Betting Against Trump Was a Market Winner Again

An index of companies he attacked blew away those he favored.

Bloomberg, February 1, 2019

Two years ago, a new presidency began, stylistically different from the one before it. As inauguration approached, I wondered: How would President Donald Trump affect the market performance of the industries and companies he championed and those he attacked?

The period between Election Day and the inauguration was filled with aggressive Twitter broadsides by the president. He tweeted at companies by name; he yelled at or praised their chief executive officers; he caused their stock prices to gyrate madly. What were the long-term consequences of being on the president’s good or bad side?

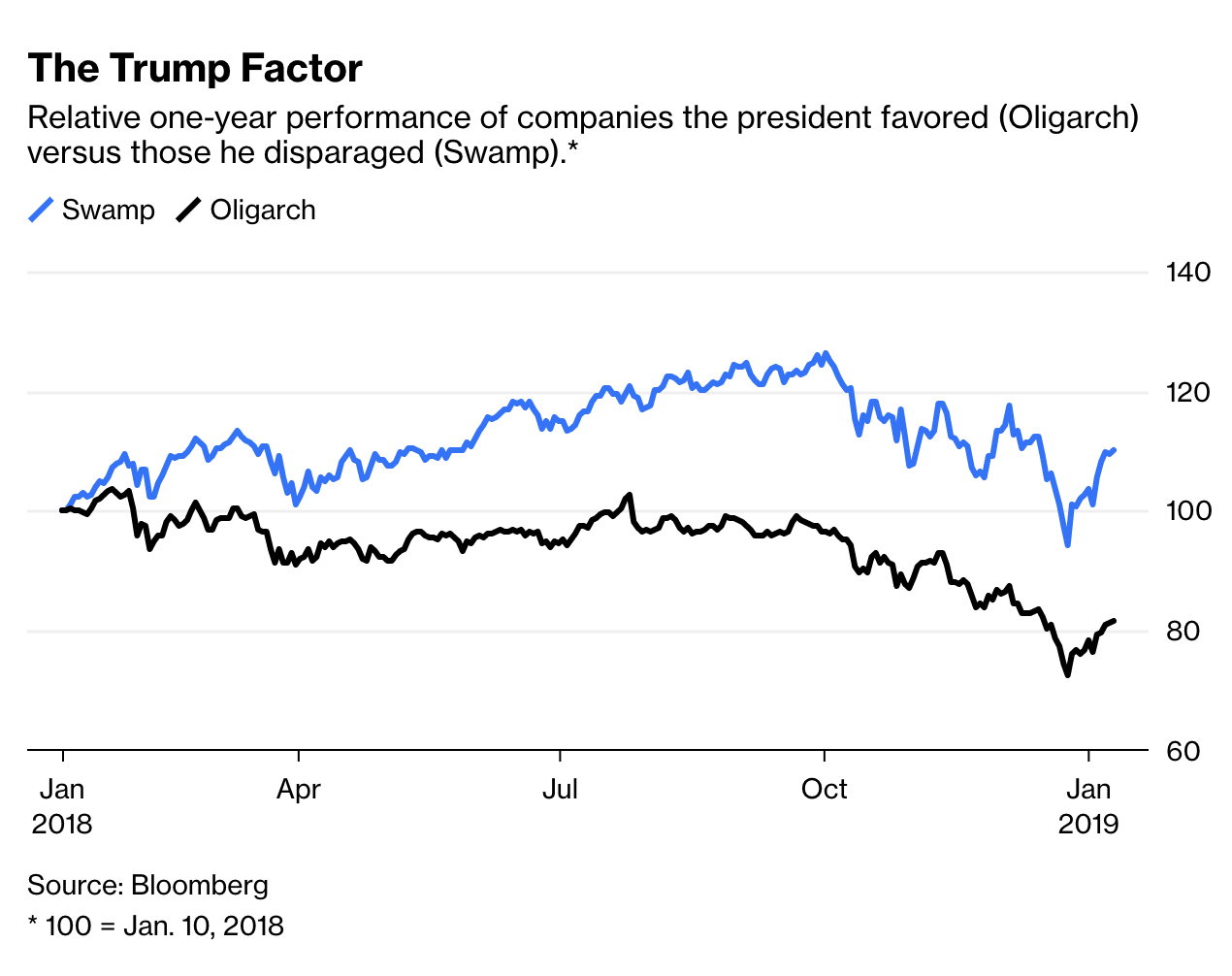

To find out, we created a pair of indexes, and tracked them for a year. The Oligarch 1 (companies he favored) and the Drain the Swamp 2 (companies he denigrated) indexes were filled with companies straight from the feed of the tweeter-in-chief. This allowed us to track how well or poorly they did relative to their relationship with the president. What impact would he have on the companies’ market performance?

