This is a guest post by Cole Frank, a research associate at the Council on Foreign Relations.

Multinational corporations’ efforts to avoid U.S. taxes by shifting profits abroad significantly distort the U.S. balance of payments (BoP). The clearest distortion is an understatement of U.S. services exports and an associated overstatement of income receipts on foreign direct investment (FDI), as U.S. multinationals transfer price their profits away to subsidiaries in low-tax jurisdictions.

The effect is big. In 2016, U.S. multinationals reported some $200 billion—roughly one percentage point of GDP—of reinvested earnings in the seven largest tax havens.

With such a noticeable impact on the U.S. balance of payments, what effect does profit shifting have on the balance of payments of tax havens?

Ireland for example.

The distortion of Ireland’s national accounts data by multinational activity is a prime example of what the Bank for International Settlements (BIS) has called“a growing tension between the nature of economic activity and the measurement system that attempts to keep up with it.” The 2015 economic data that Ireland’s Central Statistics Office (CSO) released in July of 2016 showed that in just one year real GDP had grown 26 percent; real GNP (generally thought of as less susceptible to profit-shifting distortions) by 18.7 percent; exports by 34 percent; and the country’s capital stock of fixed assets by some €300 billion. Paul Krugman called it leprechaun economics. Former governor of the Central Bank of Ireland, Patrick Honohan, wrote that the statistical distortions made “a mockery of conventional uses of Irish GDP.”

Given that the changes were attributable to the actions of just a handful of multinationals, the CSO was understandably cagey about the whole thing and suppressed some components of the normal data release in order to “protect the confidentiality of the contributing companies.” But they offered this morsel:

“The revisions to the national accounts and balance of payments statistics published in July 2016 were driven largely by increases in contract manufacturing activity attributable to Ireland due to the relocation of entities with significant contract manufacturing activity and with balance sheets dominated by intellectual property products.”

(More on contract manufacturing later.)

The CSO’s opacity and a flurry of corporate maneuvers involving Ireland in 2014 and 2015 made pinpointing the exact cause of the data irregularities difficult:

- AerCap, the world’s largest independent aircraft leasing company, had redomiciled its entire fleet of aircraft (valued at €35 billion) to Ireland;

- U.S. medical device company Medtronic was acquired (inverted) by the Irish firm Covidien for $48 billion;

- U.S. pharma giant Allergan was similarly taken over by Ireland based Actavis for $66 billion; and

- there were rumors that tech firms including Apple had shifted substantial intellectual property (IP) assets to subsidiaries in Ireland.

Plus, there was a large statistical change: the CSO had just adopted new EU guidelines (ESA 2010) for the compilation of national accounts data.

With the benefit of hindsight and the publication of the Paradise Papers, it’s possible to sketch out a clearer picture of what happened in 2014 and 2015. The account below is largely gleaned from the terrific coverage of the Paradise Papers by the International Consortium of Investigative Journalists (ICIJ) and a report [PDF] from the Economic Statistics Review Group (ESRG), which the CSO convened to address “the challenges posed by globalization for the measurement of national economic activity.”

In 2013, under pressure from the EU and U.S., Ireland announced plans to begin cracking down on profit shifting arrangements that multinationals employed by establishing tax-free Irish subsidiaries. Chief among these arrangements was the “double Irish”—a simple example of which would entail the establishment of two Irish subsidiaries and one Bermuda subsidiary. A U.S. multinational would transfer (sell) IP assets to one of its Irish subsidiaries, thus allowing it to collect the profits associated with those assets. It would then transfer the profits to the second Irish subsidiary, which despite being incorporated in Ireland was “managed and controlled” from Bermuda (or another tax haven) and owned by the Bermuda subsidiary. Differences in the U.S. and Irish tax codes meant that the U.S. considered this subsidiary an Irish company while the Irish tax code considered it a Bermuda company—effectively leaving the company a tax resident of…nowhere.

The plans Ireland announced in 2013 would end the viability of the double Irish by requiring all companies registered in Ireland to also be tax residents. Closing this loophole would, in theory, expose multinationals to Ireland’s 12.5 percent corporate rate—considerably worse than the nearly 0 percent they had.

