I’m fascinated by these sorts of allocation studies. They tend to be over broad and not necessarily reflective of all family offices, but at least its a starting point for discussions.

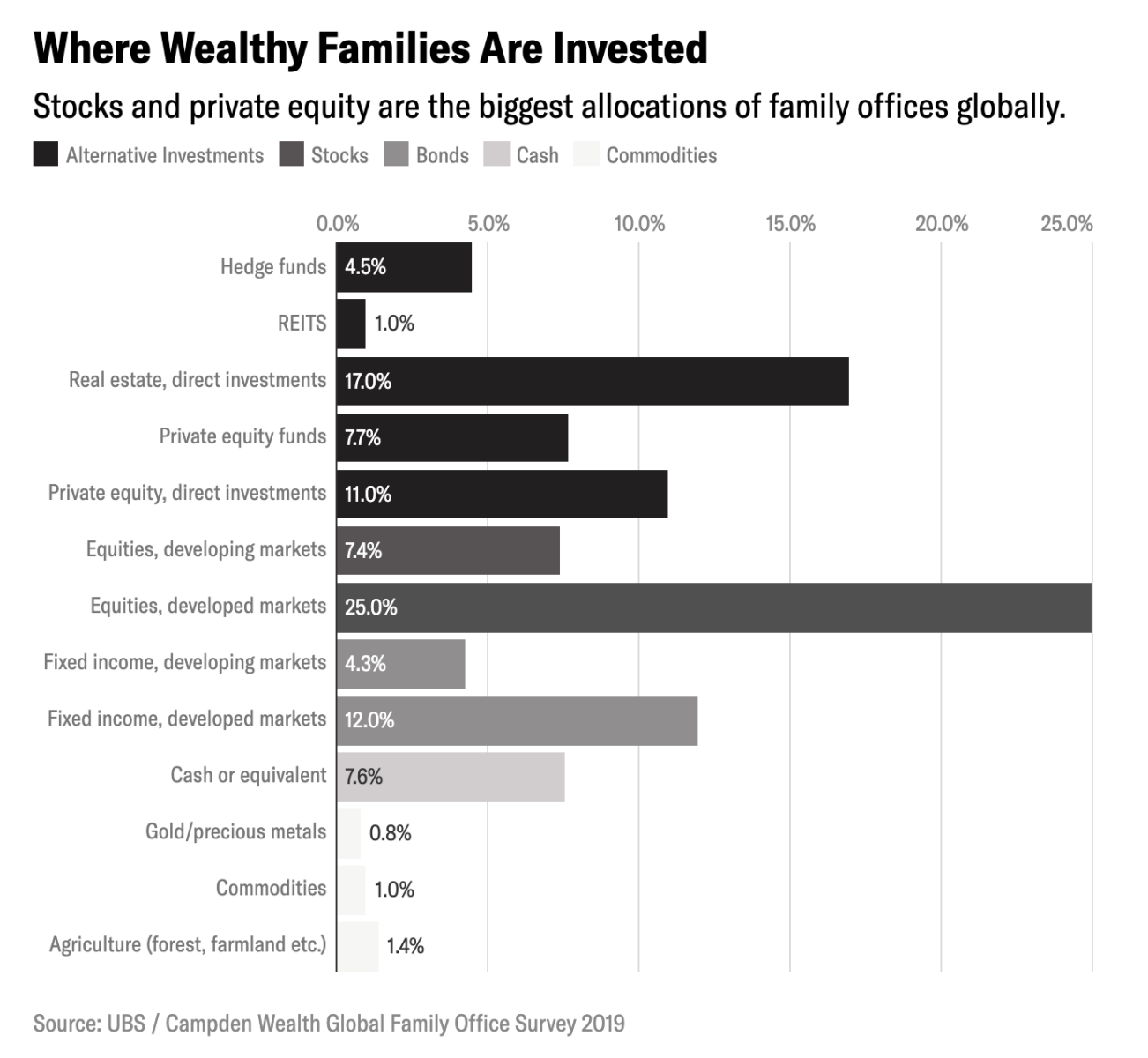

This allocation below is a mixed bag of some intelligent decision-making by very wealthy people who are looking for long term places to park their wealth and have it compound across generations.

Some of it reflects some let’s just call it lets enlightened thinking . . .

From Institutional Investor:

Family offices are planning to increase their exposure to private equity — the second biggest allocation in their portfolios — amid doubts that hedge funds can protect their wealth in a downturn, according to UBS.

Where the World’s Wealthiest Families Are Putting Capital – And Where They Aren’t

Source: Institutional Investor