Source: ETF Stream

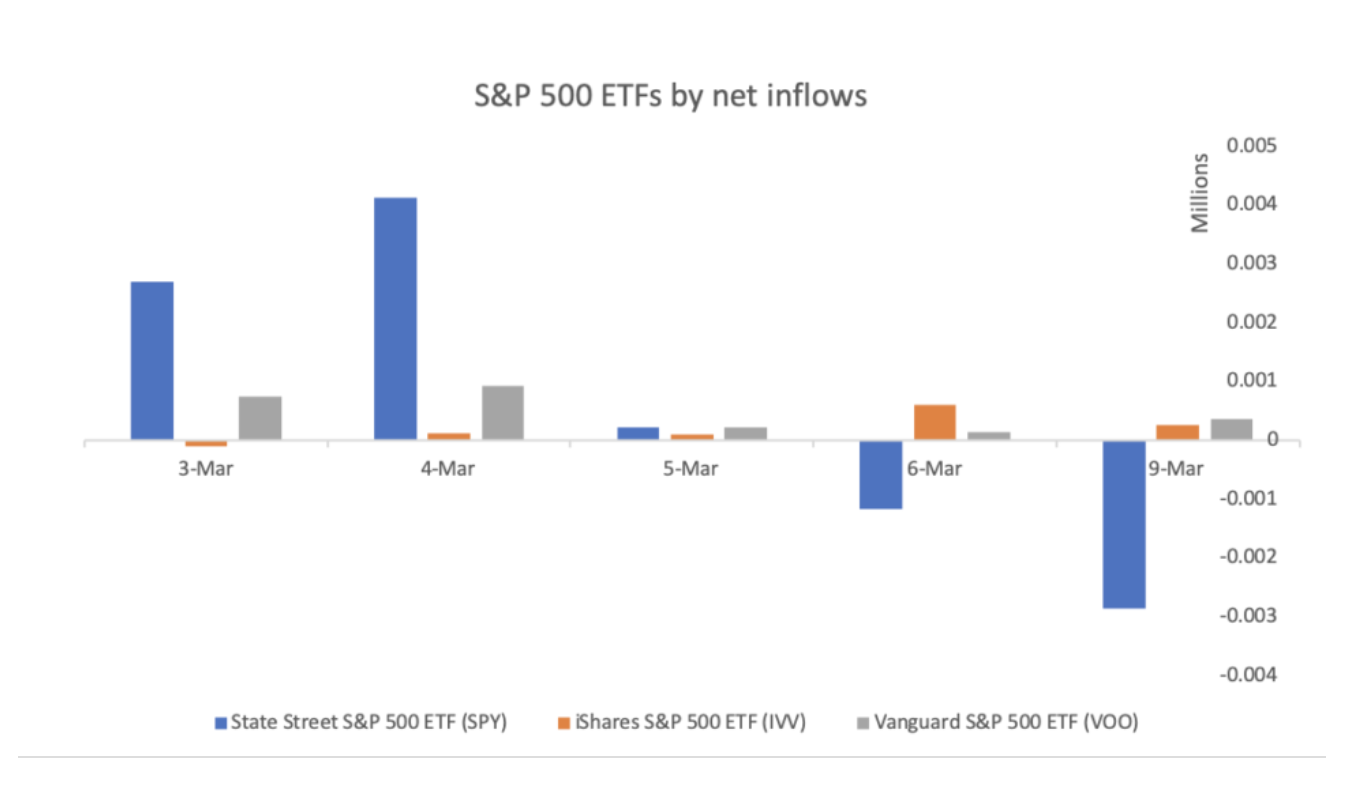

The (March 11) chart above shows three of the largest S&P500 index funds in the world from State Street, BlackRock, and Vanguard, Note these are the exact same index holdings, simply in different ETF wrappers:

-The State Street Spyders (SPY) are the professionals’ choice.

-Blackrock iShares (IVV) and Vanguards (VOO) are preferred by RIAs and individual investors.

As the sell off progressed, what happened was fascinating: the Wall Street pros were net sellers and the Mom & Pop Main Street investors were net buyers. Some of this is attributed to different timelines between investors and traders, short term and long term.

But I also suspect some of this is explained by psychology: Which S&P500 investors are less emotional and looking to take advantage of a price drop, and which ones are stressed, perhaps in a bit of a panic.

It is an intriguing differential: I cannot recall ever seeing the exact same asset handled so differently at the same exact time depending upon the ETF issuer — but not the ETF.

More on this later . . . (Update: Bloomberg column is posted)

Source:

Vanguard’s ETF investors are buying the dip

By David Tuckwell

ETF Stream, 11 March 2020

http://bit.ly/VGbtfd

See also:

Vanguard and BlackRock Dominate (September 18, 2019)