Asked more simply, if you run a publicly traded company, was it better for your stock price to be Trump’s friend or foe?

The answer, as we discovered one year later, was a shocker:

When we look at the companies Trump threatened, we discover this surprising fact: Having the U.S. president get angry with you, call you out publicly and make scary sounding threats at you — well, it turns out to be not so bad. In fact, the results are really good.

And the companies he embraced? Well, not so much.

In 2017, the Oligarch Index gained a respectable 20 percent during the year. But it lagged behind the benchmark Standard & Poor’s 500 Index’s rise of 21 percent. During the same year, the Drain the Swamp Index crushed the Oligarch Index, gaining 43 percent.

But let’s not get too far ahead of ourselves: it was only one year, and one where markets everywhere went up, something for which Trump had no qualms about taking credit. Here we are, one year later, and 2018 was a much more challenging period. Amid a spike in volatility, the S&P 500 declined 6.2 percent. How did these two indexes do in that very different environment?

The Oligarch Index really took it on the chin last year. For the one-year period ended Jan. 10, the index fell 23 percent. This was much worse than the S&P 500, which during the same period declined 5.5 percent.

And the Swamp Index? It not only beat the Oligarch again, it crushed it, rising 6.3 percent. That is a 29 percentage point advantage for Trump’s most-hated companies over his most favored ones. This is even bigger spread than the first year we tracked the indexes, when the spread was 23 percentage points.

Where did the performance advantages come from?

Once again, the despised Jeff Bezos, owner of the Washington Post, and founder and CEO of Amazon.com Inc. had a good year. Bezos is now the wealthiest person in the world, with a fortune many times larger than that of the president, the size of which is in some dispute. Amazon defied the gravitational pull of the markets last year and gained 32 percent (not counting dividends).

And Twitter Inc., whose founder Jack Dorsey refused to create a lying Hillary emoji (really), thus earning the president’s never-ending enmity, did even better, more than 36 percent. Even the “failing” New York Times added more than 23 percent during the period. Being on Trump’s bad side was not bad for business or stock prices.

The Oligarch index, meanwhile had some disasters. Colony Capital Inc., whose founder, Thomas Barrack, is a close friend and ally of the president, saw its stock get cut in half. Goldman Sachs Group Inc., dealing with an ethical cloud, fell 31 percent; Ford Motor Co. declined 34 percent. Facebook Inc., a conduit for fake news that may have helped Trump’s electoral prospects, lost almost a quarter of its value. Exxon Mobil Corp., whose former CEO served for a time as secretary of State in the Trump administration, fell 17 percent. All told, it was a rough year for the Oligarchs, with little other than huge tax cuts to comfort them.

Two very different market years that produced such similar results is curious. There was no malice aforethought on the part of this humble author in terms of picking a winning and losing pair of portfolios. But who could have imagined this would be the result, based on nothing more than presidential tweets? 3

What explains this performance differential, or more specifically why have president’s favorite corporate managers, and their companies, done so poorly under his regime, and why have his most-despised opponents done so well?

I have a few ideas:

No. 1. The 72 year-old president is an old school guy, with old school friends. Their companies are not cutting edge, and shouldn’t be expected to deliver above-average results;

No. 2. Trump, who inherited much of his wealth, is intimidated by people much wealthier than he is, who have created value or built something from scratch. Thus, he steers clear of those builders or wealth creators who make him feel inadequate;

No. 3. Dumb luck, which will eventually reverse itself.

Regardless, we will track this for the third year of the Trump presidency, and report back to you in 12 months. Expect to be surprised again.

______________

1. The Oligarch Index includes Colony Capital Inc., CoreCivic Inc., Exxon Mobil Corp., Facebook Inc., Ford Motor Co., Goldman Sachs Group Inc., JPMorgan Chase & Co., PayPal Holdings Inc., Sprint Corp., SoftBank Group Corp. and United Technologies Corp. On the Bloomberg terminal, type: {.OLGY <Index> GP <GO>}

2. TheDrain the Swamp Index includes Amazon.Com Inc., Boeing Co., General Motors Co., Kellogg Co., Lockheed Martin Corp., Macy’s Inc., New York Times Co., PepsiCo Inc., Rexnord Corp., Tesla Motors Inc., Time Warner Inc., T-Mobile US Inc., Toyota Motor Corp. and Twitter Inc. and Constellation Brands Inc. On the Bloomberg terminal, type: {.SWMP <Index> GP <GO>}

3. Hey, I may be good, but I am not THAT good.

~~~

I originally published this at Bloomberg, February 1, 2019. All of my Bloomberg columns can be found here and here.