Translation of an article by Hyun Song Shin, Economic Adviser and Head of Research of the BIS, in the Frankfurter Allgemeine Zeitung (FAZ), 15 September 2018.

This week marks the 10th anniversary of the collapse of Lehman Brothers. In many ways, we are still living through the consequences of the crisis that followed. Assessments made in the heat of the crisis often revolve around the breathless sequence of events and its salient symptoms. Not all of these assessments are on the mark. The 10-year anniversary is a good time to sift through the arguments to sort the good from the bad and dispose of some myths that have grown around the crisis.

Securitisation and moral hazard

Take the issue of securitisation and moral hazard, which figured prominently early in the crisis. Securitisation refers to the practice of parcelling loans together into a security. Securitisation of subprime mortgages became a focal point for the revulsion with bank business practices prior to the crash. The revulsion coalesced around the notion of “moral hazard”, referring to the practice of unscrupulous lenders who passed on bad loans to other market participants, with unsuspecting small investors at the end of the chain. In this way the “hot potato” theory of the crisis was born, wherein banks play a game of pass the parcel in which they pass on dud loans to the next person in the chain.

The idea is attractively simple and blames an identifiable villain, so it appeared in countless speeches and articles on the causes of the subprime crisis. One remedy, according to this line of reasoning, was that banks which securitise their loans should retain a portion of the loans, so that they have a stake in the eventual repayments – that banks should have sufficient “skin in the game”.

If the hot potato theory were true, the losses would have been concentrated among non-bank investors. However, it was the banks themselves that suffered the lion’s share of the losses from subprime mortgages. Many went bust.

On closer inspection, rather than passing on the bad loans to others outside the banking system, securitisation worked to concentrate risks in the banking sector itself. Banks used securitisation as a way to borrow in order to expand lending and increase leverage. Unlike a traditional bank that relies on retail deposits to finance its lending, securitisation opens up new sources of funding by tapping new creditors. For instance, if the bank can borrow $98 for every $100 worth of securities it pledges as collateral, the bank needs only $2 of its own funds to finance $100 of loans. The bank’s leverage, defined as the total loans divided by the bank’s equity, could then be as high as 50.

The crucial distinction is between selling a bad loan down the chain and borrowing by pledging bad loans as collateral. By selling a bad loan, you get rid of the bad loan from your balance sheet. However, borrowing against bad loans does not get rid of the bad loans. The hot potato is sitting on your balance sheet or on the books of the special purpose vehicles that you are sponsoring. To be sure, some shuffling of the risks took place between banks, but the risks stayed within the banking sector as a whole. Far from having too little skin in the game, the banks had too much. Far from passing the hot potato down the chain to a non-bank investor, banks themselves were at the end of the chain.

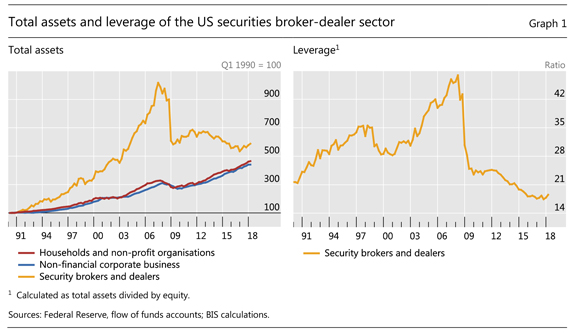

Graph 1 plots the time path from 1990 of the total assets and leverage of the US securities broker-dealer sector, which included the major Wall Street investment banks and the US-based subsidiaries of global banks that were engaged in securitisation activities.

The US broker-dealer sector’s total assets grew much faster than the rest of the economy, only to crash with the onset of the crisis. The leverage of the sector started at 22 in 1990 and rose to the dizzy height of 48 at the peak.

As balance sheets expand, banks seek out new borrowers. When all good borrowers already have a mortgage, but balance sheets still expand, banks lower their lending standards in order to lend to subprime borrowers. Such was the demand for new subprime mortgages to feed the securitisation machine that new, “synthetic” subprime assets were manufactured through credit default swaps (CDS) written on subprime loans. The seeds of the subsequent downturn in the credit cycle were thus sown.

When the downturn arrived, the bad loans were either sitting on the balance sheets of the large banks, or they were in special purpose vehicles sponsored by them. Although other investors such as pension funds and insurance companies also suffered losses, banks were most exposed. The hot potato was sitting inside the banking system, carried by some of the largest and most sophisticated banks.

Graph 1 disposes of another common myth concerning the crisis: that the collapse of Lehman was a bolt from the blue, an unexpected shock to an otherwise well functioning system. What is striking from Graph 1 is the dramatic increase in lending in the period before the crisis. The graph shines a light on the dramatic expansion of market-based lending in the mid-2000s. To get the full picture for the events at the time, we need to look at the global expansion of the banking sector, especially in Europe. The Great Financial Crisis was a transatlantic crisis.

