Retirement Plans among Pre-retirement U.S. Households

By YiLi Chien, Research Officer and Economist, and Qiuhan Sun, Research Associate

Federal Reserve Bank of St. Louis, May 2, 2019

This post discusses the participation rate in, and account balance of, retirement plans among pre-retirement U.S. households in the past three decades.1 Our analysis utilizes Survey of Consumer Finances (SCF) data from 1989 to 2016. The survey is suitable for our study because it provides cross-sectional data on U.S. households’ demographic characteristics, incomes, balance sheets and pensions every three years.

According to the SCF, the retirement accounts include:

- defined-benefit pension plans

- defined-contribution pension plans

- IRAs (individual retirement accounts)

- Keogh accounts

The retirement plan participants (or, alternately, nonparticipants) are therefore defined as those households that do (or do not) participate in any of the retirement accounts listed above.

There are two main findings in our study:

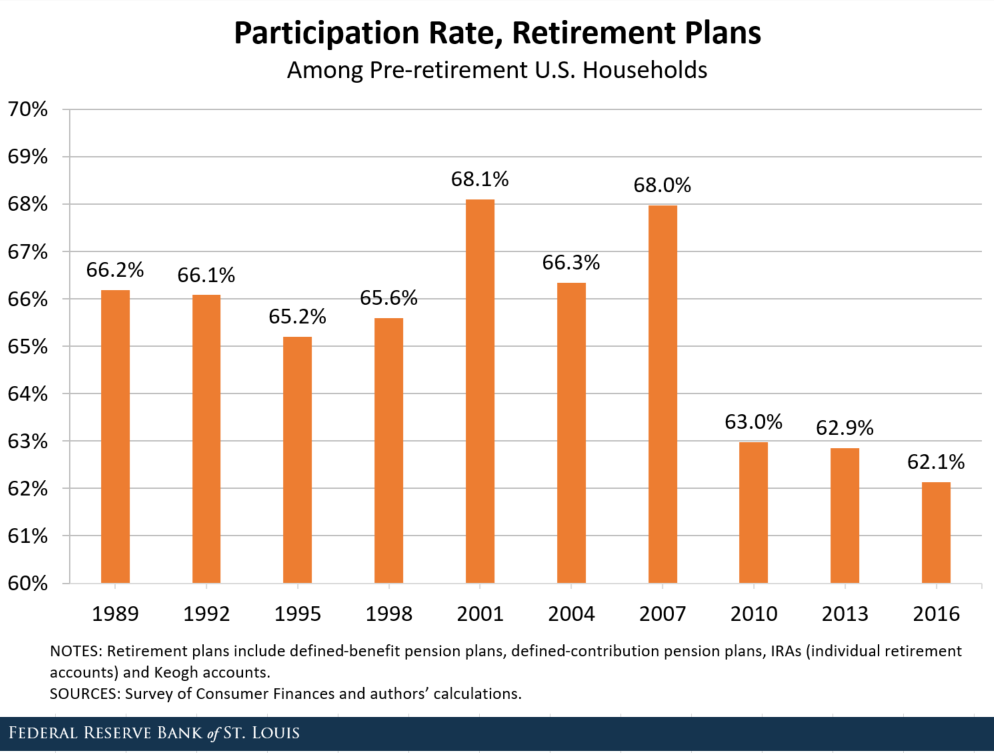

1. The Participation Rate in Retirement Plans Slightly Declined

First, households’ participation rate in retirement plans over time had been roughly constant at 66% and even declined slightly in the past decade, to 62%. The figure below provides the supporting evidence.

Given that utilization of retirement plans provides various benefits, such as tax benefits and matching contributions, this finding implies that many U.S. households do not or cannot take advantage of such benefits of the retirement plans.

It also indicates that despite the introduction of “auto-enrollment” features for many 401(k) plans and the improved accessibility of many retirement accounts, especially IRAs, the nonparticipation problem persisted over time.

