My must-read article today comes from Chief Investment Officer, and it is all about not just the Uber IPO, but IPOs as a potential investment class.

Before we get to that, a word about todays long awaited IPO, coming out at 11 am: Uber, the company that disrupted transportation, and especially taxis, raised a shocking amount of venture capital, racked up “an obscene number of corporate scandals over the last decade,” are pricing the public offering at $45 — the low end of its range at about a $75.5 billion market cap. Garret Camp — the guy who came up with the idea — stands to garner $3.7 billion dollars. He “holds the distinction of reaping the largest windfall for doing the least amount of work.”

That all happens today, when Uber goes public on the NYSE. Lots of folks are excited to see if they will get their schadenfreude on: Some are watching (or rooting) to see if the stock “will stumble badly, as other highly touted debut stocks have done lately.”

Uber has a wonderfully disruptive business model, and if they can figure out how to make it profitable, it could be a home run. Or not. I have no idea.

How will the stock do short term? Here is the general take on IPOs:

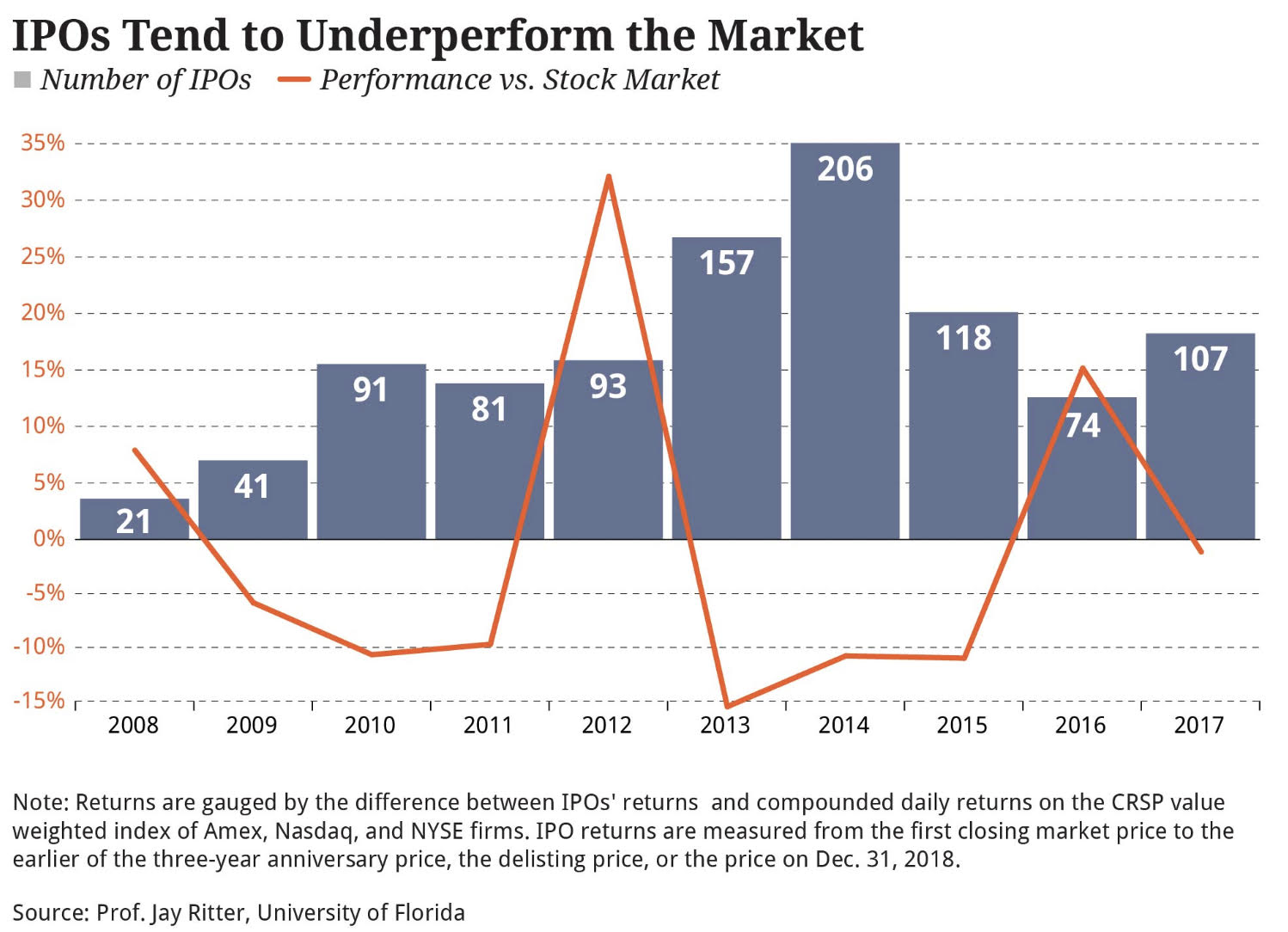

“Historical data shows that, for decades, a substantial chunk of initial public offerings (IPOs) of stock have underperformed the market. While they very often start out with a one-day pop, and may rise for a spell, a lot of them, sometimes a majority, eventually tend to lag.”

But there is a lot more to IPO performance than that first day pop or drop. CIO references data from Prof. Jay Ritter at the University of Florida, who studied IPOs from 1980 through 2014. “The problem is that they lagged the overall stock market by 17.8% When compared to companies of similar size, the IPOs trailed by 6.3%. In other words, investing in established publicly traded stocks offered better returns.”

This is consistent with prior studies by folks like Roger Ibbotson.

IPOs are exciting! They tend to grab the imagination, filling it with hopes of the next Amazon. But the key takeaway is that as a group, they tend to do poorly. The very good ones tend to be over-subscribed and only available to the biggest and most profitable customers of the underwriters.

Upon learning he was accepted as a member of the Friar’s Club of Beverly Hills, Groucho Marx famously sent a telegram to them, saying: “Please accept my resignation. I don’t care to belong to any club that would have people like me as a member.”

You should treat IPOs the exact same way . . .

Source: Chief Investment Officer