From Torsten Sløk, Deutsche Bank Securities:

Ten different indicators suggest that we are late cycle:

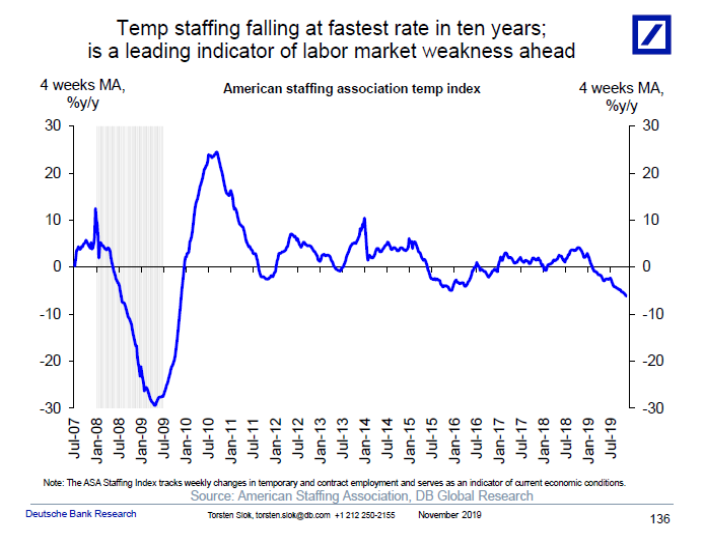

1. Growth in temp staffing is falling at the fastest rate since the recession,

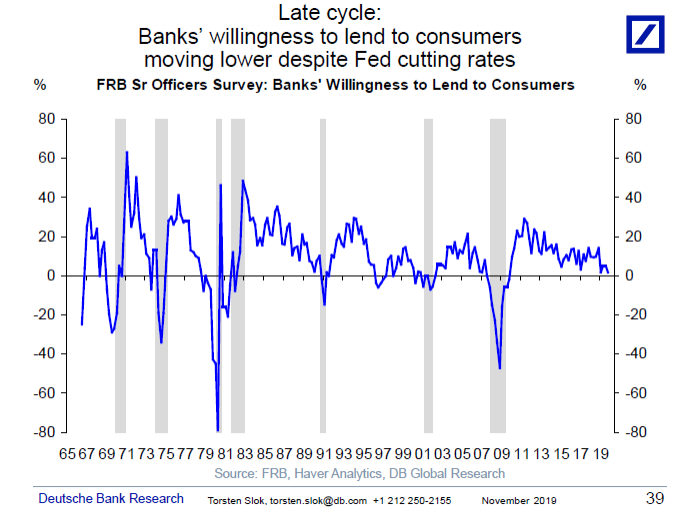

2. Banks’ willingness to lend to consumers is moving lower and approaching zero,

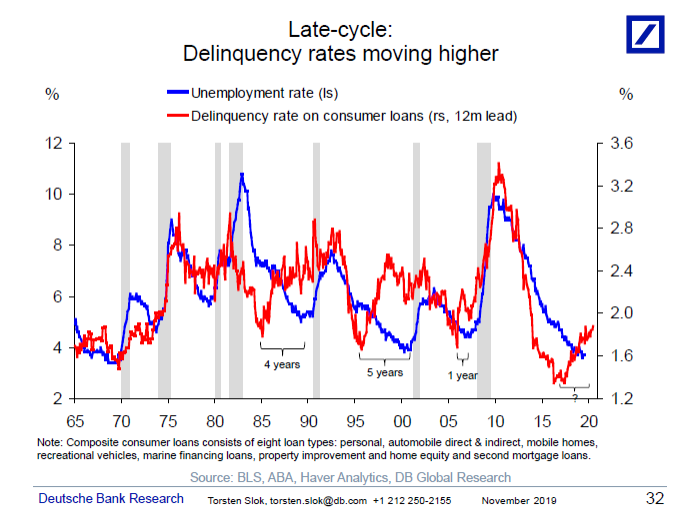

3. Delinquency rates on consumer loans are moving higher,

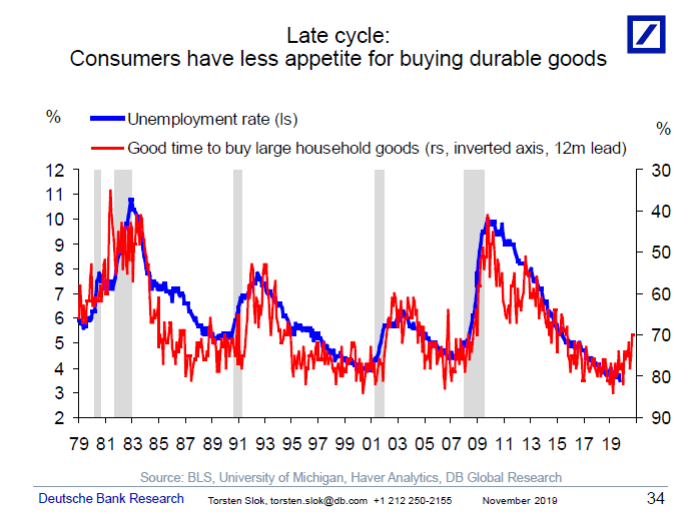

4. Consumers have less appetite for buying large household goods,