But there were two major catches:

- For existing companies and companies created prior to the end of 2014 the new rules would only be “gradually phased in” by the end of 2020.

- Ireland would also be expanding its tax deductions for firms that moved intangible assets into Ireland. These capital allowance measures would allow multinationals to reduce their tax bill by means of intracompany transfers of intellectual property and other intangibles to an Irish subsidiary. The Irish subsidiary would pay some amount of money to the branch it was receiving the assets from, but, as long as that other firm was a tax resident of a tax haven, the transfer would be essentially costless.*

Thus incentivized and facing a closing window to get in on Ireland’s tax loopholes, companies responded. Apple, for example, is reported to have established two of its subsidiaries—Apple Sales International and Apple Operations International—as tax residents of the popular tax haven Jersey, and made a third subsidiary—Apple Operations Europe—a tax resident of Ireland. The rationale of this second move was likely to then transfer IP from the Jersey subsidiaries to the Irish subsidiary as to reduce its tax bill.

Apple was not the only company to take advantage of these loopholes—the Paradise Papers include emails from law firms to U.S. firms urging them to take advantage before the “window of opportunity closes”—but they were almost definitely the largest. We don’t know how much intellectual property Apple transferred to Ireland, but some estimates put the figure in the ballpark of $200 billion.

Ireland’s capital stock rose roughly €300 billion in 2015…

What traces did this activity leave in Ireland’s balance of payments? In the words of Ireland’s Treasury (the NTMA): “A clear understanding of the current account is difficult in the face of these distortions.”

I would go a step further. At this point, multinational profit shifting doesn’t distort Ireland’s balance of payments; it constitutes Ireland’s balance of payments.

Little work has been done to better understand these BoP distortions. The ESRG report [PDF] offers a thorough accounting of the mechanics of the distortions to the national accounts—the essence of which is that the relocation of intangible assets and associated contract manufacturing to Ireland resulted in a substantial increase of value-added**—but more or less ignores the current account beyond recommending the development of a modified BoP indicator that better captures national economic activity.

The CSO has since released a modified current account balance indicator that “appropriately [adjusts] for the retained earnings of re-domiciled firms and depreciation on foreign-owned domestic capital assets.” This is a very helpful step forward, but, since all the adjustments are only made to the topline current account balance, it reveals little about the subcomponents of the current account.

Given the inherently international nature of profit shifting and Ireland’s position as a locus of this activity, a better grasp of Ireland’s balance of payments is a good place to start to understand how the international flow of goods and capital is evolving.

