Vanguard Fund Investors Get Control of Paying Taxes

The big money manager found a way to defer taxes on mutual-fund capital gains via exchanged-traded funds.

Bloomberg, May 6 2019

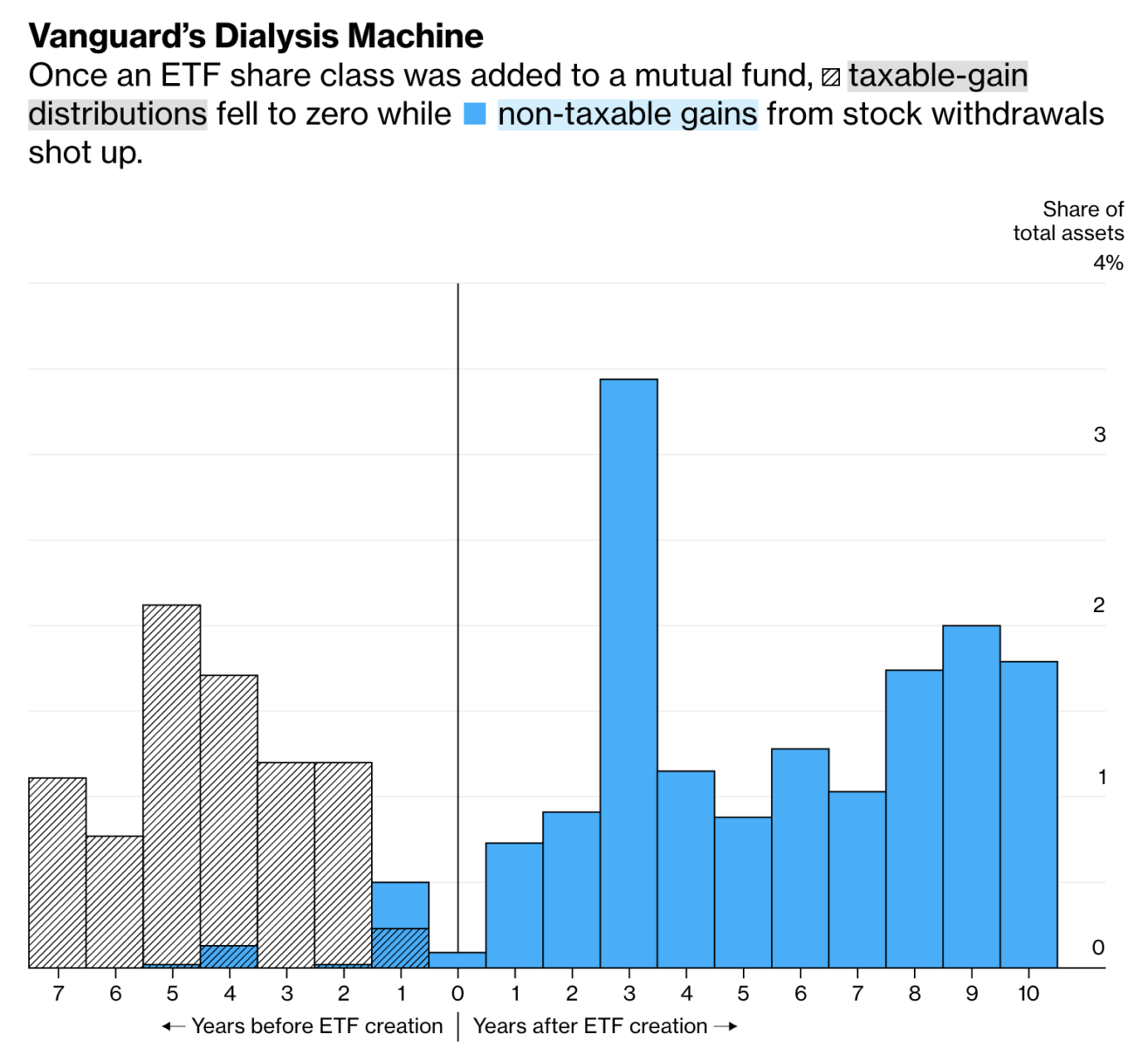

Last week’s big story about Vanguard Group’s patented tax dodge raised some interesting legal and tax issues. Our charge today is to try and take a slightly deeper look at what Vanguard has been doing and why.

Investors in mutual funds buy or sell them directly from the mutual-fund companies themselves; ETF purchasers simply go to the market and buy ETFs at the quoted prices. This simple but important structural legal difference has significant tax ramifications for fund investors.

Mutual funds (and most ETFs) are governed by the Investment Company Act of 1940. This legislation treats them like a pass-though company. When a mutual-fund investor wants to sell, the fund sells shares of appreciated stock to generate cash, but also creating a taxable capital gain. Since most funds operate as simple pass-through vehicles, those tax liabilities from the gains accrue to investors in the fund — even to holders of the fund that were not sellers.

It feels inherently unfair that sellers of a fund are the ones who generate capital gains for nonsellers. Thus, the nonselling holders owe capital-gains taxes based not on when they decide to sell, but upon the vagaries of random fate.

Enter the ETF…

Special thanks to Bill Sweet for his tax expertise and to David Nadig for his expertise on ETF structures

~~~

I originally published this at Bloomberg, May 6 2019. All of my Bloomberg columns can be found here and here.