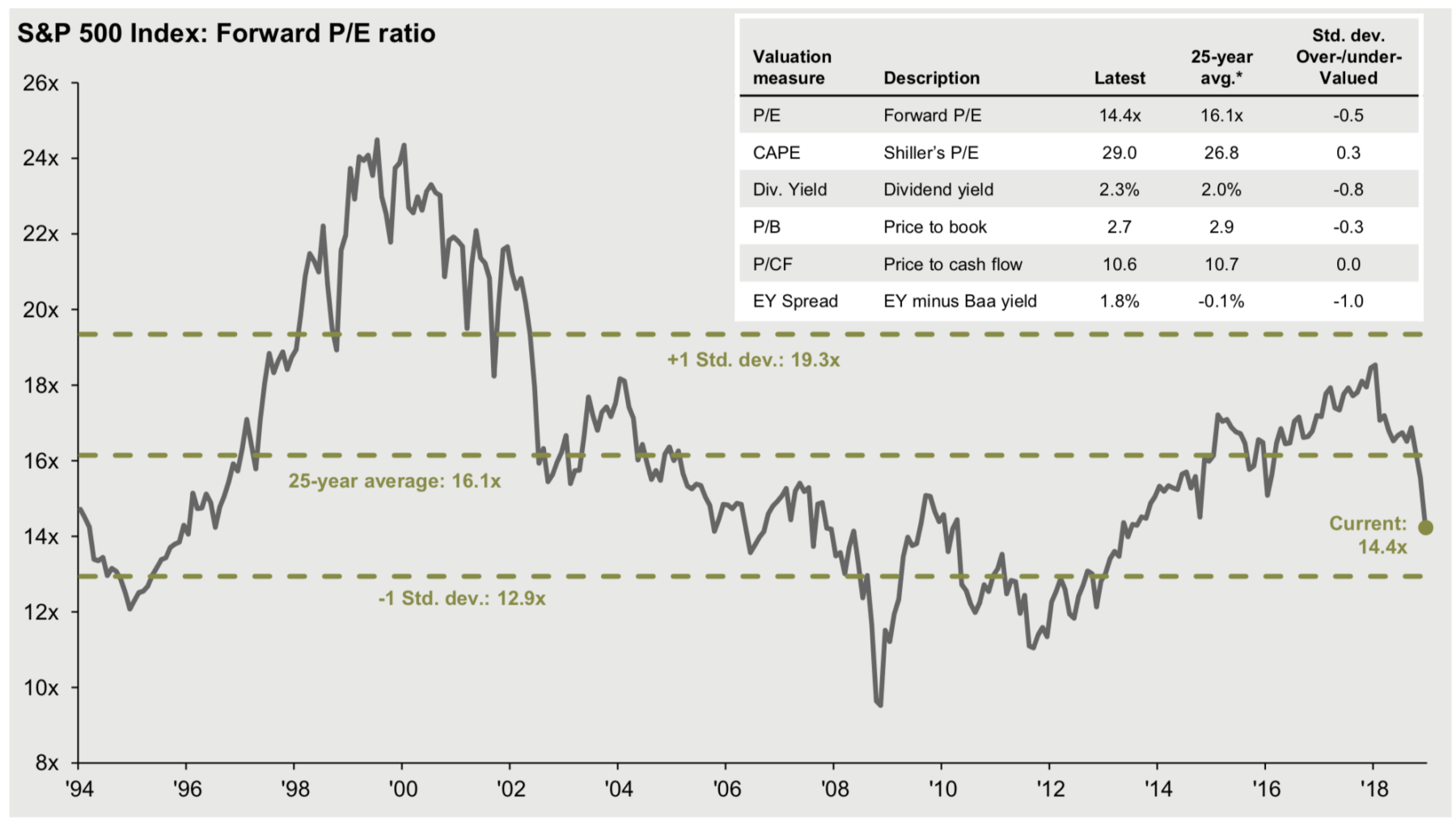

One good thing we can say about market volatility is that the 20 percent sell off in stock prices since Q4 began have returned valuations to more reasonable levels.

On a forward P/E basis, stocks are below their 25 year average — a period that includes at least one bubble and two crashes. Buyers with a 20 year investment horizon at these levels will do much better than those who paid bought in higher valuations.

The caveat is that valuation is a terrible timing tool, as stocks tend to careen wildly past fair value and can stay overbought or oversold for long periods of time. Stocks have gotten cheap and stayed that way for a decade (i.e., 1970s) or have become expensive and stayed that way for just as long a time period (i.e., the 1990s).

Source: JP Morgan