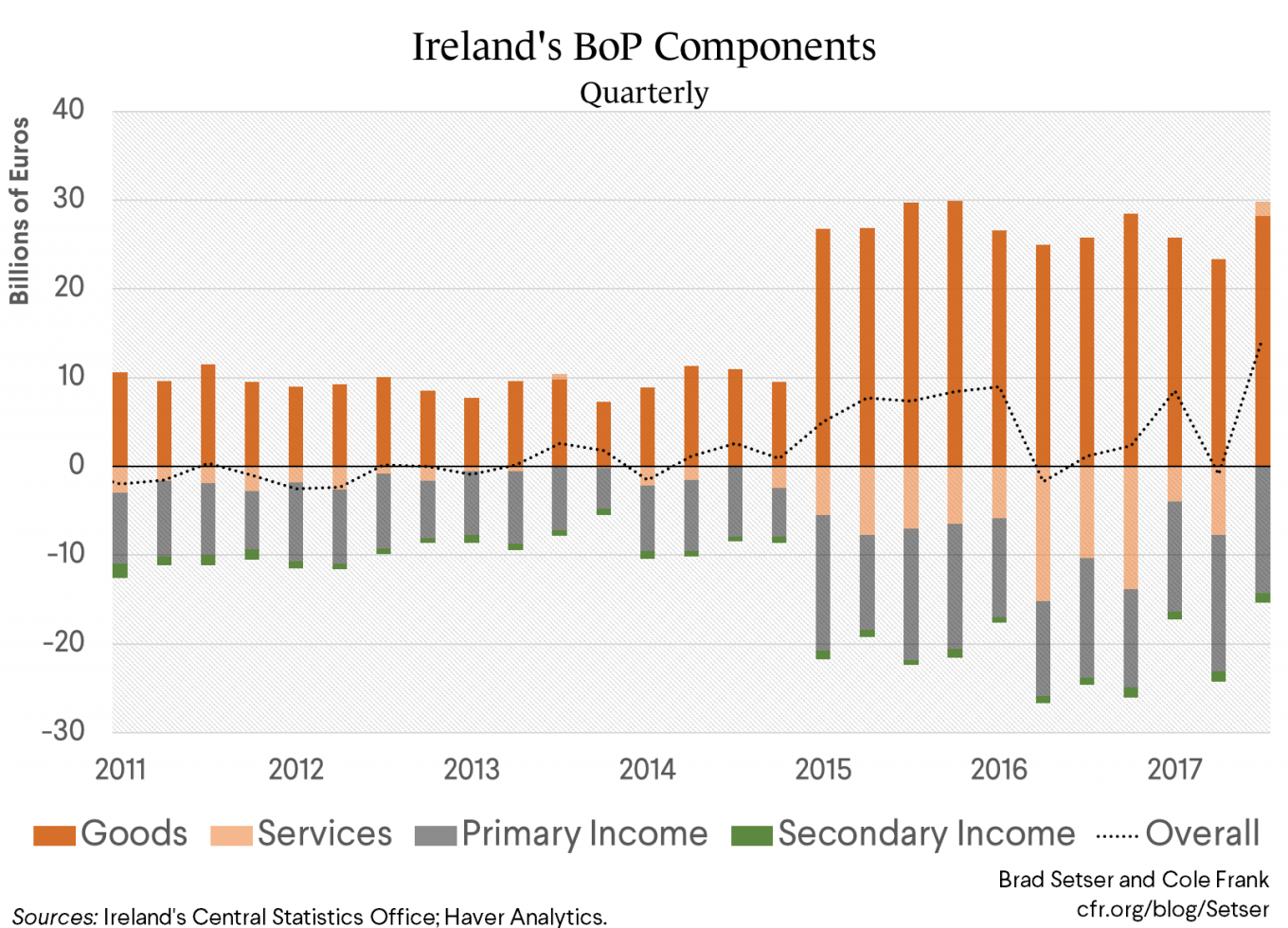

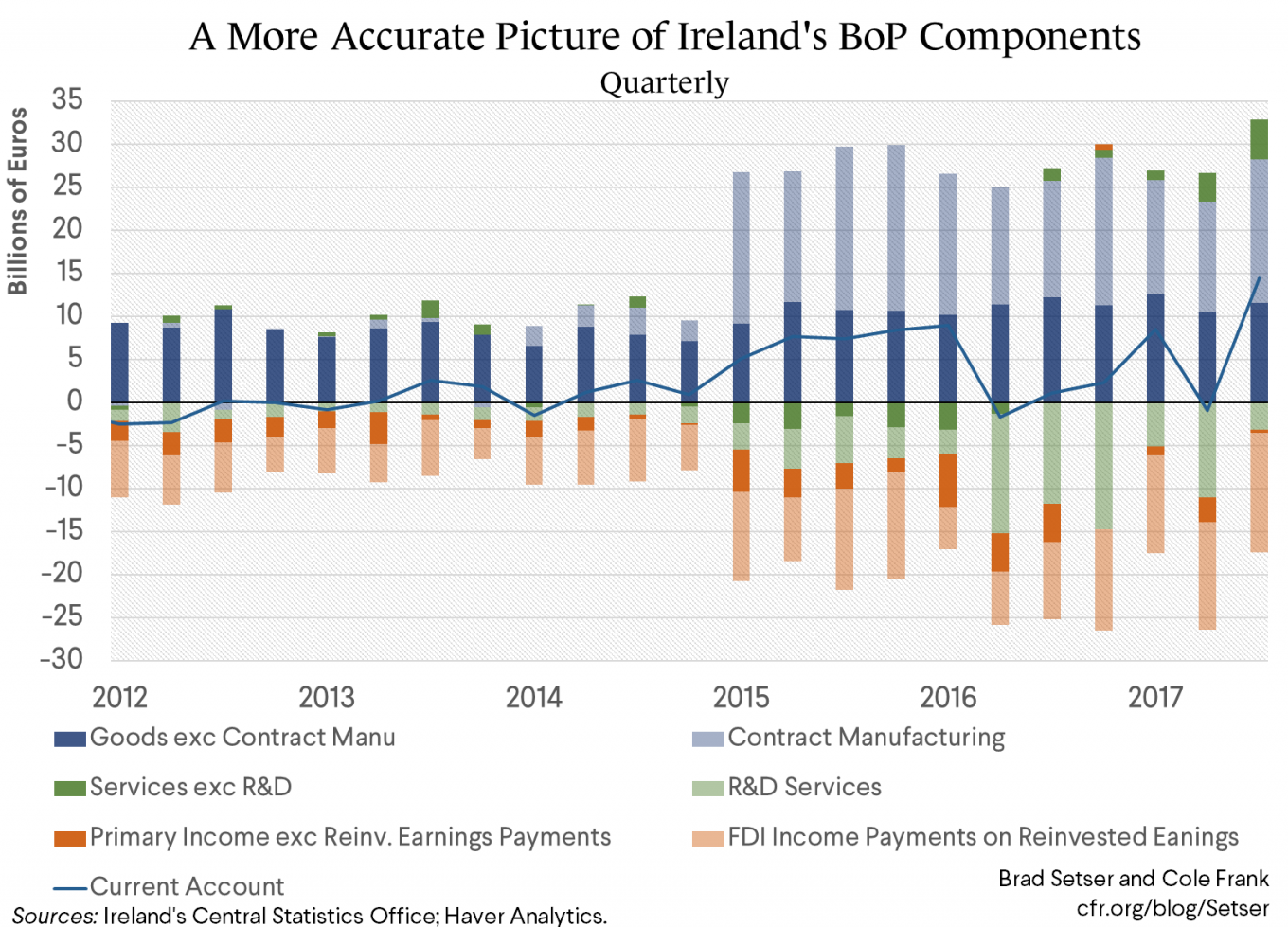

Here are the main subcomponents of Ireland’s current account:

Clearly there’s a level shift beginning in the first quarter of 2015, the goods surplus widens by more than €15 billion a quarter and is partially offset by jumps in the services and primary income