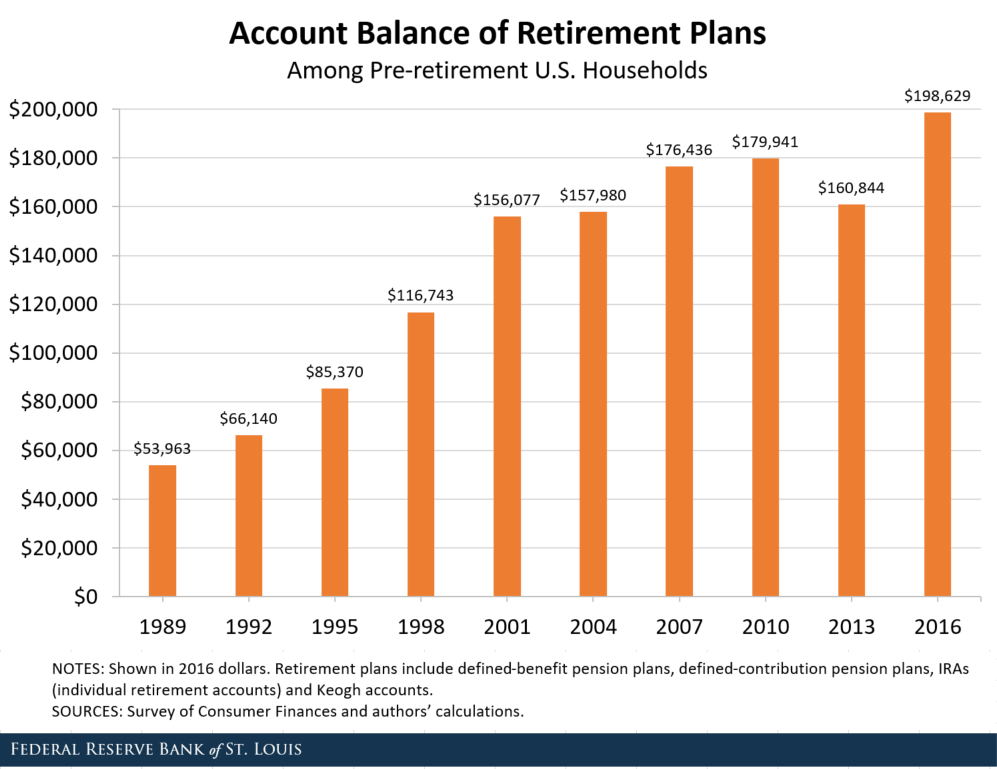

2. The Average Value of Retirement Accounts Grew Significantly

Our second main finding is that the average value of all retirement accounts combined grew significantly during this period, as shown by the figure below. The average value increased from $54,000 in 1989 to $199,000 in 2016, indicating a more than 200% increase.2

Part of this huge increase was due to economic growth. Naturally, as the economy grows, aggregate assets are accumulated and thus increase over time, resulting in higher output and a higher living standard. Thanks to the long-term growth of the U.S. economy, the average household net worth (the difference between assets and liabilities) also grew 95% during the same time.

Nevertheless, note that the growth rate of retirement accounts, 268%, is significantly higher than the growth rate of net worth, 95%. This indicates that the significant increase in the average value of retirement balances was not only due to the growth of total U.S. assets, implying that retirement plan participants actually utilized their retirement accounts more heavily.

Conclusion

These findings suggest that inequality in terms of utilizing retirement accounts could rise over time. While we do observe that utilization of retirement accounts increased (among participants), there was no improvement of the nonparticipation rate over time. Although not participating in retirement plans does not necessarily imply not saving for retirement, these nonparticipants are definitely missing the benefits, such as tax savings, brought by these retirement plans.

Notes and References

1 In the survey, pre-retirement U.S. households are defined as those headed by someone from age 50 to age 65.

2 Note that the dollar numbers reported are inflation adjusted to 2016 dollars and therefore can be compared directly. These numbers are also rounded to the closest $1,000.