larger commodity blow-ups).

Amid the mayhem, banks held tightly to their commodity desks in the belief that there was money to be made in this dynamic sector. The trend continued until the implementation of the Volcker rule, part of the Dodd-Frank Act, which went into effect in April 2014 and disallowed short-term proprietary trading of securities, derivatives, commodity futures and options for banks’ own accounts. As a result, banks pared down their commodity desks, but maintained the business.”

Here are the 8 reasons Goldberg suggests underlie the exists:

- Low volatility

- Correlation

- Crowded trades

- Leverage

- Liquidity

- Regulation

- Cartels

- It’s downright difficult

Go read the entire thing, its quite intriguing . . .

Source:

Why Commodity Traders Are Fleeing the Business

Shelley Goldberg

Bloomberg Prophet, July 12, 2017

https://www.bloomberg.com/view/articles/2017-07-12/why-commodity-traders-are-fleeing-the-business