deficits. A closer inspection of each of these three balances provides a clearer picture of just how multinational profit shifting has remade Ireland’s BoP.

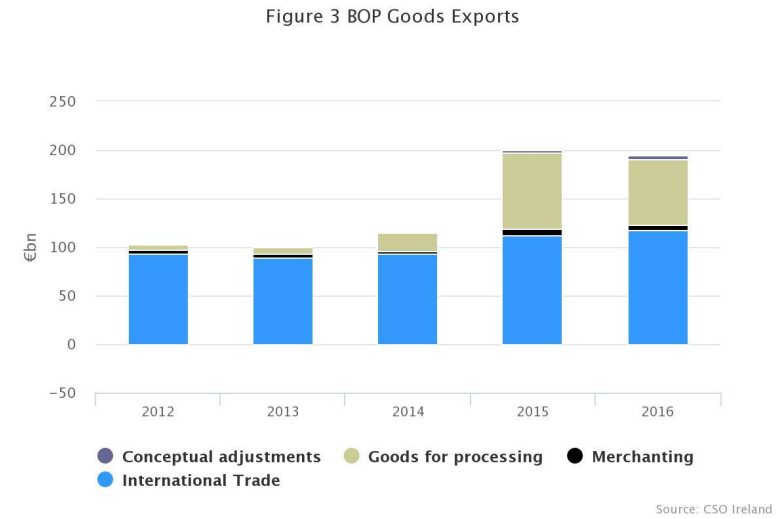

The 75 percent increase in goods exports between 2014 and 2015 is the largest single driver of change in the current account, so let’s start there.

