The Fickle Fortunes of Market Timing

Four challenges to keep in mind if you’re jumping in and out of a turbulent market.

Bloomberg September 6, 2017

Over the course of my career, I have had more than my fair share of good market calls.1 I credit a combination of hard work (6 percent), insight (4 percent) and uncanny good luck (90 percent). There’s not much to say about the 90 percent, but the other 10 is worth a closer look given yesterday’s stock selloff.

Lots of theories were floated as to why the markets reacted yesterday to things that existed the day before, but did not cause a reaction the day before. Pick from the usual parade of horribles: an increasing likelihood of military conflict between North Korea and the U.S., including the possibility of nuclear showdown; the lack of political consensus on raising the debt ceiling; the economic impact of hurricanes Harvey, Irma, Jose and whatever the next one after that is called. Maybe it was the disappointing Employment Situation report on Friday. Perhaps it was summer ending, and everyone back at their desks and lighting up out of a plethora of caution.

All or none of those could have been the reason. But I’m skeptical of assigning a “reason” to the random nature of daily market moves. Skeptical and sarcastic:

Man, this market really hates that new DACA policy . . . pic.twitter.com/0kdyyuS5RQ

— Barry Ritholtz (@ritholtz) September 5, 2017

Of course, that was a joke. The market did not suddenly feel the long-term economic impacts of suspending the Obama-era enforcement policy that protects “Dreamers” who are in the U.S. illegally. 2

Still, it points out the challenge of trying to explain day-to-day movements of markets. Therein lay one of the challenges of market timing.

There are other difficulties as well:

- Behavior: We begin with where so many things go awry for investors, namely their own inability to be rational and disciplined. To successfully jump in and out of markets, one must rely on a specific set of rules. History informs us that relying on one’s gut or intuition may result in the occasional lucky call, but it is neither reliable nor consistent. Most people tend to succumb to their own physiological responses to losing money by doing whatever to just makes the pain stop. Easy trades are rarely lucrative ones.

- Contrarian: There is a two-fold challenge to making a contrarian market call. The first is that most of the time, markets more or less get it right. Markets are kinda sorta eventually efficient. All of the various clichés you hear — “wisdoms of crowds; don’t fight the tape; the trend is your friend” — is essentially an acknowledgement that pricing is mostly rational.The second challenge is in precisely identifying when market participants have morphed from a crowd to a mob, exhibiting either extreme fear or extreme greed. But that’s what a good contrarian timer has to do.

- Every Cycle Is Different: How have the dominant elements this cycle — high-frequency trading, the rise of indexing, ultra-low rates, quantitative easing, exchange-traded funds, etc. — impacted markets? I have some ideas, but nothing I really want to wager money on. It surely would be helpful to timers to understand how these and other elements impact market moves.Don’t misunderstand what “It’s different this time” actually means: It refers to the trading error that fails to recognize human behavior is immutable and unchanging. However, market structures, investing products, firms and even trading tools do evolve and change. Don’t confuse the two.

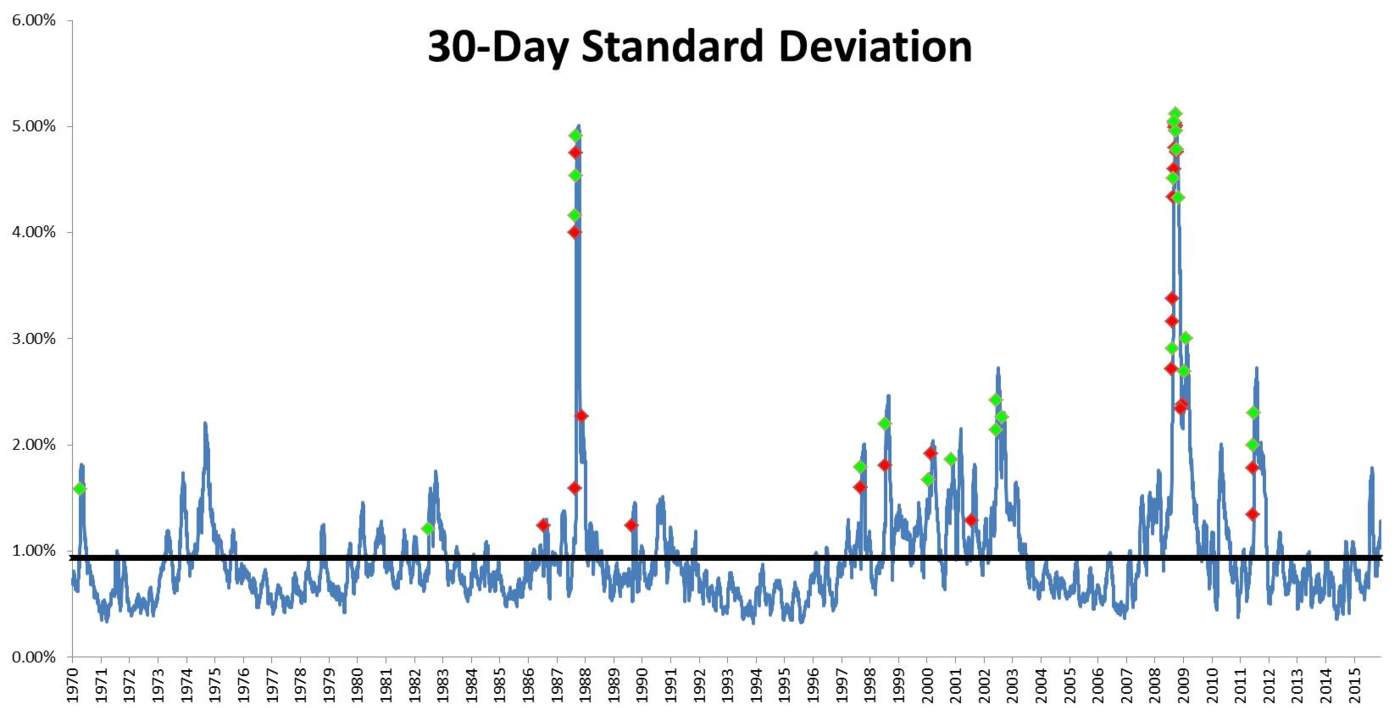

- Clustering: Perhaps the biggest challenge is that the best and worst days tend to come close in time. The reason for this is that big selloffs or huge rallies lead to wildly overbought or oversold conditions. The rubber band gets stretched too far and has to snap back.Given the relative proximity these big days have on the historical timeline (see below), and how often these occur back to back, there is little room for error. Getting most but not all of the timing right could lead to missing the big recovery or getting caught in a damaging selloff. That has the potential to seriously impact returns.

25 Best and Worst Days Tend to Cluster Together

- Source: Michael Batnick, Ritholtz Wealth Management

If you master all of that, you’re one-tenth of the way to success at market timing. The rest is luck. Many of the best timers in history were undone when their luck ran out; Joe Granville is one of the best examples of that. Of course “luck” is an unscientific construct. To be precise: There is a strong degree of randomness that makes timing such a challenging strategy.

__________

1. I tracked those calls up until September 2013, when we launched an asset management firm. Our approach is a long-term, buy and hold (more or less) low-cost asset allocation model, but we also employ a rules-driven tactical model for behavioral purposes.

2. Aggressive estimates put the economic impact over the next decade at $400 billion, but it is hardly a good reason for a selloff. Yes, many tech companies have come out defending DACA, including Microsoft, Apple and Facebook. But the possibility of $10 billion dollars per quarter doesn’t knock one and a half percent off of the U.S. market’s capitalization

Originally: The Fickle Fortunes of Market Timing