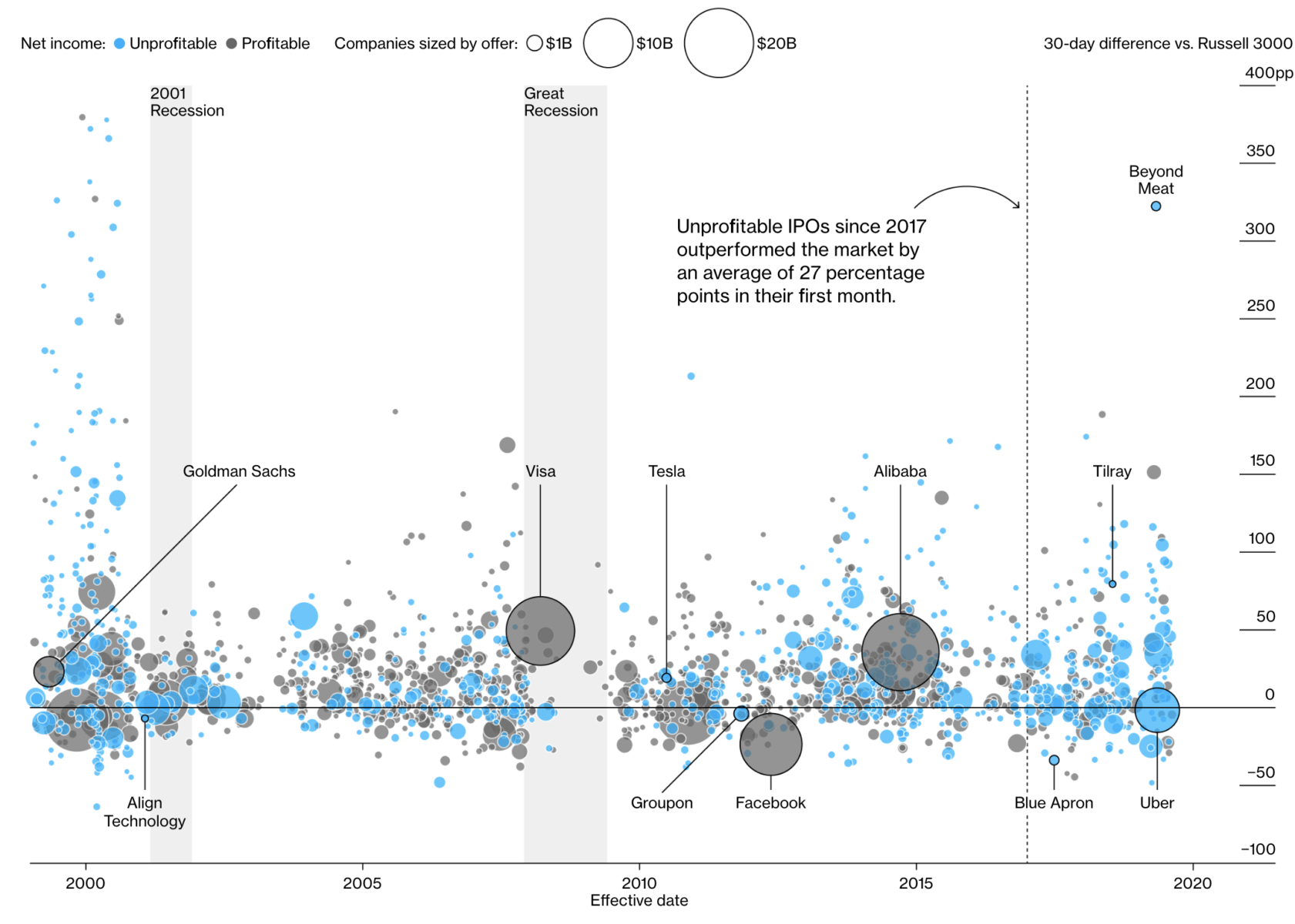

While still not as extreme as during the dot-com bubble, unprofitable company IPOs have surged since the financial crisis, with many outperforming the market in the short term:

Unprofitable Companies Are Raising the Most IPO Cash Since the Dot-Com Era

Note: As of Sept. 20, 2019. Percent change calculated as the offer price to the close 30 days from the effective date. Includes U.S. listed IPOs with offers greater than or equal to $100 million reporting financials in USD, CNY, EUR, CAD, or GBP. Excludes closed-end funds, REITs, SPEs, and SPACs. Net Income, where available, measured on a GAAP basis on effective date.

Source: Bloomberg

Here is the money quote:

“Unprofitable companies are raising money in initial public offerings at the fastest pace since the dot-com bubble when a revolution in the banking industry sparked a rush to risk…

The 2019 class of IPOs may turn out to be as risky as those dot-com companies that went bust at the turn of the century despite the exuberance surrounding them. But there may be a reason why investors keep going to the IPO trough—regardless of profitability or an immediate pathway to riches.”

As we have discussed previously, the average IPO underperforms the broader indices. And, you probably can’t get access to the oversubscribed under-writings that are likely to out perform.