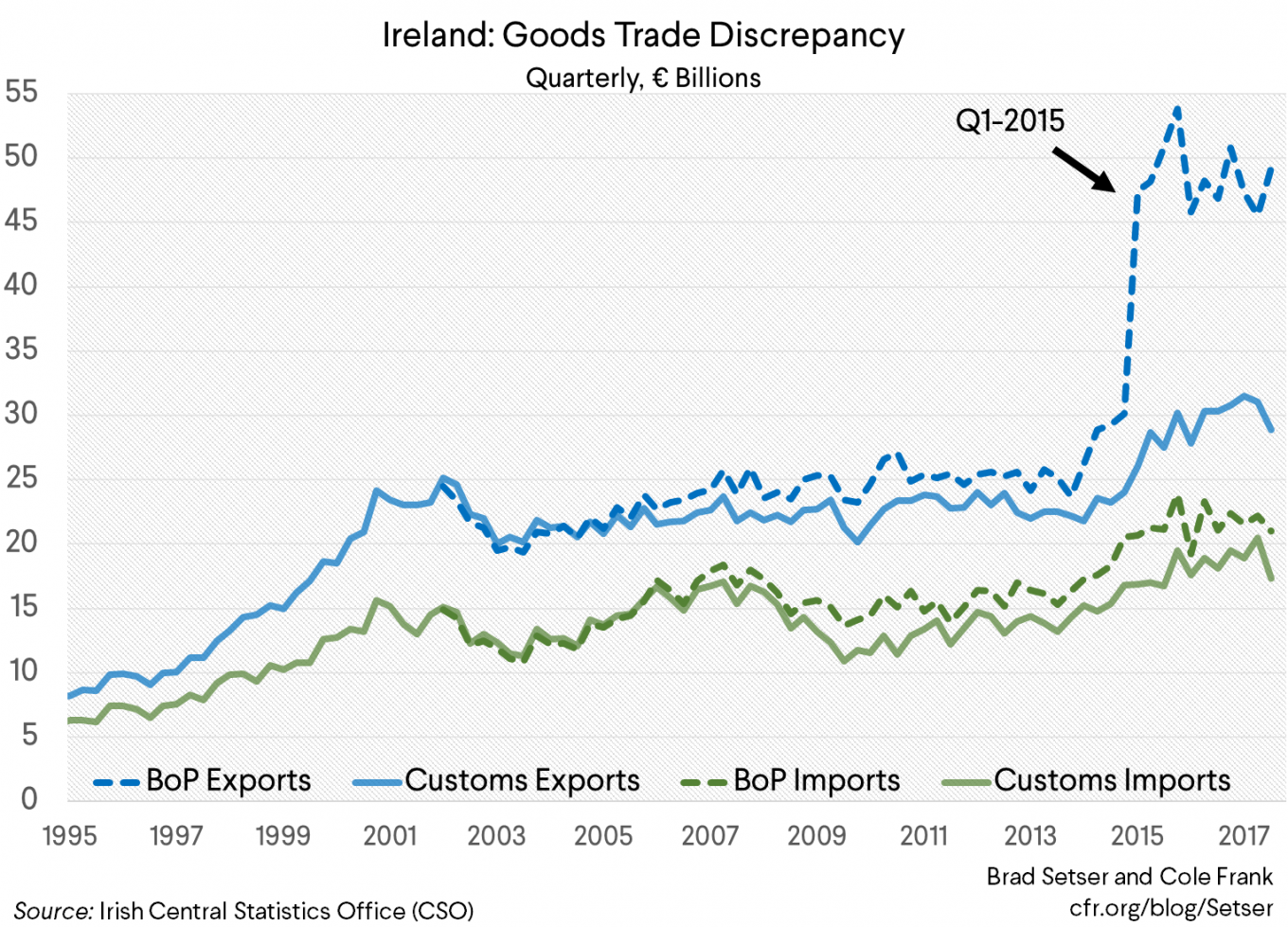

CSO’s quarterly BoP release doesn’t disaggregate goods exports and imports by sector. But, comparing the BoP data with a separate monthly international trade data series also published by CSO is revealing:

This discrepancy arises from the fact that despite both being measures of goods exports, they have slightly different underlying concepts. As detailed in this CSO memo (see question 13), the monthly international trade series is based on a “crossing the national border concept” (i.e. most people’s definition of international trade), whereas the BoP goods trade measure is based on a “change of economic ownership concept.” The distinction is not obvious, but crucial in light of the aforementioned contract manufacturing.