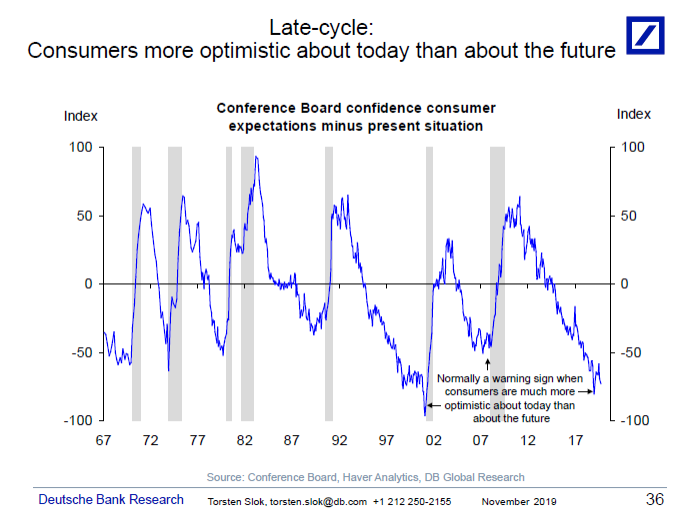

5. Consumers are much more optimistic about today than about the future,

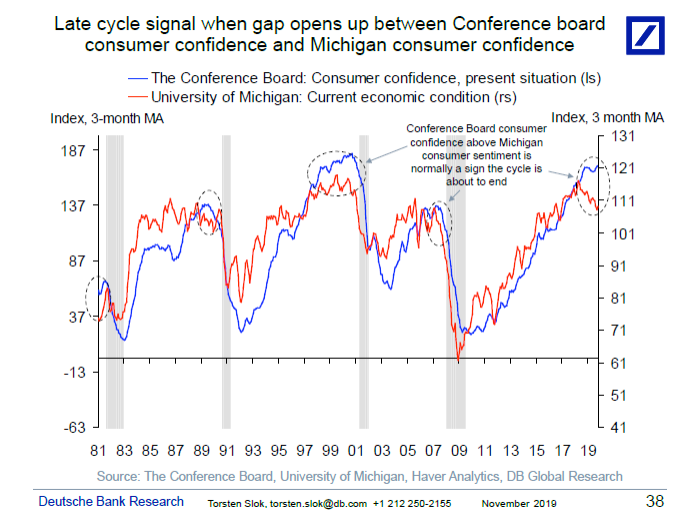

6. A gap is opening up between Conference Board consumer confidence and Michigan consumer sentiment,

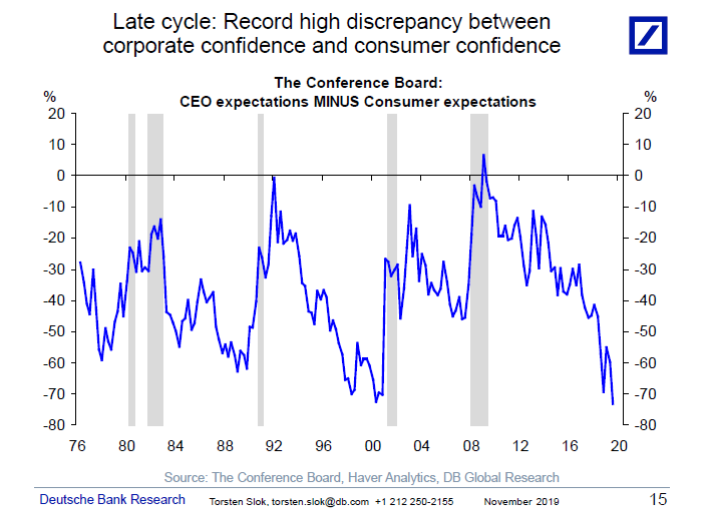

7. There is a record high difference between corporate confidence and consumer confidence,

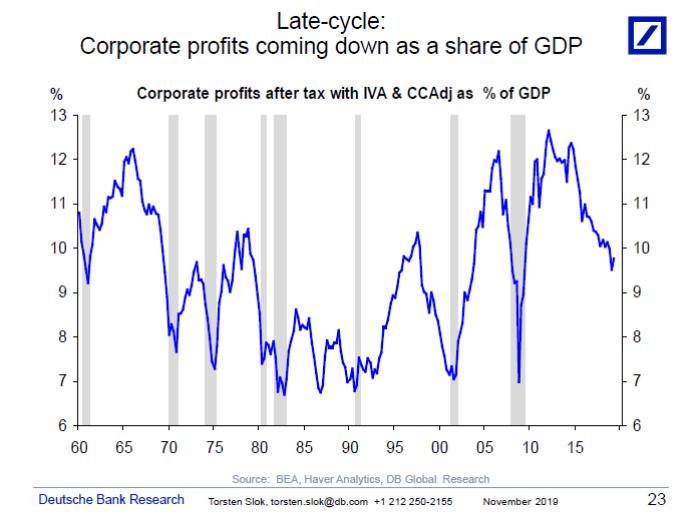

8. Corporate profits as a share of GDP peaked in 2015,

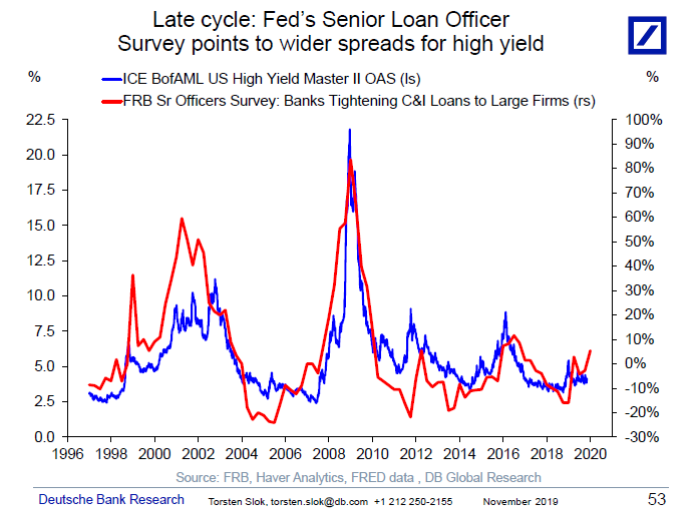

9. The Fed’s Senior Loan Officer Survey shows credit conditions are tightening for corporates, and

10. The stock and share of corporate BBB outstanding is bigger than ever, which says credit spreads should be wider, but central bank money printing continues to push spreads tighter. In that sense central banks have taken over pricing in credit markets.

Charts after the jump . . .

See charts below and here and here.

Let us know if you disagree.

Source: Torsten Sløk, Deutsche Bank Securities

Torsten Sløk, Ph.D.

Chief Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

New York, New York 10005

Tel: 212 250 2155