The transatlantic banking crisis

The Great Financial Crisis is often portrayed as an American crisis, which then spilled over globally. Europe is portrayed as a victim of this contagion, weakened sufficiently to succumb to the subsequent euro area crisis of 2011-12. This was a convenient narrative for commentators who viewed European banks as innocent bystanders.

However, the facts tell a different story. European banks suffered losses almost as great as those of US banks in the early stages of the crisis. Graph 2 plots the losses experienced by banks around the world in the period 2007-11, before the onset of the euro area crisis of 2011-12. Up to the end of 2009, US banks suffered losses of $708 billion. European banks suffered losses of $520 billion. The losses of banks from other regions were negligible.

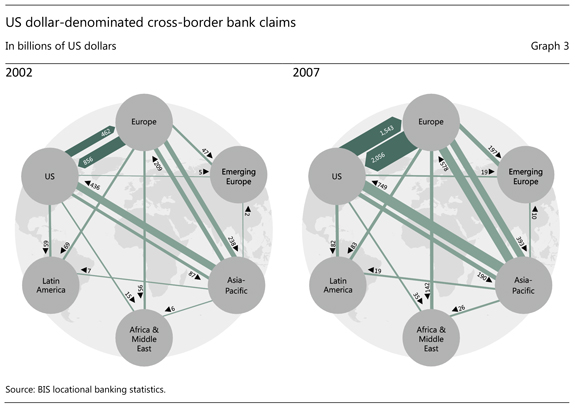

To see the full picture, we need to zoom out to take in the global flow of funds. Graph 3 presents two snapshots of cross-border bank claims in US dollars – first in 2002 and then in 2007. European banks had US dollar claims of $856 billion on US borrowers in 2002, but this grew to over $2 trillion by 2007. This increase was associated with the rapid growth of the asset-backed securities (ABS) issuer sector, which grew from modest beginnings in the early 2000s to well over $2 trillion by 2007. Subprime mortgage securitisation depended heavily on the activity of European banks. Some of the dollar funding raised to buy subprime mortgages was short-term and came from US money market funds. In fact, over half of the assets of US money market funds that lent to the private sector were the short-term promises of European banks. Additionally, European banks raised dollars from the currency swap market, where they borrowed dollars by pledging other currencies (euros, for instance) as collateral.

In effect, European banks became integrated into the US financial system and played the same role as US banks; they borrowed from US money market funds and lent to US mortgage borrowers. National borders mattered little, except in terms of which taxpayers bailed out the failing banks. European banks were bailed out by European taxpayers, illustrating the maxim that banks are global in life but national in death.

There are broader macroeconomic lessons. Before the Great Financial Crisis, commentators fretted about the large US current account deficit and raised concerns about a depreciation of the US dollar, drawing parallels with the experience of emerging market economies that suffer a sudden stop in capital flows. However, far from crashing, the dollar soared with the onset of the financial turmoil. European banks with dollar debts bought dollars in the currency market to repay their maturing debts. Dollar appreciation fed on itself, as the stronger dollar piled further pressure onto these banks’ balance sheets. Central bank dollar swap lines were instrumental in quelling the crisis.

Where are we now?

Post-crisis reform of bank regulation was aimed at many of the known weaknesses. Basel III rules now impose stricter limits on bank leverage and liquidity mismatch. As seen in Graph 1, US broker-dealer leverage has come down very substantially. European banks continued their deleveraging over the last decade. Only recently have they begun to expand their cross-border activity. As a result, the bank intermediation channel of crisis propagation is much less in focus.

Having addressed known past weaknesses, it is important to lift our eyes and identify where new weaknesses may lie. Although vulnerabilities in bank intermediation are much lower and bank resilience is higher, total debts of households, firms and governments are now higher than they were before the Lehman crash.

In addition, debt claims are increasingly held directly by creditors in the form of bonds, rather than being intermediated by banks. Low interest rates and central bank asset purchase programmes that rescued the global economy from the depth of the crisis pushed long-term rates lower, generating the wave of search for yield by long-term investors. Asset managers ought to be a stabilising influence in financial markets, absorbing losses without insolvency. However, recent experience has shown once again that such investors have limited appetite for losses, frequently joining in any selling spree.

Ironically, the “passing of the hot potato” is closer to the truth now than it was before the crisis. The market for leveraged loans that package loans to companies into fixed income instruments has grown rapidly due to the search for yield. Bonds from emerging market borrowers, both companies and sovereigns, boomed in the years after the crisis, although we are seeing the first rumbles of a potential reversal. European investors such as pension funds and life insurance companies have been big buyers of all of these instruments. The role of the dollar as the global funding currency is more important than ever, and exchange rates have taken on the role of a barometer of risk appetite.

Richard Nixon’s historic visit to China in 1972 produced one of those quotes whose origin is doubtful, but which fits well with the Great Financial Crisis of 2008. In response to a question on the consequences of the French Revolution, Premier Zhou Enlai is said to have quipped that it was “too early to tell”. The global economy is in much better shape than in the breathless days of September 2008, but 10 years after the collapse of Lehman Brothers it is indeed too early to tell how well we have overcome the challenges. We have made much progress, but we are not yet out of the woods.