Contract manufacturing, also known as goods for processing, occurs when a firm in country A contracts a firm in country B to manufacture goods on its behalf and then send the goods on to country C for final sale. The subcontracting process (i.e. the actual production of the good in country B) is not considered a change of economic ownership and thus is not recorded in the balance of payments. Rather, any manufacturing inputs remain under country A’s ownership, country A’s payment to country B for the production is recorded as a service export from B to A, and the sale of the final good to country C is recorded as a goods export from A to C.

So, nearly the entirety of both the gap between the two trade series and the spike in Ireland’s BoP exports can be explained by contract manufacturing***—a practice that Apple is known to use for the production of its hardware.

On to services trade. According to reporting in the FT, a recent unreleased European Commission report on tax avoidance highlighted the fact that royalty payments (often used for profit-shifting) averaged more than 20 percent of Ireland’s GDP between 2010 and 2015. While it’s true that Ireland runs a substantial deficit in “royalties/licenses,” it is almost perfectly offset by a surplus in “computer services”. Both of these categories have increased steadily since 2012, rather than simply spiking in 2015. Instead, the source of the widening of the overall services deficit since 2015 seems to be largely a product of the balance on “business services: research and development.” Imports of which grew substantially in q1 of 2015 and then again in q2 of 2016:

As outlined in the 2013 Levin subcommittee hearing, Apple has historically transferred the legal rights for its international sales to its international subsidiaries by charging the subsidiary some share of Apple’s global R&D budget. Most likely, the widening of the Irish services deficit since 2015 is due to similar arrangements. Annual Irish imports of R&D services increased from €8.7b in 2014 to €18.6b in 2015, and then an astounding €47b in 2016…

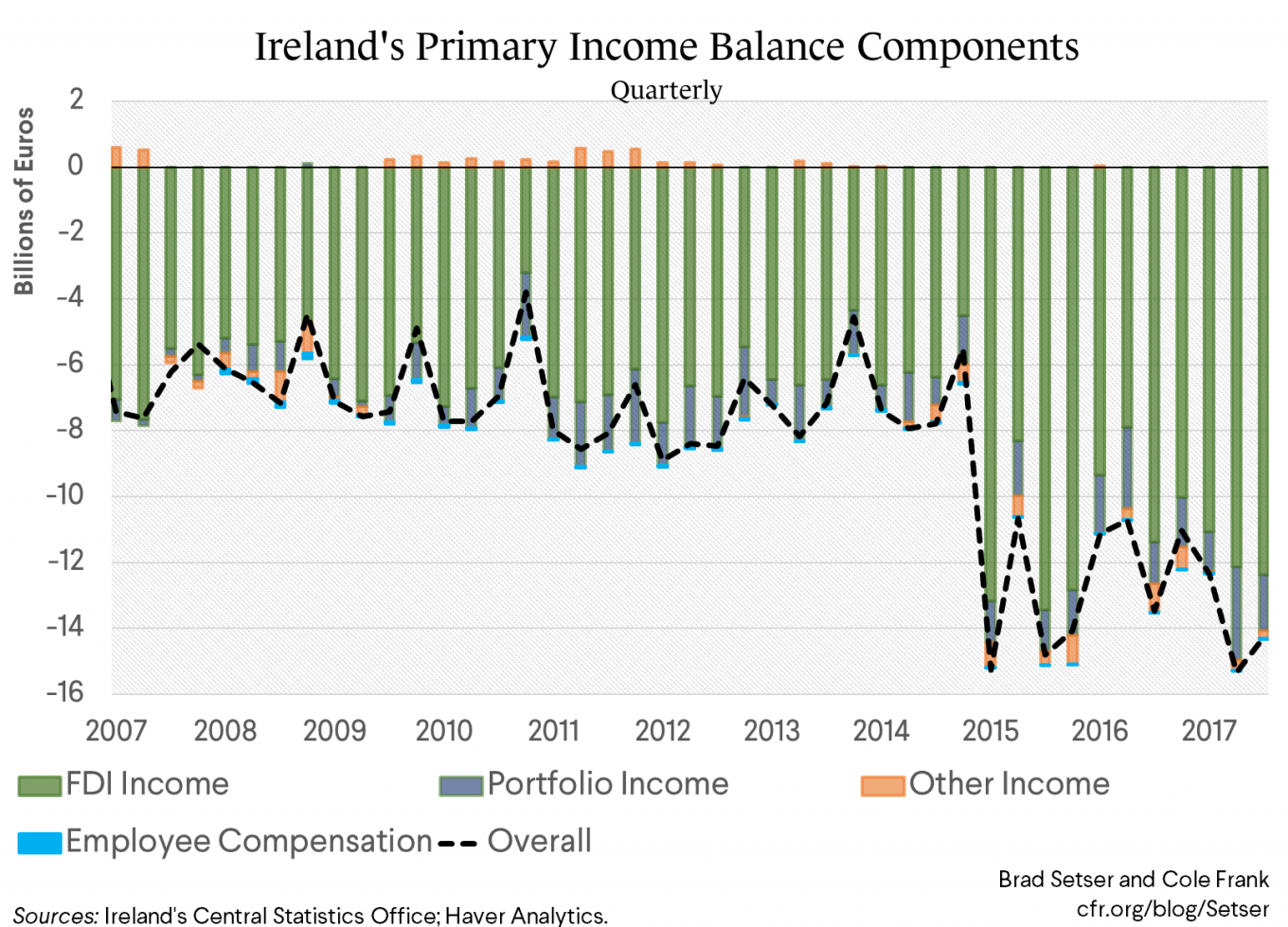

This brings us to the primary income balance. Ireland has substantial portfolio asset and liability positions, but the income on these positions consistently offsets to the tune of about €2 billion in quarterly net payments. The changes in the primary income balance are instead almost entirely a function of the change in income on foreign direct investment:

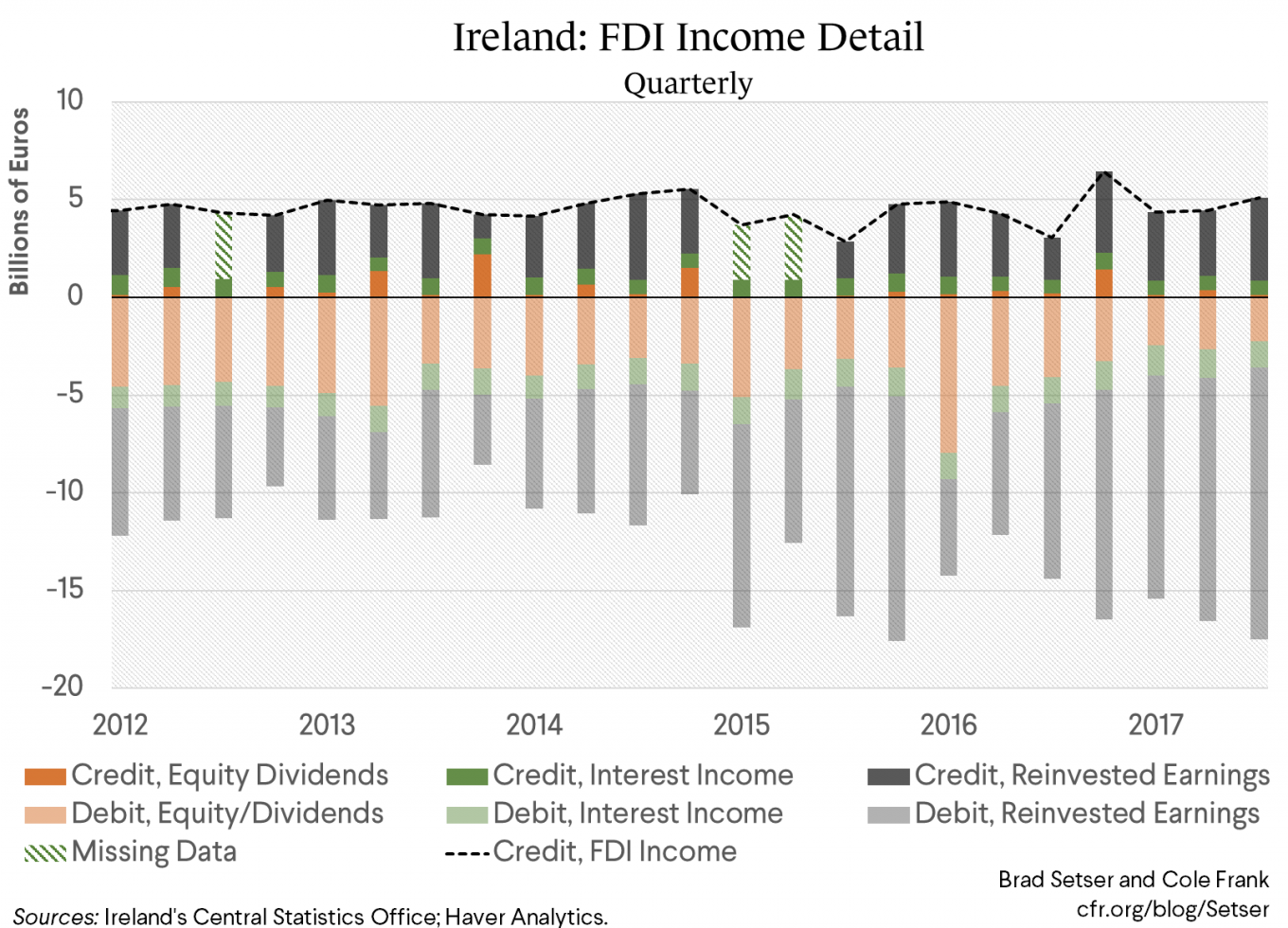

The FDI income deficit doubled from €24 billion in 2014 to €48 billion in 2015. And this change in the balance on FDI income boils down to, you guessed it, reinvested earnings.

This makes a lot of sense. As Brad Setser has previously explained, the profits that U.S. multinationals book outside the U.S. and then retain outside the U.S. (U.S. corporations oft-cited overseas cash piles) show up in the BoP as income receipts on U.S. FDI abroad. This is the substance of the $200 billion overstatement of the U.S. primary income balance. The flip side of profit-shifting inflating the U.S. primary income balance, is profit-shifting dragging down the primary income balances of Ireland and the other tax havens.****

To review, the main impacts of multinational profit-shifting on the Irish BoP would appear to be: an increase in FDI income debits in the form of multinationals’ reinvested profits; an increase in service imports in the form of payment for multinationals’ R&D budgets; and an increase in goods exports that are not actually produced in or exported from Ireland. Split these out and you get this:

* Via these capital allowance measures, companies could offset their entire tax bill by transferring enough intangible assets. Ireland’s 2018 budget caps the annual deduction at 80 percent of the intangible asset’s relevant income.

** While the increase in GDP would have been similarly large under Ireland’s old national accounting standards (ESA 1995), a change in the way the new ESA 2010 standards recorded intangible assets (as investment rather than consumption) meant that the ESA 2010 GNP growth rate was much larger than the ESA 1995 GNP growth rate would have been. For lots more on Irish national income accounting see Seamus Coffey’s blog.

*** According to the ESRG report, contract manufacturing is “the most significant of adjustments made to the primary [customs] data.” That said, there are other manufacturing schemes that are recorded differently in the two trade series. See Annex IV of the report [PDF] for details on these. And this graph from a Q2-2017 CSO data briefing (contract manufacturing is synonymous with “goods for processing”):

****Multinationals with subsidiaries in Ireland show up differently in the primary income balance than re-domiciled PLCs (also known as corporate inversions). While all of a foreign subsidiary’s (e.g. Apple Ireland) profits will show up in the current account as a FDI income payment, inverted corporations’ profits only show up in the current account (as portfolio equity income payments) if they are distributed to foreign shareholders as dividends. Furthermore, the profits of these inverted corporations’ foreign subsidiaries show up in Ireland’s current account as FDI income receipts. So, Ireland’s primary income deficit is likely understated.

Source: Council on Foreign Relations